Construction contract awards provide relief in the wake of ISG collapse

- Large spike in contract awards driven by major infrastructure projects suggests negative effects of ISG collapse are still to come

- Residential development is on the rise but still falls way short of housing targets

- Infrastructure saw the largest gain in planning approvals with an increase of 136%

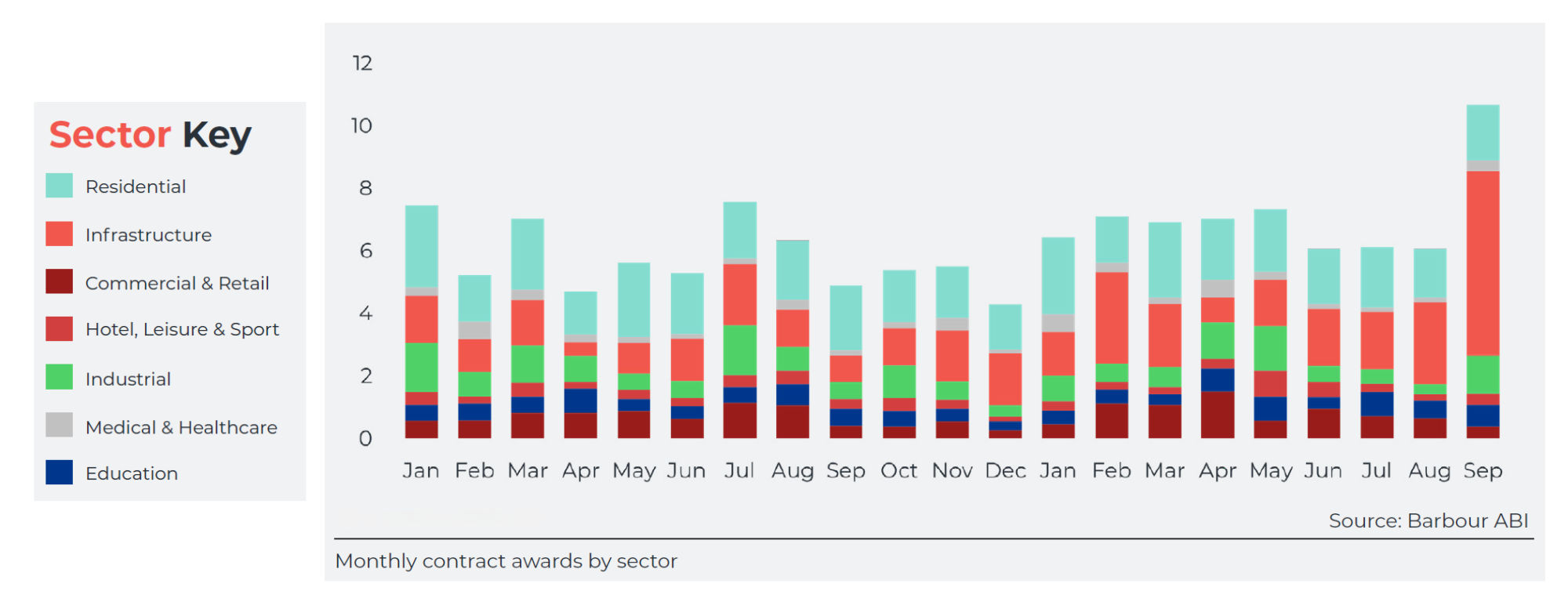

Contracts awarded for construction projects in the UK were up 76% to £10.7bn in September, thanks to two large infrastructure projects in the form of the Hornsea Offshore Wind Farm (£3.6bn) and the East Birmingham to Solihull Metro Extension (£735m).

Without these major projects, contract awards remain roughly in line with previous months, according to analysis by Barbour ABI. This shows that the impact of ISG’s collapse in September has yet to fully impact the sector.

The industrial sector, where much of ISG’s on-site work resided, saw the largest proportional increase at 289% to £1.2bn after a dip in recent months. Almost half of this value came from the £500m Gigafactory in the Southwest.

However, Barbour ABI sounded a cautious note about the future.

“Looking forward, there continue to be some key risks to growth in the construction sector; continuing materials price inflation, skills shortages and an ageing demographic of construction workers,” said Barbour ABI head of business and client analytics, Ed Griffiths. “Additionally, construction insolvencies are at their highest level since the financial crisis of 2008. Notably, this month saw Tier 1 contractor ISG fall into administration.”

“ISG’s headline-grabbing work on 69 ongoing central government projects is just the tip of the iceberg when you look at the full data set of the company’s contract portfolio. The ripple effect will be extremely worrying for the sector.”

Sector continues to grapple with new housing targets

Residential contracts were rising in September, up 14% alongside a 9% increase in approvals. However, Barbour ABI found new figures released by the Government showed the extent of the challenge ahead for meeting housing targets.

