Equity and loan capital for property development

Contents |

[edit] Introduction

There are two distinct types of funding available for development projects and other commercial activities:

- Funds provided in return for a share in the ownership of the project: 'Equity'.

- Funds provided in the form of loans which will carry a coupon and will be repayable at some future point in time: 'loan capital'.

There are also various 'hybrid' types of funding which contain elements of both equity and loan capital or a right to convert a loan into equity.

[edit] Equity

Equity can take many forms, for example; ordinary shares, preference shares or partnership shares. In each case, the capital provided in return for such shares will be for the purpose of acquiring ownership or part ownership of the project itself and, for that reason, those funds are considered to be most at risk in the event that the project fails to become financially viable.

All shares carry rights and obligations and in certain circumstances one type of share may be converted into another. In establishing the capital structure for a development it is vital that risk and reward are measured carefully and properly reflected in the types and proportions of shares issued.

[edit]

Ordinary shares are the riskiest form of equity which will only provide a return if the development is profitable. The return on these shares can then either be in the form of income i.e dividends, or by way of a capital gain if the shares are sold.

The key point to remember however is that there is no guarantee of a return on the amount invested.

[edit]

This type of share usually provides for interest to be paid on a regular basis. If the company does not generate sufficient income to pay the interest, unpaid interest may accrue and become payable as and when the company has sufficient income to do so. This type of share will rank ahead of ordinary shares in the event that the company is liquidated.

Holders of these shares may not have a vote on the manner in which the company is managed so in many respects a preference share is similar to providing loans. Preference shares are no longer as popular as they used to be having been largely replaced by loans and hybrid forms of funding.

[edit]

Increasingly, developments are procured via Special Purpose Vehicles (SPV's) which are often constituted in Limited Liability Partnership (LLP) form. This type of structure is increasingly popular, mainly because of the way in which it is treated for UK tax purposes. In particular it is beneficial where the investors in a project may come from all over the World and whose individual tax circumstances may be very different from their co-investors.

Investing in a LLP for such a purpose usually involves issuing investors with a minimal shareholding, which represents their capital investment into the venture, together with loan notes bearing an agreed coupon.

Holding partnership shares confers certain rights to the holders although day to day management will be undertaken by the managing partner.

[edit] Loans

Project’s funding is most commonly provided by loan capital.

Loan capital is more flexible than equity capital. It can be introduced and withdrawn more readily and does not confer any ownership rights to those who are providing the loans.

However, loan capital can be problematic if the project does not succeed, as non-payment of interest or a failure to make capital repayments can result in the loan providers taking control of the project, usually wiping out the value of any equity investment.

Loans can be provided in many different ways, from simple overdraft facilities to complex mezzanine finance deals which can involve convertibility of loans into capital if certain events occur.

Loans can also be referred to as 'corporate bonds'.

As with equity, different types of loan will carry different conditions and levels of security. Generally, the less the security provided to a particular class of loan, the higher the interest rate payable. On complex deals there may be different classes of loan finance whose security may be set out in a clear order of precedence. By this it is meant that in the event of the project failing, holders of primary loan notes, for example, would be repaid in full before the holders of secondary loan notes and so on.

[edit] Related articles on Designing Buildings Wiki

- Bad debt.

- Bridging loan.

- Company acquisitions in construction.

- Construction loan.

- Construction organisations and strategy.

- Equity in property.

- Funding prospectus.

- Funding options.

- Leaseback.

- Mezzanine finance.

- Microeconomics.

- Project-based funding.

- Property development finance.

- Property ownership.

- Remortgage.

- Special purpose vehicle.

- Types of development.

- Working capital.

Featured articles and news

OpenUSD possibilities: Look before you leap

Being ready for the OpenUSD solutions set to transform architecture and design.

Global Asbestos Awareness Week 2025

Highlighting the continuing threat to trades persons.

Retrofit of Buildings, a CIOB Technical Publication

Now available in Arabic and Chinese aswell as English.

The context, schemes, standards, roles and relevance of the Building Safety Act.

Retrofit 25 – What's Stopping Us?

Exhibition Opens at The Building Centre.

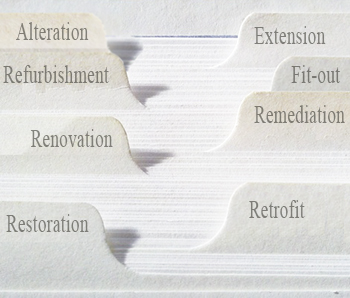

Types of work to existing buildings

A simple circular economy wiki breakdown with further links.

A threat to the creativity that makes London special.

How can digital twins boost profitability within construction?

The smart construction dashboard, as-built data and site changes forming an accurate digital twin.

Unlocking surplus public defence land and more to speed up the delivery of housing.

The Planning and Infrastructure Bill

An outline of the bill with a mix of reactions on potential impacts from IHBC, CIEEM, CIC, ACE and EIC.

Farnborough College Unveils its Half-house for Sustainable Construction Training.

Spring Statement 2025 with reactions from industry

Confirming previously announced funding, and welfare changes amid adjusted growth forecast.

Scottish Government responds to Grenfell report

As fund for unsafe cladding assessments is launched.

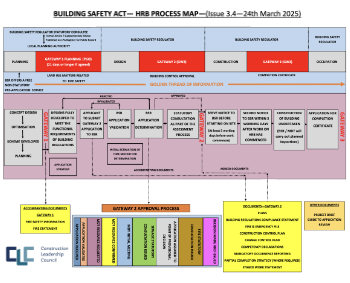

CLC and BSR process map for HRB approvals

One of the initial outputs of their weekly BSR meetings.

Building Safety Levy technical consultation response

Details of the planned levy now due in 2026.

Great British Energy install solar on school and NHS sites

200 schools and 200 NHS sites to get solar systems, as first project of the newly formed government initiative.

600 million for 60,000 more skilled construction workers

Announced by Treasury ahead of the Spring Statement.