Home improvements swapped for green energy upgrades

Contents |

[edit] Homeowners turn to green energy upgrades as home improvement activity declines

- Home improvement applications are 27% down since 2021.

- A desire to reduce energy bills is driving a rise in applications citing solar panels and insulation.

- Wales and the North West see sharpest declines.

Demand for extensions, loft conversions and garden work has fallen dramatically following a post-pandemic boom, as home improvement enthusiasts switch focus to green energy upgrades to reduce bills.

The number of home improvement applications has fallen by 27% overall since 2021 with 2023 seeing the lowest numbers since 2013. The fall follows an unprecedented spike in activity following the pandemic that saw nearly 450k applications in 2021.

The new insight into homeowner spending trends is revealed in a major new study, the Home Improvement Index, launched by data analysts Barbour ABI to monitor activity across the sector.

Barbour ABI consulting analyst, Brian Green said “The build-up of excess savings from reduced spending on holidays and entertainment and the sense of being caged during lockdown generated a surge in home improvement in 2021. That exuberance in the market has now yielded to the downward pressures created by a cost-of-living crisis.”

[edit] Solar and insulation rise to top of wish lists

It is not a story of decline across all spending types. In 2023, there were two and a half times as many applications citing solar panels as in 2019. Insulation is one and a half times higher than in 2019 and 60% up since 2021.

Brian explained: “There has been a swift transition over the past year or so in the motivations for home improvement among households. From a pandemic-prompted eagerness to invest in improving outside space or a home office we have seen households increasingly driven by the cost-of-living crisis.

“It’s clear that a desire to cut household energy bills is driving a shift to green energy solutions. While home improvement applications fell, the number including solar panels is skyrocketing. Insulation is on the up too – people are looking for easy adjustments that they can make to try and bring energy bills under control.

“The upshot is that there are challenges ahead for those working within the home improvement sector. However, there are also opportunities for businesses who can adapt to shifting market trends.”

[edit] Regional variations

The cost-of-living crisis is impacting harder on some regions than others. The regions that saw the biggest drop last year were Wales (-16.8%) and the North West (-14.1%). Low house prices relative to the rest of Britain and recent falls in prices are inevitably inhibiting investment in home improvement in these areas.

Conversely London saw the smallest fall in applications with wealthy areas in the capital such as Kensington and Chelsea seeing applications rise sharply in contrast with lower income areas in the rest of Great Britian.

The Home Improvement Index is now available on Barbour ABI’s website.

[edit] The UK’s Home Improvement hotbeds

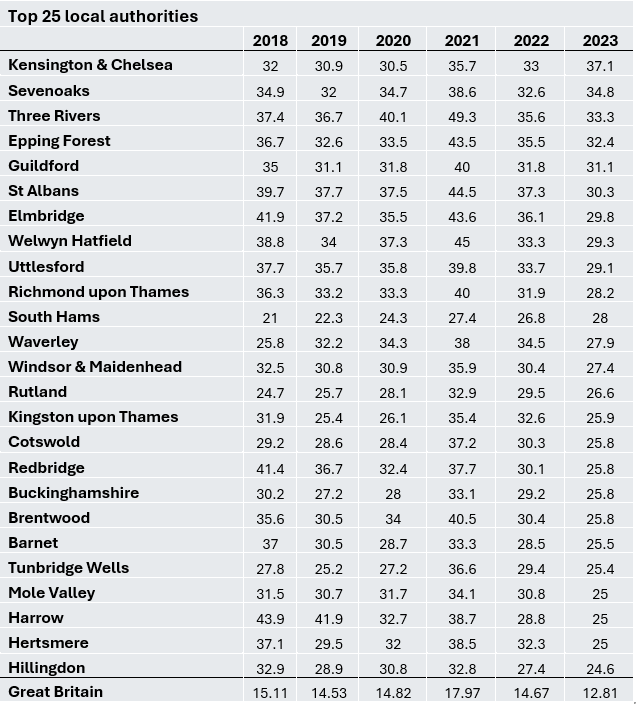

London leads the country for home improvements with 20.5 applications per 1000 homes. Kensington and Chelsea rank highest in the country with 37.1 applications per 1000 homes.

Outside of London, the South East remains the UK’s hotbed for home improvement with Sevenoaks and Guildford both ranking in the top five in the country. Households in the South East spend on average £2,582 on alterations and improvements, almost twice as much as both London residents (£1,420) and the UK as a whole (£1,438) according to ONS figures on family spending in the UK.