“Analysis of the government’s latest housing supply data shows starts in Q2 were down significantly compared to the same period last year, with approximately 23k starts compared to 66k in 2023,” said Griffiths. “Average completions over the past four quarters would add up to around 812k homes over five years should current levels continue. Well short of the 1.5m target set by the Government for this parliamentary period.”

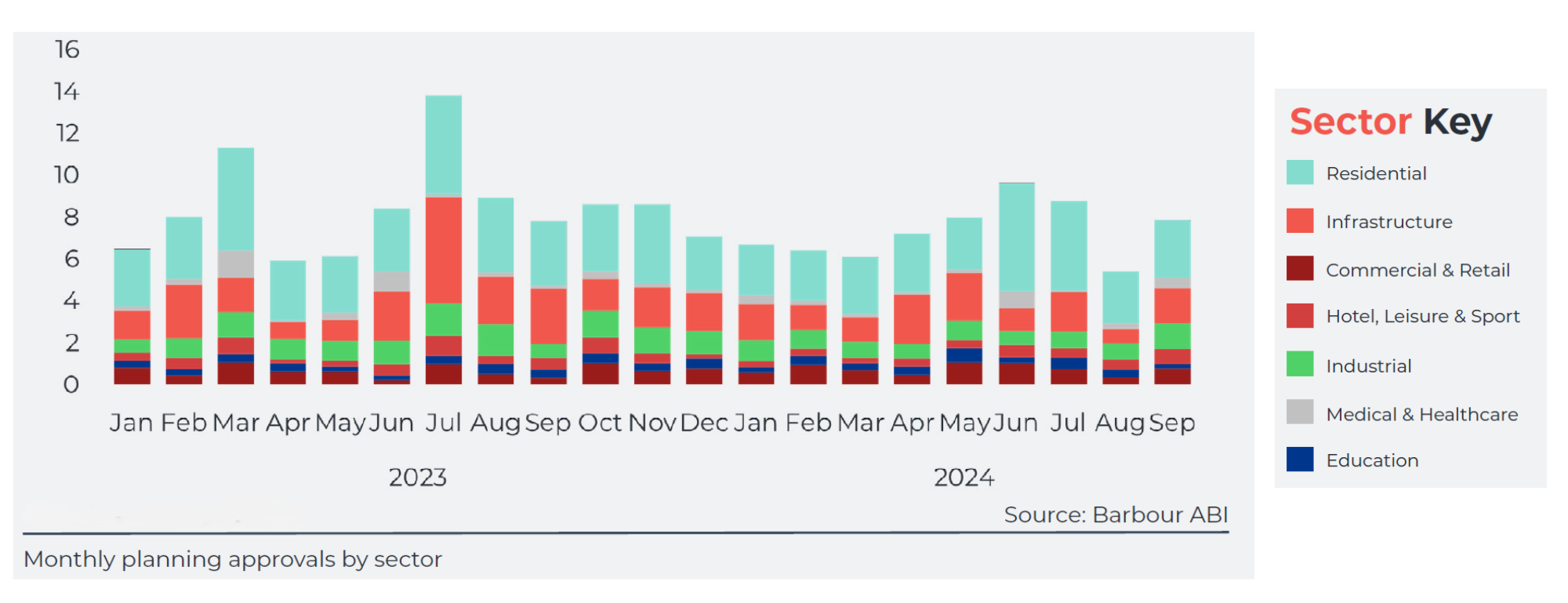

[edit] Planning approvals are up

Planning approvals increased by 44% in September to £7.9bn, following a disappointing August.

Infrastructure saw the largest gain of 136% to £1.7bn, its highest month since October 2023. Highlights included 700MW and 1000MW Battery Storage Projects in Scotland and the North East respectively.

