Trade credit insurance

Contents |

[edit] Introduction

Trade credit insurance or TCI (also known as business credit insurance or credit insurance) is a form of insurance from private companies and government agencies to cover business-to-business transactions, particularly in non-service sectors such as manufacturing and construction. The purpose of this form of insurance is to protect businesses from bad debt.

[edit] History

As a business practice, trade credit insurance emerged in Western Europe between World Wars I and II. It was often applied to transactions between two countries, and political stability was frequently one of the main factors in terms of risk and repayment. Natural disasters, acts of terrorism and currency devaluations or shortages also play a part in the risk associated with global transactions.

Since the 1990s, the trade credit insurance market has been primarily focused on Western Europe, but it is now present in the Americas, Asia and Eastern Europe as well. In the international marketplace, trade credit insurance is referred to as export credit insurance (or ECI), which sets out to reduce the risk of doing business on a global scale.

[edit] Protecting both parties

Both trade credit insurance and export credit insurance are meant to protect vendors from non-payment, should the customer require extra time to fulfil financial obligations. The purpose is to give businesses the confidence to trade with each other even when there is a degree of risk or uncertainty involved.

Trade credit arrangements are conceptually similar to bridging loans, but instead of applying to property transactions between a financial institution and an individual consumer, trade credit insurance applies to transactions between two businesses, and it allows a business to generate income without having to invest in prepayment.

Like bridging loans, the business covered by a trade credit insurance policy will pay an agreed percentage rate for the duration of the arrangement (which is typically within one year). This rate is based on the business history and creditworthiness of the recipient. Premiums for trade credit insurance are typically made in monthly instalments.

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description from the experts at Cornish Lime.

IHBC planning for growth with corporate plan development

Grow with the Institute by volunteering and CP25 consultation.

Connecting ambition and action for designers and specifiers.

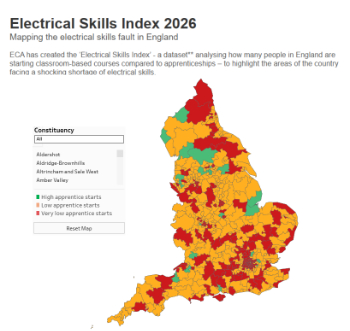

Electrical skills gap deepens as apprenticeship starts fall despite surging demand says ECA.

Built environment bodies deepen joint action on EDI

B.E.Inclusive initiative agree next phase of joint equity, diversity and inclusion (EDI) action plan.

Recognising culture as key to sustainable economic growth

Creative UK Provocation paper: Culture as Growth Infrastructure.

Futurebuild and UK Construction Week London Unite

Creating the UK’s Built Environment Super Event and over 25 other key partnerships.

Welsh and Scottish 2026 elections

Manifestos for the built environment for upcoming same May day elections.

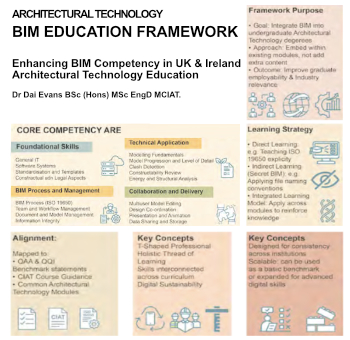

Advancing BIM education with a competency framework

“We don’t need people who can just draw in 3D. We need people who can think in data.”