London construction cools as hotspots appear nationally

- London saw a fall in construction contracts spending of 18.5% in 2023. The Southeast saw a fall of 17.6%.

- New hotspots appear in East of England, Yorkshire and Scotland

Analysis conducted by Barbour ABI and the Construction Products Association (CPA) has revealed that construction spending is seeing a geographic shift as the industry recovers following the post-pandemic period and the infamous Liz Truss mini-budget.

Comparing ONS figures from 2022 with contract awards data from 2023, researchers discovered spending shifting away from traditional construction powerhouses in London and the Southeast, with new hotspots in construction activity appearing all over Great Britain.

Barbour ABI’s head of business and client analytics, Ed Griffiths said: “There are clear hotspots for upcoming construction activity over the next 6-24 months, with hotspots outnumbering coldspots, where activity has gone down, by almost three-to-one overall and six-to-one for infrastructure.

Encouragingly, regions with hotspots were spread across Great Britain and hotspots outnumbered coldspots in all regions of Great Britain.”

London and the Southeast, which have seen the highest spending on construction in the UK, saw contract awards reduce by 18.5% and 17.6% respectively – wiping out gains made in 2022. Westminster, traditionally responsible for one of London's biggest spending shares, took a 20% hit along with Berkshire (39%) and West Surrey (32%) in the Southeast.

Meanwhile, Manchester was in the top 10 largest regions in terms of the value of contracts awarded in 2023. However, this was 18% lower than a year earlier.

[edit] New winners across the UK

Analysts found contract awards growth of 7.9% in the East of England, with Cambridge, Suffolk and the Essex regions all registering double or triple digit increases. Yorkshire and the Humber also registered a 0.8% increase with Leeds a notable hotspot with a 23.7% increase and Lincolnshire seeing a 159.1% increase.

Perhaps the most interesting figures came in Scotland, which saw a 32% increase in contract Awards. This included the Scottish Boarders, which recorded the highest increase in the UK at 374.3% and Glasgow, which rose 30%.

“Overall contract awards remained stable at a national level, but looking at a more granular level reveals stark differences in regional performance with growth rates ranging between +374% and -95%. What we can say is that the post-pandemic boom initially focused itself on London and the Southeast is finally showing signs of trickling out to the rest of the UK.

This will come as a relief for more regionally focused businesses and a signal to contractors that it may be time to start looking outside of the big powerhouse areas for more projects to add to their pipeline.”

Overall, the report found 82 construction hotspots in the UK compared to just 31 coldspots, with 29 hotspots related to infrastructure projects.

You can download the Regional Construction Hotspots in Great Britain report here.

[edit] Notes to editors

Regional Awards growth

| Region | Contract Awards Growth in 2023 |

| Scotland | 32.00% |

| East of England | 7.90% |

| Yorkshire and Humber | 0.80% |

| North West | -7.50% |

| North East | -7.70% |

| East Midlands | -8.30% |

| West Midlands | -10.30% |

| South East | -17.60% |

| London | -18.50% |

| Wales | -28.30% |

| UK Average | -0.80% |

--Barbour ABI 11:50, 16 Sep 2024 (BST)

[edit] Related articles on Designing Buildings

- 2023 Spring Budget summary and industry response.

- A second spring budget of 2023.

- April turn for the worse, for construction, as market seesawing continues.

- Benchmarking in the construction industry.

- Construction contract awards jump to £7.3bn in May as uncertainty continues

- Construction industry reports.

- Construction industry revs engines in January.

- Construction industry statistics.

- Election fails to spark construction industry revival

- Homeowners turn to green energy upgrades as home improvement activity declines.

- Infrastructure tumbles, adding to construction industry woes.

- Mixed results for construction in January 23 as planning approvals fall.

- New engineering data shows over £52bn of projects were awarded to top 50 firms in the last year.

- Planning approvals increased by 20% in June ahead of Labour’s new drive for housebuilding

- Residential takes the reins as contract awards even out.

- Subdued planning environment figures provide scant hope for house-building targets.

- Types of consultant in the construction industry.

- UK Construction saw an £11.1bn fall in spending in 2023

- Useful links for the construction industry.

Featured articles and news

Shortlist for the 2025 Roofscape Design Awards

Talent and innovation showcase announcement from the trussed rafter industry.

OpenUSD possibilities: Look before you leap

Being ready for the OpenUSD solutions set to transform architecture and design.

Global Asbestos Awareness Week 2025

Highlighting the continuing threat to trades persons.

Retrofit of Buildings, a CIOB Technical Publication

Now available in Arabic and Chinese aswell as English.

The context, schemes, standards, roles and relevance of the Building Safety Act.

Retrofit 25 – What's Stopping Us?

Exhibition Opens at The Building Centre.

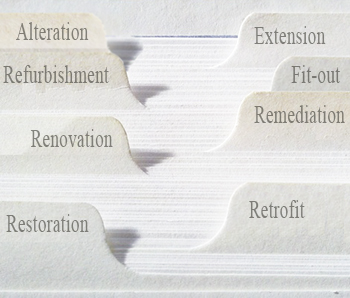

Types of work to existing buildings

A simple circular economy wiki breakdown with further links.

A threat to the creativity that makes London special.

How can digital twins boost profitability within construction?

The smart construction dashboard, as-built data and site changes forming an accurate digital twin.

Unlocking surplus public defence land and more to speed up the delivery of housing.

The Planning and Infrastructure Bill

An outline of the bill with a mix of reactions on potential impacts from IHBC, CIEEM, CIC, ACE and EIC.

Farnborough College Unveils its Half-house for Sustainable Construction Training.

Spring Statement 2025 with reactions from industry

Confirming previously announced funding, and welfare changes amid adjusted growth forecast.

Scottish Government responds to Grenfell report

As fund for unsafe cladding assessments is launched.

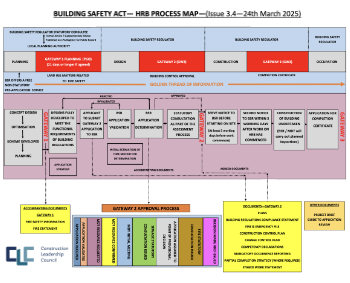

CLC and BSR process map for HRB approvals

One of the initial outputs of their weekly BSR meetings.

Building Safety Levy technical consultation response

Details of the planned levy now due in 2026.

Great British Energy install solar on school and NHS sites

200 schools and 200 NHS sites to get solar systems, as first project of the newly formed government initiative.

600 million for 60,000 more skilled construction workers

Announced by Treasury ahead of the Spring Statement.