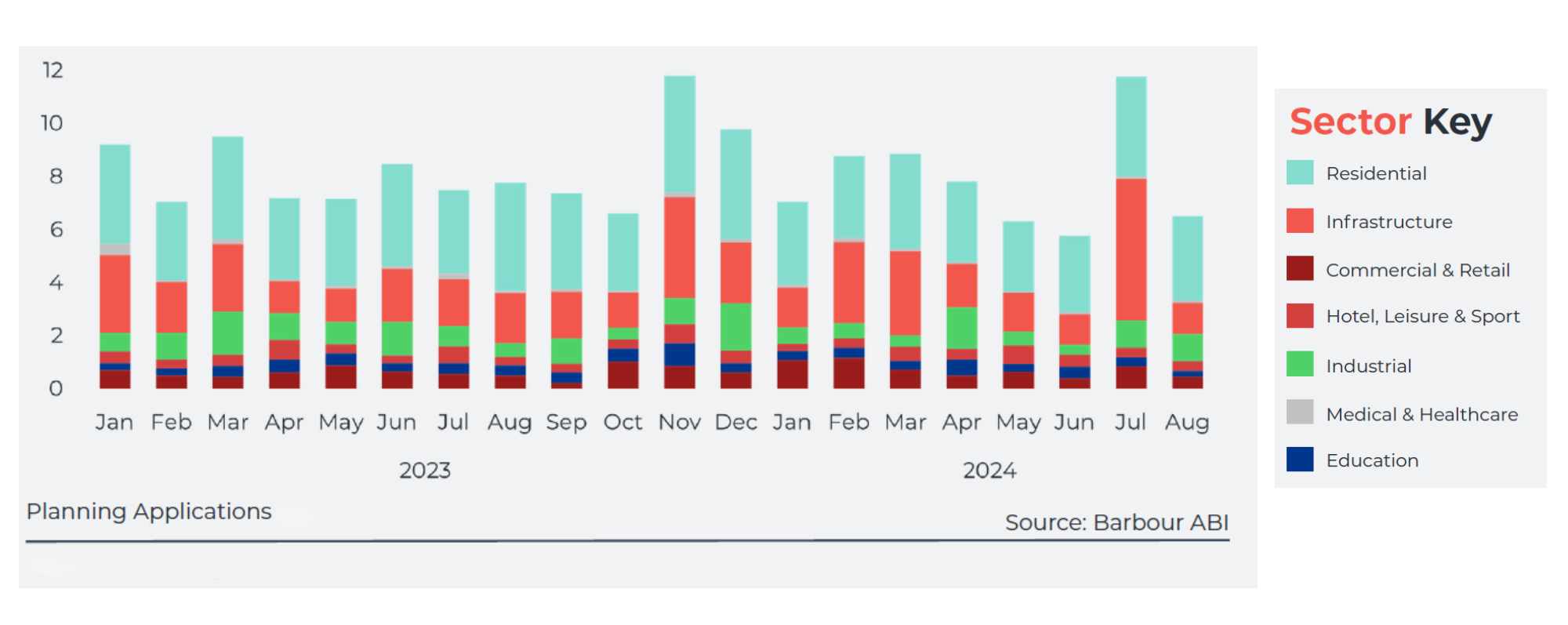

While application values for August were low, falling 45% to a total of £6.5bn, the decrease was made more dramatic by a high July boosted by large energy projects. This is shown by a monthly decrease of 78% in Infrastructure.

Griffiths added: “Planning figures returned to a more normal trajectory in August following a bumper July. This will be a key area to watch going forward to see if the ISG collapse has affected overall market appetite for new projects.”

--Barbour ABI 13:42, 09 Oct 2024 (BST)

[edit] Related articles on Designing Buildings

- Budget.

- Business model.

- Campaign for cash retentions reform.

- Cash flow statement.

- Contract claims.

- Capital costs for construction projects.

- Cash flow in construction.

- Compliance.

- Construction manager.

- Construction organisation design.

- Construction organisations and strategy.

- Corporate finance.

- Election fails to spark construction industry revival.

- Insolvency Act 1986 - Use of Prohibited Names.

- Insolvency in the construction industry.

- Insourcing.

- ISG administration, October support update.

- ISG files for administration.

- Joint venture.

- Liens.

- London construction cools as hotspots appear nationally.

- Planning approvals increased by 20% in June ahead of Labour’s new drive for housebuilding

- Profitability.

- Resolution planning.

- Site administrator.

- Solvency.

- Subcontractor.

- Support for ISG contractors, companies and employees.

- Succession planning.

- Types of construction organisation.

- Vested outsourcing.

Featured articles and news

Amendment to the GB Energy Bill welcomed by ECA

Move prevents nationally-owned energy company from investing in solar panels produced by modern slavery.

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Heat pumps, vehicle chargers and heating appliances must be sold with smart functionality.

Experimental AI housing target help for councils

Experimental AI could help councils meet housing targets by digitising records.

New-style degrees set for reformed ARB accreditation

Following the ARB Tomorrow's Architects competency outcomes for Architects.

BSRIA Occupant Wellbeing survey BOW

Occupant satisfaction and wellbeing tool inc. physical environment, indoor facilities, functionality and accessibility.

Preserving, waterproofing and decorating buildings.

Many resources for visitors aswell as new features for members.

Using technology to empower communities

The Community data platform; capturing the DNA of a place and fostering participation, for better design.

Heat pump and wind turbine sound calculations for PDRs

MCS publish updated sound calculation standards for permitted development installations.

Homes England creates largest housing-led site in the North

Successful, 34 hectare land acquisition with the residential allocation now completed.

Scottish apprenticeship training proposals

General support although better accountability and transparency is sought.

The history of building regulations

A story of belated action in response to crisis.

Moisture, fire safety and emerging trends in living walls

How wet is your wall?

Current policy explained and newly published consultation by the UK and Welsh Governments.

British architecture 1919–39. Book review.

Conservation of listed prefabs in Moseley.

Energy industry calls for urgent reform.