Strategic marketing plan

[edit] Introduction

The three-year marketing plan addresses strategic issues. The shorter one-year tactical marketing plan tackles more immediate and operational tasks. Preparation of the three year marketing plan must precede the one year tactical marketing plan, with the latter being a function of the former and not vice versa. Extrapolating the one-year plan into the three-year plan (as many businesses do) will serve no useful purpose.

The following nine-point plan describes the principal component parts of a professional strategic marketing plan. The author would like to acknowledge that this is a summary of the McDonald nine step process and readers who require a more detailed explanation, as well as all the forms to complete in carrying through the methodology, are recommended to refer to Marketing Plans, M.H.B McDonald (published by Heinemann).

[edit] Step 1 - Statement of intent or mission statement

This statement should have been defined and set in the corporate plan, however at the business unit level (as distinct from company or group level) a further mission statement may be required. Mission should be differentiated from more esoteric concepts such as vision statements which tend to be far more ideological or a long-term statement of strategic intent.

In this context the mission statement defines the role of the business unit as well as the business in which it should primarily be involved. It may also highlight its distinctive competence and give a broad indication of future direction without being overly visionary.

[edit] Step 2 - Performance summary

This section should examine past to present performance in terms of normal financial measures such as sales value and volume, margins/profitability, contribution, etc. By using an extended time period, e.g. the last two or three years, a broader picture will put the current situation into perspective. Effectively this involves trying to identify the reasons for good or bad performance in the past as they may offer a number of key areas to address.

[edit] Step 3 - Financial projections

Having looked at past financials, projected figures should be considered for the planning period under consideration. Similar measures as described above should be applied - sales projections by value and volume, contribution and profitability, etc.

[edit] Step 4 - Market overview

This section begins to draw on the information and analysis gleaned from the marketing audit (see Marketing audit for more information). How a manager describes their own market-place is to some extent a matter for personal opinion, however, some of the key elements that should be included are market segments - how the market is divided into different segments and which ones the business unit primarily wants to do business with, and what is changing within this market - in terms of market segments and niches, competitors or even the legislative framework that may shape a market-place.

Marketers need to provide a summary of the market in enough detail to be informative but not so detailed as to overbalance the marketing plan. McDonald recommends the use of visual aids wherever possible, e.g. bar charts, pie charts, product life cycle curves, etc.

[edit] Step 5 - SWOT analyses

The SWOT analysis (Strengths, Weaknesses, Opportunities and Threats) is the conclusion of a great deal of preceding work. In assessing Strengths and Weaknesses, the business unit needs to be able to compare its own performance on a limited number of factors that are critical to success with how its competitors are performing. This necessitates listing the key or critical factors for success in order of priority and according each a weighting where the total of weightings adds up to 1, 10 or 100. This weighting in effect rates how important each factor is in determining success in the market place.

The business unit can then assess its own performance on each factor, again out of ten or some similarly easy number, and then do the same for all direct competitors. By multiplying the weight of each factor with the score attained a total weighted score can be calculated which directly compares performance with the competition and thereby quantifies strengths and weaknesses in a reasonably objective fashion.

The external factors, the Opportunities and Threats, can now be examined. Once again following the work completed in the marketing audit, a summary of the macro or wider business environment factors can be considered in terms of government policy, technological developments etc (described in the marketing audit article as the STEEP analysis - Socio-cultural, Technological, Economic, Environmental, Political).

From this point the manager(s) concerned should be able to state the different assumptions to be made in each product / market segment and thereafter the main objectives and strategies to be followed. This is based on the fact that that the key issues will have been brought out from the analysis made above e.g. SWOT points. This should not be confused with the overall marketing objectives and strategies within the marketing plan which have still to be set (these are considered under Step 8 below).

Each direct competitor should be examined separately to consider what their current position in the market is, what strategies they appear to be following to pursue what objectives, and what strategies they are likely to pursue over the next three years. Once again, the level of detail required will depend on the nature of the market and the degree of direct competition, as well as the amount of knowledge possessed about competitors, in terms of their intended broad marketing as well as product/market segment strategies.

See SWOT analysis for more information.

