Landlord

Contents |

[edit] Introduction

The term ‘landlord’ refers to a property owner who rents all or part of that property by lease or licence for a period of time.

There are different types of landlord, which can be determined by the actual time span for which a property is rented:

- Portfolio landlord: This is a landlord who owns five or more properties.

- Buy-to-let landlord: This is a landlord who buys a property in order to rent it out to tenants as a medium to long-term investment.

- Let-to-buy landlord: This is a landlord who lets their existing property in order to facilitate a move to a new home they have bought. This can be a useful option when a property is proving difficult to sell.

- Short-term landlord: This is a landlord who only lets their property for a short period of time, typically between a few weeks to up to 6 months.

- Long-term landlord: For up to 7 years the landlord has repair obligations under Section 11 of the Landlord and Tenant Act. After 7 years they may not depending on the terms of the tenancy agreement.

An implied tenancy agreement, such as in the case of accommodation being part of a job (e.g. vicar, publican), means that the occupant should carry out the landlord’s duties.

The duties held by a landlord apply to a range of accommodation that has been rented out for less than 7 years:

- Residential premises: Rented by local authorities, housing associations, private sector landlords, housing co-operatives, hostels.

- Rooms: Let in bedsit accommodation, private households, bed-and-breakfast accommodation, hotels.

- Rented holiday accommodation: Chalets, cottages, flats, caravans, narrow boats on waterways.

The landlord/tenant relationship differs from that of the freeholder/leaseholder. A freeholder owns the ‘title absolute’ of a property and their details will appear on the land registry. A leaseholder uses the property for a specified period subject to conditions set out in the lease in return for the payment of rent.

The leaseholder may be permitted to sell the lease to another party or purchase the freehold (a process known as leasehold enfranchisement). They may also, in multi-occupancy properties, enter into collective ownership of the property freehold, known as commonhold.

[edit] Duties of landlords

The main responsibility of the landlord is to keep the property safe, free from health hazards and in a well-maintained condition. Any contents of the property must also be safe and should not cause injury or damage to tenants, neighbours or the public.

The council can hold a landlord to account using the Housing Health and Safety Rating System (HHSRS).

[edit] The Building Safety Act 2022

A landlord or any superior landlord will be considered the accountable person for a building, where no special measures or building safety manager has been specifically appointed. As a landlord a Building Safety Manager should be appointed to develop a safety case for the building which outlines how the safety of the building will be managed and maintained over time. All residential buildings (new and existing) that are 18m tall or higher, or at least seven storeys tall (referred to as higher-risk buildings) must be registered with the Building Safety Regulator (BSR) providing relevant information about the building.

The Golden Thread of information contained under the Building Safety Act must be upheld, meaning a digital record of the building must be retained and updated, this includes design, construction, and maintenance information. This building information record must be up to date and readily available to tenants and the Building Safety Regulator. Part of this includes the need to engage with the buildings residents, by developing a Residents’ Engagement Strategy to ensure that tenants have access to building safety information about and involved in safety discussions.

As such the Building Safety Act places further emphasis on landlords to ensure that residential buildings are safe, meaning they are required and responsible for the implementing steps to ensure safety compliance. This maybe done through a number of actions including: Regular safety inspections and risk assessments to identify and address safety issues promptly. Safety upgrades such as fire-resistant cladding or improved fire safety measures. Communicating with and keeping residents informed about safety measures, evacuation procedures, and any changes to a building’s safety. Ensuring a building complies with fire safety regulations, including fire alarms, sprinkler systems, and escape routes as appropriate.

For further information visit Building Safety Act 2022

[edit] The Landlord and Tenant Act

The Landlord and Tenant Act is the governing legislation for landlords and business tenants. A business tenants is somebody who rents or leases the place where they conduct their business.

The legislation obliges the landlord to keep the property structure and exterior well maintained. The costs of repairs or maintenance undertaken during the tenancy period must be borne by the landlord, unless damage has been directly caused by the tenant. If landlords don’t fulfil their legal obligations then local authorities have the power to prosecute.

The landlord is legally responsible for:

- The structure and exterior of the property.

- Services such as lighting, heating, hot water installations and water supply.

