Self build insurance

[edit] Introduction

Deciding to build, renovate or extend a property involves a lot of planning, and the risks associated with such a project are quite varied and diverse. It is a serious investment that requires the protection of the right insurance package and specialist risk and insurance advice from a construction professional.

There are a number of online self-build insurance products that can be purchased with a minimal question-set and with little or no advice around how to assess risk, legal duties, which aspects are insurable and options as to how to transfer the risk in a cost efficient way.

[edit] Construction (Design & Management) Regulations 2015

The first thing to consider when looking to manage a renovation, extension or a completely new build is awareness of the CDM Regulations and how they apply to the project. Unless experienced in the construction industry, most people are unaware that since 2015, these regulations apply to all UK construction sites, regardless of size or value.

The Construction (Design & Management) Regulations 2015 (referred to as CDM) are the main set of regulations for managing the health, safety and welfare of UK construction projects and apply to all building and construction work. This includes new build, demolition, refurbishment, extensions, conversions, repair and maintenance.

The CDM Regulations place responsibility for managing the health and safety of a construction project on three main duty holders:

- The client ensures that the construction project is set up so that it is carried out from start to finish in a way that adequately controls the risks to the health and safety of those who may be affected.

- The principal designer manages health and safety in the pre-construction phase of a project. This role extends to the construction phase through the principal designer's duties to liaise with the principal contractor and ongoing design work

- The principal contractor manages the construction phase of a project. This involves liaising with the client and principal designer throughout the project, including during the pre-construction phase.

For the successful delivery of a project, good working relationships between the duty holders are essential from the start. The client has overall responsibility for the successful management of the project and is supported by the principal designer and principal contractor in different phases of the project. Depending upon the nature of the project, the principal designer and principal contractor may be supported by designers, sub-contractors and workers.

[edit] Phases of work

There are three important phases of a project: before, during and after construction or building work:

- The pre-construction phase: the inception, design and planning stage of a project (before the construction or building work starts), although it is acknowledged, design and planning continues into and through the construction phase.

- The construction phase: the start-to-finish stage of the construction or building work.

- The post-construction phase: the practical completion of the construction or building work, including handover.

Designers and contractors should be appointed at the earliest opportunity to help prepare and plan your project. Experience has shown that, when designers and contractors are involved early in the project, everyone is better able to plan ahead and solve problems together to deliver a more successful project.

Even the simplest tasks, such as arranging routine maintenance or minor building work, require adequate time to plan and manage the work safely.

[edit] The right contract

For the client (or employer), the next key question is whether to put a formal contract in place with the contractor and possibly the designer too. Contracts can help all parties agree and clarify insurance responsibilities for a project.

Contracts for all types of projects are available from various sources (e.g. JCT, trade associations and so on), however, it may be helpful to get professional legal advice when considering which contract is most suitable for the project.

The JCT Minor Works Building Contract (Minor Works) is designed for smaller, basic construction projects where the work is of a simple nature. The insurance provisions are therefore shorter and simpler than those in other contract forms, such as the JCT Design & Build Contract. However, it is still very important to carefully consider the insurance provisions contained in Section 5 of this contract form and ensure project requirements are met.

[edit] Insurance Options

Once a plot of land for a new build project has been purchased you have a legal duty of care and are legally responsible for it. These are the different types of coverage available for this.

[edit] Public liability

Public liability (or land owners liability) insurance protects against the cost of unanticipated incidents that can occur and where property owners are legally liable - such as trip or fall injuries to third parties or visitors - whether the injured party is there for legitimate purposes or not.

Public liability insurance for a plot of land only is not compulsory, but it is important to protect legal duty of care as a property owner, whether it contains existing structures, material storage or even if the land is vacant with little or no apparent hazards.

Public liability insurance provides cover for claims from third parties for injury or property damage.

Most contractors already carry public liability insurance, however this doesn’t apply if the owner is found at fault for an incident on site unless there is a contract in place to make the contractor responsible for insuring against third party injury and property damage for the duration of the project.

It is not unusual for public liability insurance limits of £5 or £10 million to be carried or requested. The cost of injury claims on construction sites in the UK can currently reach as much as £25 million.

[edit] Employers' liability insurance

If the project involves directly employing trades, the owner will require employers' liability insurance. It is also a legal requirement for all UK limited companies to hold employers' liability insurance.

This insurance cover is much like public liability but designed to cover contractors working, or ‘employed’ for the site. This works in two ways in that it will cover a contractor should they have an accident on site and the owner is held negligent for but also acts as contingency cover for injuries to employees of contractors should the contractor's insurance fail.

In a self-build project, the owner may be held legally liable for a contractor’s injury on site. Something as innocuous as providing a set of ladders to a contractor, who subsequently falls and sustains injury can, and probably will, lead to a claim against the owner.

Claims of this nature can be expensive in providing compensation for potentially long-term injuries and high legal costs.

Although the current legal limit of cover is £5,000,000, insurers will provide a limit of £10,000,000 as standard. No excess applies.

[edit] Contract works (or contractors all risk) insurance

This insurance is designed to cover new works - materials, fixtures and fittings involved in the project on an all risks basis. Correctly and comprehensively insuring the project from start to finish is a key part of managing the risk of any building project. There is also a high risk of site theft of tools and materials as well as malicious damage.

