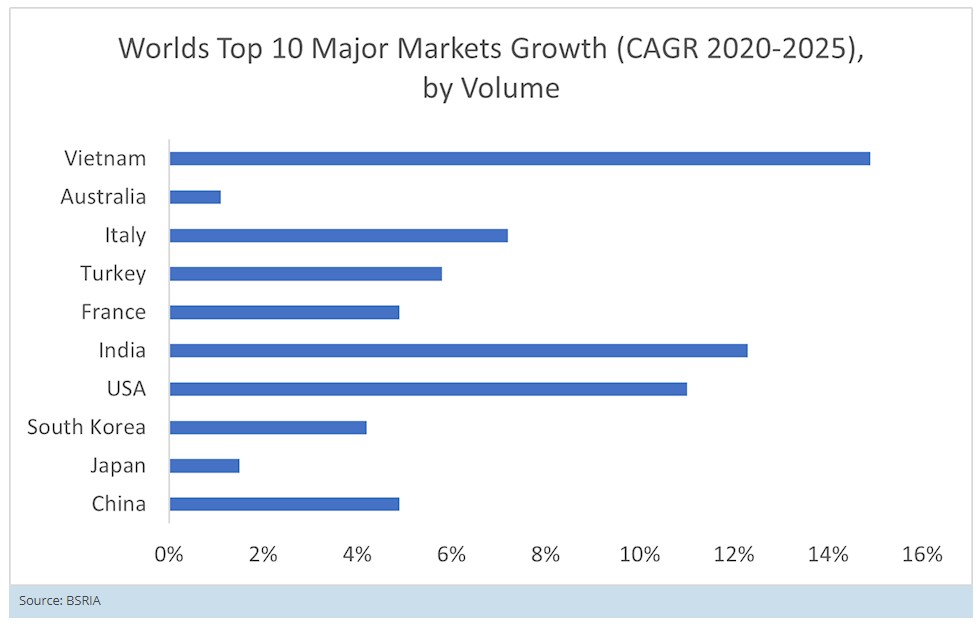

US among top 2020 global variable refrigerant flow markets

Variable refrigerant flow (VRF) technology has been around for nearly 40 years, invented in 1982 in Japan. In 2020, the US became the fourth biggest VRF market in the world after China, Japan, and South Korea. Globally, the VRF market reached USD 12billion in 2020 (with a contraction of 4% compared to 2019 level due to the impact of COVID-19).

VRFs traditionally have been installed in light commercial and medium size projects up to 300kW capacity range, however in the last decade the increase of mini-VRF sales (<20kW) enabled its rapid penetration in the residential market. As of 2020, 55% of global VRF sales comprised mini-VRF, by volume. We are also seeing this trend in the US, where around 24% of VRF sales are for residential applications.

The VRF market is a relatively mature market in Asia and Europe, while it is still relatively new in the Americas and Middle East, India, and Africa. In the Middle East, VRF units have been taking market share from rooftop units where they are traditionally installed in residential villas. In Asia and Europe, the VRFs have been taking the market share from multi-splits, rooftops, ducted single splits and scroll compressor chillers.

The US market reached USD 657m in 2020 and has seen significant growth since 2010, seeing a 19% growth in value terms (CAGR) between 2009 – 2019. In the US, VRFs are taking share away from traditional US ducted units, PTAC (Packaged Terminal Air Conditioner) and residential and light commercial rooftops units, but less so replacing scroll chillers, due to less significance of this market in the US. In the US, the VRF market is led by Mitsubishi Electric, followed by Daikin, LG and Fujitsu.

The global success of VRF products can be attributed to several factors, such as its energy efficiency – especially at part-load compared to conventional HVAC systems – its flexibility in zonal control, delivery of simultaneous heating and cooling, heat recovery and ease of installation with no duct work required. However, initial capital cost could be a deterring factor when it comes to decision making, therefore Life Cycle Costing (LCC) should be carried out for a better comparison.

The range of applications vary hugely, from a single-family home to offices, data centres, hospitality, hospitals and so on. However, for maxi VRF (>20kW units) offices are a significant application.

Outside the US, retail and hotels are also key applications for VRF, but this is less significant in the US, due to continued success of PTAC units (which is specific to the North American market). In recent years, we have seen an increasing adoption of VRFs in residential applications and in the US, particularly in townhouses.

The monitoring of single dwelling energy usage through sub-metering allows landlords to charge each tenant for their energy usage. In China, where up-market properties are sought after with a pre-installed air conditioning unit, this has encouraged the use of mini VRFs.

This trend has also been seen in other cities, for example in London. As the effects of climate change drive change for shorter and milder winters, the VRFs’ ability to heat and cool efficiently meets this demand between seasons.