- Ventilation, serious damp.

- Basins, sink, baths and showers.

- Usually responsible for maintaining and repairing common areas, such as staircases.

Part II of the Act offers business tenants legal protection for the value they may have built up in a location which would be lost if they had to leave their premises when the lease expired; for example, if they have installed a lot of equipment, If the location is vital to their operation, if business continuity is important, and so on.

See Landlord and Tenant Act for more information.

[edit] The Gas Safety (Installation and Use) Regulations

The landlord must:

- Ensure the safe installation and maintenance of gas equipment by a registered engineer.

- Have a registered engineer undertake an annual gas safety check on each appliance and flue.

- Provide tenants with a copy of the gas safety check record before moving in.

- Keep accurate records of all inspections, noting dates and repairs carried out.

[edit] The Electrical Equipment (Safety) Regulations

The landlord must:

- Ensure that the electrical system, such as sockets and light fittings, is safe.

- Ensure that all appliances, such as cookers and kettles, are safe.

[edit] The Smoke and Carbon Monoxide Alarm (England) Regulations

The landlord must:

- Provide fire alarms on each floor.

- From 1 October 2015, private landlords in England have been required to fit carbon monoxide detectors in every room with a solid fuel burning appliance. Detectors must be tested at the start of each tenancy, and penalties for failure to comply can be up to £5,000.

- Ensure each prescribed alarm is in proper working order on the day the tenancy begins if it is a new tenancy.

[edit] Fire safety

The landlord must:

- Ensure escape routes are accessible and in good condition.

- Provide fire extinguishers where necessary.

- In accordance with the Regulatory Reform (Fire Safety) Order, a fire risk assessment must be carried out to minimise the risk of fire.If the property is furnished, the landlord must ensure that furniture and furnishings comply with the guidelines set under the Furniture and Furnishings Fire and Safety Regulations.

NB: Some of these safety requirements were updated under the Homes (Fitness for Human Habitation) Act 2018.

[edit] Costs

There are a number of costs to a landlord when letting a property:

[edit] Letting agent fees

Agencies help market the property, vet prospective tenants, collect and chase rent, and may also manage the maintenance of the property. The level of service determines the fee to be paid by the landlord.

[edit] Income tax and capital gains tax

Income tax must be paid on the rental income, voluntary Class 2 or Class 3 National Insurance may also be paid and then profit when selling the property may be subject to capital gains tax if the price has increased since the landlord purchased the property. There may be different rules if a property is within the Rent a Room Scheme.

[edit] Maintenance

The landlord’s obligations to maintain the property mean that they will bear the costs for cleaning, replacing damaged articles, repainting, replacing services, and so on.

[edit] Insurance

Buildings insurance protects against fire and flood damage. Contents insurance covers the house contents. Landlord liability insurance covers landlords in the event of a tenant suffering an injury in the house for which the landlord may be responsible.

[edit] Unpaid rent

Landlords must budget to allow for a certain percentage of rental income over the course of a year going unpaid, either for non-payment by tenants or due to the property being empty between tenants.

[edit] Rent

Rent is the sum of money paid by the tenant to the landlord on a weekly, monthly, or other basis. Periodic tenancies that continue on a weekly or monthly basis cannot be subject to more than one rent increase per year by the landlord without the tenant’s agreement.

A fixed-term tenancy, which runs for a defined time period, allows the landlord to increase the rent only if the tenant agrees. Without agreement, the rent can only be increased when the fixed term ends and before it is renewed. However, virtually all commercial leases issued in the UK will contain a provision allowing the landlord to periodically adjust the rent payable by the tenant.

The following obligations apply to any tenancy:

- The landlord must get the tenant’s permission before the rent can be increased by more than previously agreed.

- The rent increase must be fair, realistic, and not out of keeping with average local rents.

- The procedure for increasing rent set out in the tenancy agreement must be adhered to.

- Without such a procedure in the tenancy agreement, the rent can only be increased at the end of the fixed term.

- If the tenancy is weekly or monthly the landlord must give a minimum of one month’s notice for rent increases. If the tenancy yearly then they must give 6 months’ notice.

- Landlords can pursue eviction procedures if a tenant falls behind with rent payments.