Contract works cover includes weather events such as storm and water damage as the property is unlikely to be completely weatherproof and secure. Risks of fire and water escape are also common for a project nearing completion.

Sometimes policy limits and conditions are insufficient. Sometimes banks or loan financiers will request their interest are noted on the contract works insurance to protect their financial investment.

[edit] Existing structures

For an extension or a renovation, it is also important to protect the existing property during the project. Most UK household insurers will not maintain, extend or hold insurance cover whilst work is being carried out on the property, particularly if that work is structural. If the property is also unoccupied, most UK household insurers will either restrict cover heavily or even withdraw all cover until occupied again.

Insurance for existing structures is generally available on either a restricted cover basis, or full all risks basis – again depending on the project and property. Separate standalone cover can be arranged from various insurers whilst the property is under renovation.

[edit] Equipment cover

If contractors are using their own machinery and tools, owned or hired-in, it is best to ensure they insure these items, or even better, remove them for site overnight or when not in use to prevent attracting the attention of thieves.

If the owner is hiring any plant or tools in their own name, these shoudl be insured with the hirer or with the contract works insurance previously mentioned.

[edit] Structural warranty

Once a new build project is complete, a structural warranty insurance policy can be placed for a period of 10 or 12 years. Its main purpose is to cover the property against latent defects and structural defects. Cover includes surveyor visits at set periods of the project to make sure work is done to the correct standard.

If there is the chance the propert will be sold within the first 10 years, a structural warranty is required – the buyers’ mortgage provider will normally insist on one from an insurer that is on the CML approved list (Council of Mortgage Lenders).

[edit] Professional indemnity insurance

Under CDM regulations, the principal designer is responsible for the design elements of the project – this can include material specification, method of build, dimensions, use of space as well as the structural matters of loadbearing and even shoring, excavating or piling techniques to be used. These are typically architects, engineers, surveyors and so on.

Some builders offer a complete design and build or design and construct service where all elements of the project are managed and performed by the principal contractor. The risk of financial loss resulting from incorrect design or specification, professional services in general, is covered by professional indemnity insurance.

Architects, surveyors and engineers typically hold this type of insurance to protect them from claims of professional negligence – this can apply to any of the aforementioned risks as well as others as defined by the UK courts (duty to warn, matters of buildability and so on).

It is important that any professionals involved in the project hold this type of insurance for the services they provide and to the extent and cover limit required

[edit] Other insurance considerations

Sometimes the project’s architect will identify the risk of property damage to third party property that is not likely to be due to a negligent act. An extension to the above insurances may be required – this is called non negligence insurance and is often given the name of the contract clause that defines it in the JCT building contract suite – JCT 6.5.1 Insurance.

This is to typically provide cover for damage that occurs to a neighbouring property where plans have been followed to the letter and neither the owner nor the contractor are held negligent.

If a JCT contract is being used for the project, the owner should refer to the architect for advice as to whether this clause should be operative and whether the appropriate insurance is required – each project is different and professional advice should always be sought.

This insurance cover is normally the responsibility of the contractor to take out and hold for the duration of the project – it can be placed on a standalone basis or as an extension to their public liability insurance.

New site developments, during the pre-planning stage for some new developments, depending on risk, may encounter legal problems affecting title and development sites. The main issues that can be encountered are - restrictive covenants (freehold and leasehold), lack of legal access/legal rights to use the services, interference with third-party rights such as rights of way, services, mining rights, planning permission and building regulations.

Legal indemnity insurance can be taken out to protect developers and property owners against potential legal problem arising from these issues.

[edit] Related articles on Designing Buildings

Featured articles and news

British Architectural Sculpture 1851-1951

A rich heritage of decorative and figurative sculpture. Book review.

A programme to tackle the lack of diversity.

Independent Building Control review panel

Five members of the newly established, Grenfell Tower Inquiry recommended, panel appointed.

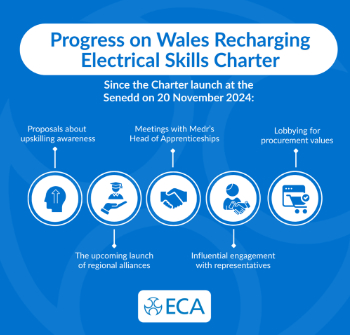

ECA progress on Welsh Recharging Electrical Skills Charter

Working hard to make progress on the ‘asks’ of the Recharging Electrical Skills Charter at the Senedd in Wales.

A brief history from 1890s to 2020s.

CIOB and CORBON combine forces

To elevate professional standards in Nigeria’s construction industry.

Amendment to the GB Energy Bill welcomed by ECA

Move prevents nationally-owned energy company from investing in solar panels produced by modern slavery.

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Heat pumps, vehicle chargers and heating appliances must be sold with smart functionality.

Experimental AI housing target help for councils

Experimental AI could help councils meet housing targets by digitising records.

New-style degrees set for reformed ARB accreditation

Following the ARB Tomorrow's Architects competency outcomes for Architects.

BSRIA Occupant Wellbeing survey BOW

Occupant satisfaction and wellbeing tool inc. physical environment, indoor facilities, functionality and accessibility.

Preserving, waterproofing and decorating buildings.