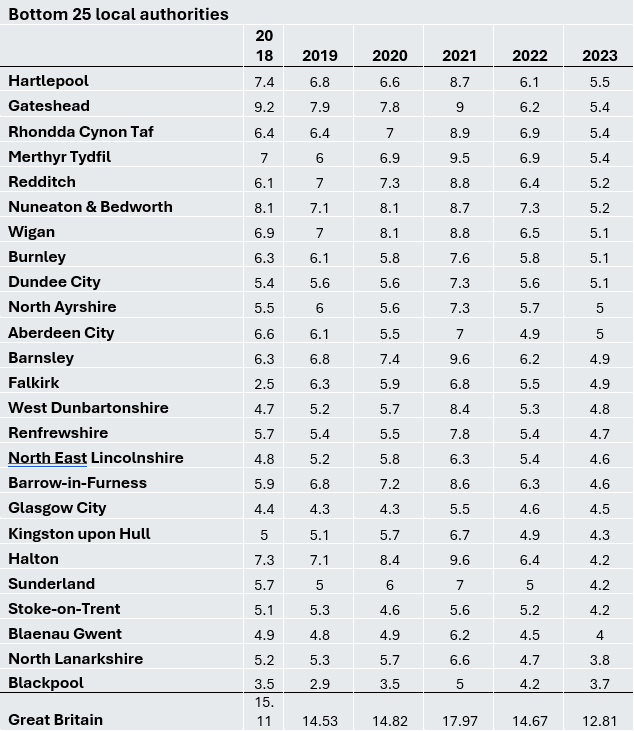

People living in the North East of England are least likely to be making major improvements to their homes with just 6.8 applications per 1000 homes, followed by Scotland and Wales. No regions in the north made it into the top 5.

[edit] About Barbour ABI

Barbour ABI was founded to support the UK construction industry – helping businesses to sustain and grow. We are the exclusive provider of New Orders Estimates to the Office for National Statistics and partner to the Infrastructure & Projects Authority in providing the National Infrastructure and Construction Pipeline.

As the market leading provider of construction project information, we strive to allow our clients to access the very best, most accurate and up-to-date data on construction projects and the key decision makers that are involved.

Not only do we generate construction project leads, but we also are able to inform the industry of the latest trends and developments using our data to analyse and form a complete picture of the past, present and future.

We consider current affairs and their impact on our industry, where the opportunities and threats lie, and therefore how our clients can future-proof themselves.

Our mission is to provide our clients with the best experience and that the service and product we provide is an extension of their own business and something they can’t do without.

[edit] Related articles on Designing Buildings

- Construction industry revs engines in January.

- Construction contract awards reach 7.1bn in February, their highest level in seven months.

- Green deal home improvement fund.

- Home improvement.

- Home Improvement Report: Homeowners embrace solar panels and insulation as cost-of-living crisis bites.

- Homeowners fear cost-of-living crisis will derail home improvement plans.

- UK Construction saw an 11.1bn fall in spending in 2023.

Featured articles and news

Amendment to the GB Energy Bill welcomed by ECA

Move prevents nationally-owned energy company from investing in solar panels produced by modern slavery.

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Heat pumps, vehicle chargers and heating appliances must be sold with smart functionality.

Experimental AI housing target help for councils

Experimental AI could help councils meet housing targets by digitising records.

New-style degrees set for reformed ARB accreditation

Following the ARB Tomorrow's Architects competency outcomes for Architects.

BSRIA Occupant Wellbeing survey BOW

Occupant satisfaction and wellbeing tool inc. physical environment, indoor facilities, functionality and accessibility.

Preserving, waterproofing and decorating buildings.

Many resources for visitors aswell as new features for members.

Using technology to empower communities

The Community data platform; capturing the DNA of a place and fostering participation, for better design.

Heat pump and wind turbine sound calculations for PDRs

MCS publish updated sound calculation standards for permitted development installations.

Homes England creates largest housing-led site in the North

Successful, 34 hectare land acquisition with the residential allocation now completed.

Scottish apprenticeship training proposals

General support although better accountability and transparency is sought.

The history of building regulations

A story of belated action in response to crisis.

Moisture, fire safety and emerging trends in living walls

How wet is your wall?

Current policy explained and newly published consultation by the UK and Welsh Governments.

British architecture 1919–39. Book review.

Conservation of listed prefabs in Moseley.

Energy industry calls for urgent reform.