Deposits are usually paid by new tenants to landlords to secure the property and provide security in the event of default, or damage to the property. If a home is rented on an assured shorthold tenancy (AST) that started after 6 April 2007, the landlord must put the deposit in a government-backed tenancy deposit scheme (TDP).

For more information, see Rent.

[edit] Termination

It is possible for a landlord to terminate a tenancy by the service of a statutory notice which provides a termination date not less than 6 months or more than 12 months after the notice has been served. The landlord must also prove a statutory ground for possession. It may be necessary for a landlord to satisfy the Courts if matters cannot be agreed with the tenants.

A landlord cannot serve the notice if the tenant has reported issues at the property being 'revenge eviction' and a landlord cannot serve the notice within the first three months of the tenancy.

The landlord may have to pay compensation to a business tenant on obtaining possession of premises based on statutory grounds, which is calculated as a multiplier of the rateable value.

NB a Superior Landlord is the person or company for the time being who owns the interest in the property which gives him the right to possession of the premises at the end of the Landlord's lease of the property.

[edit] Related articles on Designing Buildings

- Agricultural tenancy.

- Break clauses in leases.

- Buy-to-let mortgage.

- Commonhold.

- Derogation from grant.

- Electrical safety in the private rented sector.

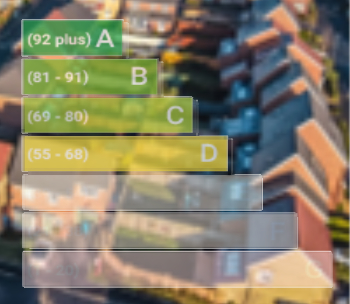

- Energy efficiency regulations: The challenges for landlords.

- Failure to notify tenant.

- Freehold.

- Ground rent.

- Homes (Fitness for Human Habitation) Act 2018.

- Housing tenure.

- How to evict a tenant.

- Landlord and Tenant Act.

- Lease negotiations.

- Leasehold.

- Leasehold covenants.

- Occupier.

- Owner occupier.

- Property guardianship.

- Quiet enjoyment.

- Rent.

- Rent free period.

- Rent review.

- Right to rent.

- Section 13 notice.

- Section 21 notice.

- Tenancy deposit protection.

- Tenant.

- Vacant possession.

Featured articles and news

Great British Energy install solar on school and NHS sites

200 schools and 200 NHS sites to get solar systems, as first project of the newly formed government initiative.

600 million for 60,000 more skilled construction workers

Announced by Treasury ahead of the Spring Statement.

The restoration of the novelist’s birthplace in Eastwood.

Life Critical Fire Safety External Wall System LCFS EWS

Breaking down what is meant by this now often used term.

PAC report on the Remediation of Dangerous Cladding

Recommendations on workforce, transparency, support, insurance, funding, fraud and mismanagement.

New towns, expanded settlements and housing delivery

Modular inquiry asks if new towns and expanded settlements are an effective means of delivering housing.

Building Engineering Business Survey Q1 2025

Survey shows growth remains flat as skill shortages and volatile pricing persist.

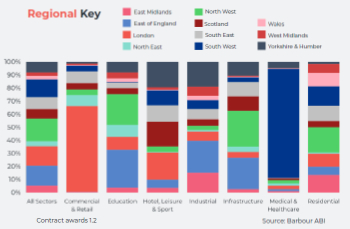

Construction contract awards remain buoyant

Infrastructure up but residential struggles.

Home builders call for suspension of Building Safety Levy

HBF with over 100 home builders write to the Chancellor.

CIOB Apprentice of the Year 2024/2025

CIOB names James Monk a quantity surveyor from Cambridge as the winner.

Warm Homes Plan and existing energy bill support policies

Breaking down what existing policies are and what they do.

Treasury responds to sector submission on Warm Homes

Trade associations call on Government to make good on manifesto pledge for the upgrading of 5 million homes.

A tour through Robotic Installation Systems for Elevators, Innovation Labs, MetaCore and PORT tech.

A dynamic brand built for impact stitched into BSRIA’s building fabric.

BS 9991:2024 and the recently published CLC advisory note

Fire safety in the design, management and use of residential buildings. Code of practice.