Smart Connected HVAC market

New market studies published by BSRIA in January 2019 suggest Europe is seeing a rapid growth in the market for smart connected HVAC, that is, heating, cooling or air conditioning systems that are connected to a network (usually the internet) so that their performance can be monitored and analysed. This allows faults to be identified, the causes diagnosed and the correct replacement parts delivered. In addition, the wealth of data collected can allow service teams to predict when a part is likely to fail and to fix the problem before anyone in the building notices it.

BSRIA estimates that the total market for smart connected HVAC in Europe was worth almost 200 million Euros in 2018 and this is set to more than double by 2023, reaching more than 415 million Euros.

Senior BSRIA analyst Henry Lawson said:

|

"...our research shows that the European market for Smart Connected Air Conditioning is mainly driven by commercial, non-residential buildings. For smart connected heating – most of the activity and demand is in the residential sector. "For commercial buildings the biggest single driver is business continuity and maintaining optimal physical environment. If you are running a hotel, or selling chilled food, or if you are responsible for a home or hospital for people who are ill or elderly – then any outage of air conditioning and cooling systems can have serious consequences, ranging from financial losses to risks to people’s health. "Malfunctioning air conditioning is also a chronic waster of energy, with even something as simple as a blocked filter increasing energy consumption by up to 30 per cent. Energy used by air conditioning also has environmental implications – especially with rising temperatures. The last two years have seen a stalling in Europe’s efforts to reduce greenhouse gas emissions and anything that can help is likely to be encouraged. "Manufacturers benefit from improved customer loyalty and also from the wealth of data collected about the performance of their products. "The European Smart Air Conditioning market is still relatively small, at about 45 million Euros in 2018, but is forecast to almost treble to 130 million Euros by 2023. The majority of this value is represented by service and maintenance. Chillers represent the largest sector of the market though there are also solutions for VRF and Air Handling Units. Most of the largest air conditioning manufacturers either already offer a solution in Europe or are planning to introduce one. Major controls manufacturers also have offerings. "The biggest market is currently in Germany but there is demand across Europe. "The European Smart Connected Residential Heating market is more mature, valued at over 140 million Euros in 2018, most of which was accounted for by hardware, software and communications. It is also forecast to grow rapidly to exceed 284 million Euros by 2023. "Consumers across Europe are increasingly interested in ways in which they can monitor and control their energy consumption more effectively, while comfort is also a factor, for example in being able to preheat a home ahead of one’s arrival. Heating manufacturers, particularly boiler manufacturers see the service as a means of differentiating their products from the competition by providing a better service. A similar service can also be provided for heat pumps. "The UK is currently the largest market for smart connected heating, though demand is growing rapidly in the other major European markets. "While the European market for smart HVAC is still in its infancy, it has enormous potential as part of the smart buildings and smart homes revolution. To achieve its full potential some key issues need to be addressed. These include establishing a robust commercial model. Customers, service organisations and manufacturers all stand to benefit so the costs and benefits need to be distributed equitably. "A slightly more intractable problem is that of data security, both real and perceived, as both commercial organisations and private individuals continue to be nervous about any kind of online access to key systems and also to the information about their behaviour." |

More detail is available in:.

- Europe Smart Connected Air Conditioning in Commercial Buildings 2018.

- Europe Smart Connected Heating in Residential Buildings 2018.

Both reports provide an overview of the current European Union (including the UK). They also drill down into the five largest country markets: France, Germany, Italy, Spain and the UK with a summary for the rest of the EU.

--BSRIA

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

Farnborough College Unveils its Half-house for Sustainable Construction Training.

Spring Statement 2025 with reactions from industry

Confirming previously announced funding, and welfare changes amid adjusted growth forecast.

Scottish Government responds to Grenfell report

As fund for unsafe cladding assessments is launched.

CLC and BSR process map for HRB approvals

One of the initial outputs of their weekly BSR meetings.

Architects Academy at an insulation manufacturing facility

Programme of technical engagement for aspiring designers.

Building Safety Levy technical consultation response

Details of the planned levy now due in 2026.

Great British Energy install solar on school and NHS sites

200 schools and 200 NHS sites to get solar systems, as first project of the newly formed government initiative.

600 million for 60,000 more skilled construction workers

Announced by Treasury ahead of the Spring Statement.

The restoration of the novelist’s birthplace in Eastwood.

Life Critical Fire Safety External Wall System LCFS EWS

Breaking down what is meant by this now often used term.

PAC report on the Remediation of Dangerous Cladding

Recommendations on workforce, transparency, support, insurance, funding, fraud and mismanagement.

New towns, expanded settlements and housing delivery

Modular inquiry asks if new towns and expanded settlements are an effective means of delivering housing.

Building Engineering Business Survey Q1 2025

Survey shows growth remains flat as skill shortages and volatile pricing persist.

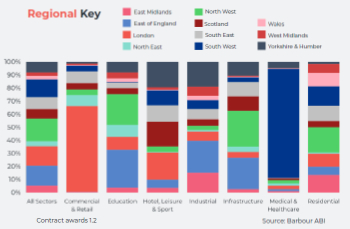

Construction contract awards remain buoyant

Infrastructure up but residential struggles.

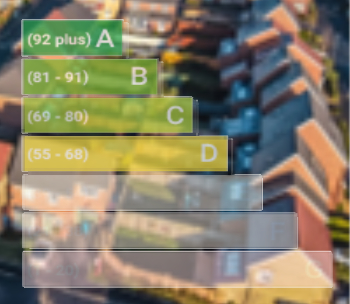

Warm Homes Plan and existing energy bill support policies

Breaking down what existing policies are and what they do.

A dynamic brand built for impact stitched into BSRIA’s building fabric.