VRF is not the only Asian technology seeing growth in the US. We are also seeing an increase in ductless split systems replacing traditional ducted splits technology; however, this is still from a low base.

Following the financial crisis of 2008, there were several years with fewer large construction projects where large-capacity HVAC systems were specified. During these years, VRFs were particularly popular with refurbishment projects as well as small- to medium-size new build projects. VRF was one of the few solutions which continued to see growth. The opportunities in the VRF market encouraged traditional air conditioning product suppliers to merge with VRF suppliers to offer a complete product range to stay competitive in the market. As a result, we have seen a number of global alliances and acquisitions to ensure major companies can present a full portfolio to the market and take advantage of the strengths of their solutions combined with a local sales network.

In North America, the partnership between Carrier and Midea was announced in September 2017 in residential ductless HVAC. The partnership allowed Carrier to penetrate the growing ductless splits market whilst allowing Midea access to the distribution channel. Another partnership was formed in January 2018 between Trane and Mitsubishi Electric for ductless splits and VRF products in the US and select Latin American countries.

The challenge for the VRF market is the fallen demand from the hospitality and office sectors. As a rule of thumb, around a third of VRF sales tends to come from these sectors in major markets, and in the US, these two sectors comprised 34% of the sales in 2020.

Another challenge is the Global Warming Potential (GWP) working fluid that is being used in VRF units. The current R410A has a GWP of 2088 and is being phased out in VRFs in Europe, replaced with R32 refrigerant with a GWP of 677. China, which accounts for around 67% of the world’s VRF market, is also rapidly replacing R410A with R32 refrigerant. The latest BSRIA World Air Conditioning study showed that just over 50% units sold were with R32, whereas in the US, the sales of R32 refrigerants in VRF sales were negligible.

Although 2021 will be a challenging year for the VRF market in the US, as we will not see the double-digit growth rates seen in the past, the market is nevertheless expected to see good growth bearing in mind the maturity of the US air conditioning market.

Most markets are recovering from the impact of COVID-19, with the VRF market globally set to see 5.4% growth (CAGR 2020-2025) compared to expected CAGR growth for the US is around 8% (CAGR 2020-2025).

If you would like further information on either study please contact BSRIA Worldwide Market Intelligence on:

- BSRIA UK (Europe): wmi@bsria.co.uk; +44 (0) 1344 465 540.

- BSRIA USA (Americas): sales@bsria.com; +1 312 753 6803.

- BSRIA China (China): [email protected]; +86 10 6465 7707.

This article originally appeared on the BSRIA website under the headline, 'US among the major VRF markets in the World'. It was published in June 2021.

--BSRIA

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

A case study and a warning to would-be developers

Creating four dwellings for people to come home to... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

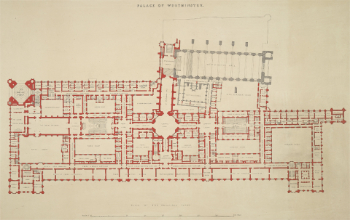

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description from the experts at Cornish Lime.

IHBC planning for growth with corporate plan development

Grow with the Institute by volunteering and CP25 consultation.

Connecting ambition and action for designers and specifiers.

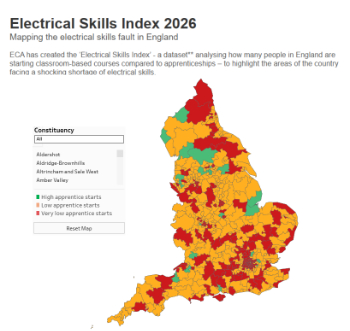

Electrical skills gap deepens as apprenticeship starts fall despite surging demand says ECA.

Built environment bodies deepen joint action on EDI

B.E.Inclusive initiative agree next phase of joint equity, diversity and inclusion (EDI) action plan.

Recognising culture as key to sustainable economic growth

Creative UK Provocation paper: Culture as Growth Infrastructure.

Futurebuild and UK Construction Week London Unite

Creating the UK’s Built Environment Super Event and over 25 other key partnerships.

Welsh and Scottish 2026 elections

Manifestos for the built environment for upcoming same May day elections.

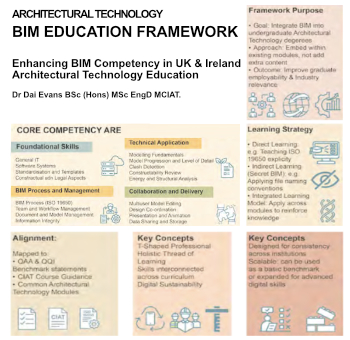

Advancing BIM education with a competency framework

“We don’t need people who can just draw in 3D. We need people who can think in data.”