[edit] Step 6 - Portfolio summary

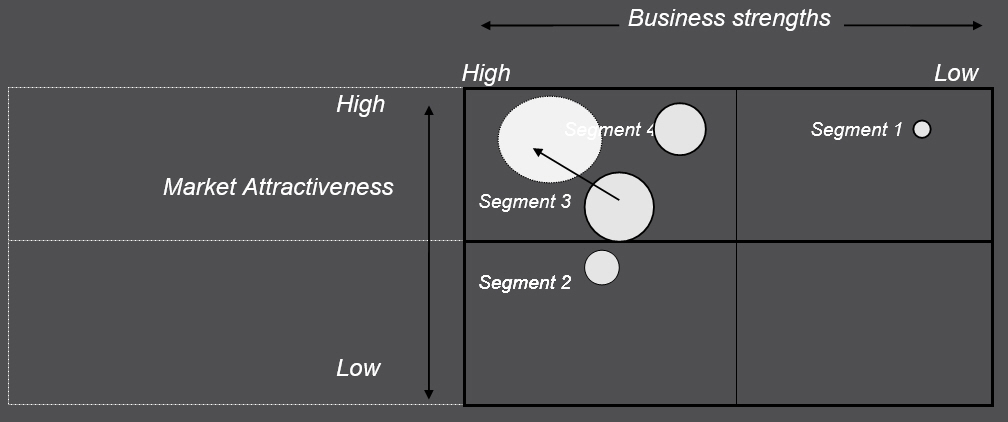

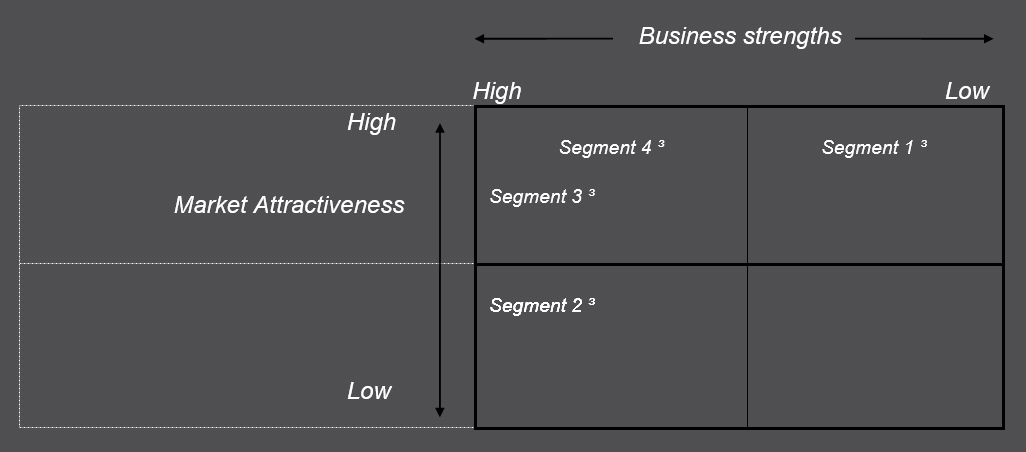

The work conducted above to produce concise but meaningful SWOT analyses can be summarised by means of a portfolio matrix, sometimes also labelled the Shell Directional Policy matrix.

Market segments should have already been defined and ordered in terms of preference for doing business with. Segments at the top of the list are those that will be likely to deliver the best results, e.g. the most attractive market segments.

Having established the attractiveness of each segment, the business unit must now assess their own strengths in serving that segment compared to the competition. The pertinent questions in this regard should already have been answered, e.g. current market share; ability to grow; proximity to customers, etc. From this situation the manager should be able to plot the business unit’s position on the portfolio matrix.

Equipped with this analysis an assessment can be made as to which market segments the business unit is best equipped to serve and which will render the most beneficial results. In the example above segment 1 may be very attractive but the business is least equipped to serve it, given its low strength rating. Segments 2, 3 and 4 can all be met with a high degree of strength but segment 2 has a low attractiveness rating. This leaves segments 3 and 4 as being the most likely for future focus.

Equipped with this analysis an assessment can be made as to which market segments the business unit is best equipped to serve and which will render the most beneficial results. In the example above segment 1 may be very attractive but the business is least equipped to serve it, given its low strength rating. Segments 2, 3 and 4 can all be met with a high degree of strength but segment 2 has a low attractiveness rating. This leaves segments 3 and 4 as being the most likely for future focus.

McDonald takes this matrix system further, replacing static positions marked above as ³, with circles where the diameter of the circle represents the proportion of total turnover that that particular market segment accounts for.

This can be taken a step further by plotting where these segments should be on the same matrix in a year or three’s time. This is represented in the diagram below with the dotted circle showing both a movement on the matrix and a growth in size of segment 3. This signifies both a shift in the attractiveness and the ability of the business to serve segment 3 in addition to forecast increase in sales.

[edit] Step 7 - Assumptions (Ceteris paribus)

Ceteris paribus is Latin for ‘other things remaining equal’, unfortunately in dynamic, ever changing market-places this rule very rarely holds true. Given that so many things can change, it is logical to list any key points or assumptions on which the marketing plan is based. If these key criteria are not fulfilled then the marketing plan will not be able to deliver.

This should not be used as a caveat or loophole for the marketer to absolve themselves of responsibility, rather a genuine reflection of external factors that may be beyond the control of the marketer, e.g. economic growth/decline, rising interest rates, the organisation’s access to capital investment or a competitor’s withdrawal from a market-place.

More detailed lists of assumptions may be made for individual product / markets; however the overall marketing plan should only include those key criteria that will directly affect its successful implementation.

[edit] Step 8 - Setting objectives and strategies

Having completed step 5 (SWOT analysis) and step 6 (portfolio summary) as well as any outstanding assumptions, the marketing plan is now in a position to tackle objectives and strategies.

