Leaseback

The term 'leaseback' (also known as sale-and-leaseback) refers to a financial arrangement in which the party selling an asset (usually property) leases it back from the purchaser. This is generally a long-term arrangement, allowing them to use the asset but no longer owning it. The seller of the asset becomes the lessee, and the purchaser becomes the lessor.

Companies often raise capital by taking up debt and giving up equity, in order to grow the business. Leaseback is neither debt nor equity; the company doesn’t increase its debt load but gains access to capital through the sale of assets, while not having capital tied up in the asset. Tax benefits can sometimes be gained through the use of leasebacks.

The arrangement is rather like that of a pawnshop in that a company exchanges a valuable asset for a certain amount of money. The difference is that there is no expectation that the asset will be bought back by the company.

Builders and construction companies with high fixed assets are common users of leaseback arrangements. They can be useful when a company needs to use the capital invested in an asset for other investments, but where they still require the asset in order to operate. The advantage to the lessor is that they receive a guaranteed lease with stable payments for a specified period of time.

The company may have the option to repurchase the asset at the end of the term or at specified points within the term.

There can be complexities in terms of defining the extent to which the company still has risks and liabilities relating to the asset even though it has sold it to the lessor.

Other disadvantages include the fact that the original owner loses any further interest in the growth of the asset’s value. In the case of property, the rent is also likely to be revised upwards at regular intervals, so what may have appeared to be a cheap source of funding in the short term, can prove to be expensive over the long term.

To avoid this drawback, an off-balance sheet version of leasebacks can be used. A 50-50 joint-owned company is set up which borrows the bulk of the capital to buy the assets, granting the vendor a lease in the normal way. Via its half-ownership of the joint company, the original owner retains an interest in the performance of the properties in the future.

[edit] Find out more

[edit] Related articles on Designing Buildings Wiki

- Construction loan.

- Discounted cash flow.

- Equity and loan capital.

- Funding options.

- Joint venture.

- Mezzanine finance.

- Partnering and joint ventures for construction.

- Private Finance Initiative

- Property development finance.

- Real Estate Investment Trusts.

- Remortgage.

- Special purpose vehicles.

- Speculative construction.

Featured articles and news

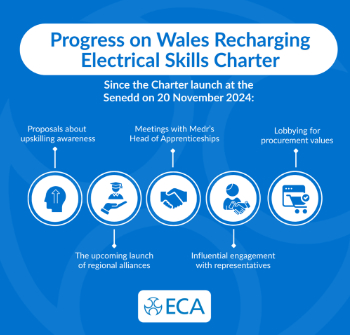

ECA progress on Welsh Recharging Electrical Skills Charter

Working hard to make progress on the ‘asks’ of the Recharging Electrical Skills Charter at the Senedd in Wales.

A brief history from 1890s to 2020s.

CIOB and CORBON combine forces

To elevate professional standards in Nigeria’s construction industry.

Amendment to the GB Energy Bill welcomed by ECA

Move prevents nationally-owned energy company from investing in solar panels produced by modern slavery.

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Heat pumps, vehicle chargers and heating appliances must be sold with smart functionality.

Experimental AI housing target help for councils

Experimental AI could help councils meet housing targets by digitising records.

New-style degrees set for reformed ARB accreditation

Following the ARB Tomorrow's Architects competency outcomes for Architects.

BSRIA Occupant Wellbeing survey BOW

Occupant satisfaction and wellbeing tool inc. physical environment, indoor facilities, functionality and accessibility.

Preserving, waterproofing and decorating buildings.

Many resources for visitors aswell as new features for members.

Using technology to empower communities

The Community data platform; capturing the DNA of a place and fostering participation, for better design.

Heat pump and wind turbine sound calculations for PDRs

MCS publish updated sound calculation standards for permitted development installations.

Homes England creates largest housing-led site in the North

Successful, 34 hectare land acquisition with the residential allocation now completed.

Scottish apprenticeship training proposals

General support although better accountability and transparency is sought.

The history of building regulations

A story of belated action in response to crisis.

Moisture, fire safety and emerging trends in living walls

How wet is your wall?

Current policy explained and newly published consultation by the UK and Welsh Governments.

British architecture 1919–39. Book review.

Conservation of listed prefabs in Moseley.

Energy industry calls for urgent reform.