CLC Material Supply Chain Group statement

The first report of 2024 from the Construction Leadership Council's (CLC) Material Supply Chain Group shows the year starting the same way 2023 ended, with good levels of product availability and prices remaining flat or falling slightly.

The easing of pressure on product availability has largely been driven by continuing reduced demand across the different regions and sectors of the UK market, with those supplying housebuilders the worst hit. New housebuilding continues to be held back by high interest rates and planning challenges. Larger builders do not anticipate a second half upturn at this stage. Regional mid-cap builders, however, cite the availability of smaller sites as their number one concern but expect to maintain current output levels throughout the year.

Any risk to product supply from the disruption in the Red Sea are yet to materialise, although the Group is monitoring the availability and cost of supplies from the Indian subcontinent and Asia such as decorative sandstone, plywood, and sheet materials, hand tools, ironmongery and electrical goods. A longer sea journey of 10-15 days has led to delays in deliveries, so the main concern here relates to five-fold price increases stemming from increased shipping and container costs for these products.

The Group is also monitoring the supply of semi-conductors, which has been under pressure since the start of the pandemic. With four major design and manufacturing facilities in Israel, the conflict here has the potential to add further pressure on supply, and lead to increased prices.

Brick manufacturers have adjusted capacity to meet anticipated demand for 2024, while balancing stock levels. They recommend that all customers plan ahead, placing forward orders to maintain supply.

There is good availability of aggregates, cement and concrete, with demand not forecast to markedly improve until 2025 in spite of the current pipeline of infrastructure projects. There is also a plentiful supply of steel, but the supply chain here is under financial strain due to the downturn in demand.

Otherwise, there are concerning reports that late payment for materials is creeping up in a number of regions, although it is being managed at this stage. Obtaining trade credit insurance, however, is a bigger issue. Firms complain of coverage costing more and being reduced or withdrawn as insurers become more nervous about the level of construction insolvencies. The joint chairmen of this Group are meeting with members of the Association of British Insurers to promote a greater understanding of building material supply within the wider construction landscape, with a view to changing insurers' current blanket approach towards risk management.

Finally, the issues of labour costs, availability and skills shortages continues to rank high for most of the Group. This ranges from concerns around a lack of resources amongst building control teams from 6 April to difficulties finding enough qualified site staff to support the transition to newer, more sustainable technologies and products. These concerns have been shared with the wider CLC and we are continuing to have discussions with government and the Building Safety Regulator.

This article originally appeared on the CIAT news and blog site as "CLC Material Supply Chain Group statement" dated February 23, 2023 and was written by John Newcomb, CEO of the Builders Merchants Federation and Peter Caplehorn, CEO of the Construction Products Association, co-chairs of the Construction Leadership Council’s Material Supply Chain Group.

--CIAT

[edit] Related articles on Designing Buildings

- BSI construction product identification system.

- CIAT articles.

- CLC urges inclusion of fluctuations provisions in contracts.

- Contractor vs supplier.

- Framework agreement.

- Green supply chain management.

- Integrated supply team.

- Named supplier.

- Modern slavery and the supply chain.

- Subcontractor vs supplier.

- Supply.

- Supply chain integration.

- Supplier.

- Supplier selection.

- Supply chain management.

- Technology and collaboration: Improving the construction supply chain.

- Vertical integration.

- What is causing the rise in steel prices?

Featured articles and news

Grenfell Tower Principal Contractor Award notice

Tower repair and maintenance contractor announced as demolition contractor.

Passivhaus social homes benefit from heat pump service

Sixteen new homes designed and built to achieve Passivhaus constructed in Dumfries & Galloway.

CABE Publishes Results of 2025 Building Control Survey

Concern over lack of understanding of how roles have changed since the introduction of the BSA 2022.

British Architectural Sculpture 1851-1951

A rich heritage of decorative and figurative sculpture. Book review.

A programme to tackle the lack of diversity.

Independent Building Control review panel

Five members of the newly established, Grenfell Tower Inquiry recommended, panel appointed.

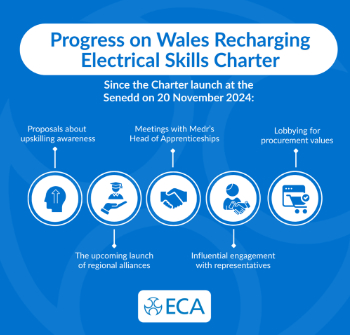

Welsh Recharging Electrical Skills Charter progresses

ECA progressing on the ‘asks’ of the Recharging Electrical Skills Charter at the Senedd in Wales.

A brief history from 1890s to 2020s.

CIOB and CORBON combine forces

To elevate professional standards in Nigeria’s construction industry.

Amendment to the GB Energy Bill welcomed by ECA

Move prevents nationally-owned energy company from investing in solar panels produced by modern slavery.

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Heat pumps, vehicle chargers and heating appliances must be sold with smart functionality.

Experimental AI housing target help for councils

Experimental AI could help councils meet housing targets by digitising records.

New-style degrees set for reformed ARB accreditation

Following the ARB Tomorrow's Architects competency outcomes for Architects.

BSRIA Occupant Wellbeing survey BOW

Occupant satisfaction and wellbeing tool inc. physical environment, indoor facilities, functionality and accessibility.

Preserving, waterproofing and decorating buildings.