The distinction between objectives and strategies is that an objective is the end goal and the strategy is the means to achieving the goal. It should be noted that many marketers mix the two up so as to make them indistinct (“our strategy is to beat competitor X”).

A further important point is made by McDonald:

‘Marketing objectives ...should be about products and markets only, since it is only by selling something to someone that the SBU’s [Strategic Business Unit’s] financial goals can be achieved. Advertising, pricing and other elements of the marketing mix are other means (the strategies) by which the SBU can succeed in doing this. Thus pricing objectives, sales promotion objectives, advertising objectives and so on should not be confused with marketing objectives.’

On this basis McDonald cites the interaction of products to market segments, e.g. selling existing products to existing or new segments as marketing objectives with a corresponding marketing strategy of ‘improve product functional performance and perceived value in conjunction with new communications campaign’. This would require both new production and communications sub-strategies which will complement the marketing strategy.

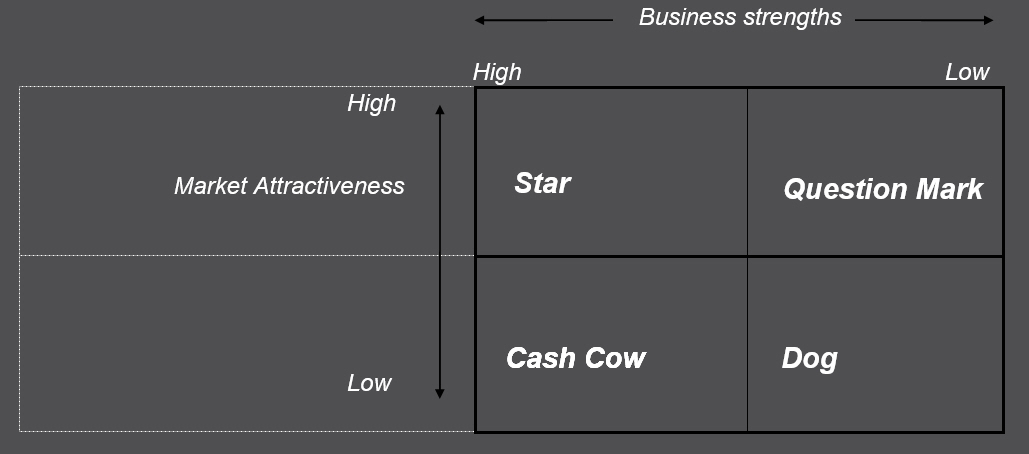

In finalising marketing objectives and strategies McDonald recommends referring back to the portfolio analysis and using the labels developed originally by the Boston Consulting Group (BCG) in order to simplify the position of different market segments or product / markets. The idea here is that each quadrant of the matrix has its own label describing their combination of attractiveness and strength. These are self-explanatory when shown in their respective quadrants:

In its most simple terms any business unit needs to have some kind of balance in the product / markets it serves. Cash cows deliver positive cash flow but will not last forever. Dogs are a drain on cash flow and unless they can be developed into question marks or stars then they should be divested. Question marks, also known as problem children or wildcats, have the potential to become either dogs or stars. Stars are obviously very desirable but are difficult to cultivate, etc.

In its most simple terms any business unit needs to have some kind of balance in the product / markets it serves. Cash cows deliver positive cash flow but will not last forever. Dogs are a drain on cash flow and unless they can be developed into question marks or stars then they should be divested. Question marks, also known as problem children or wildcats, have the potential to become either dogs or stars. Stars are obviously very desirable but are difficult to cultivate, etc.

This BCG approach to portfolio management should be viewed as a facilitator and not a scientific end in itself. It simply aids the decision-making process providing a useful framework in which to plan an approach to the market which takes account of both the market’s needs and the firm or business unit’s skills and core competences.

[edit] Step 9 - Financial projections

At this point, the marketer should be able to provide three-year projections for the key financial markers, as described earlier - sales by value, gross profit, contribution, etc.

This article was created by --Philip Collard 14:36, 11 December 2013 (UTC)

[edit] Related articles on Designing Buildings Wiki

- Embedding successful key client management.

- Marketing audit.

- Marketing planning.

- Market segmentation.

- Mission statement.

- One-year tactical or operational marketing plan.

- Routes to market.

- SWOT analysis.

- Vision.

- Winning work.

[edit] External references

- Marketing Plans, Malcolm McDonald, Butterworth Heinemann Professional Publishing Ltd.

Featured articles and news

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Many resources for visitors aswell as new features for members.

Using technology to empower communities

The Community data platform; capturing the DNA of a place and fostering participation, for better design.

Heat pump and wind turbine sound calculations for PDRs

MCS publish updated sound calculation standards for permitted development installations.

Homes England creates largest housing-led site in the North

Successful, 34 hectare land acquisition with the residential allocation now completed.

Scottish apprenticeship training proposals

General support although better accountability and transparency is sought.

The history of building regulations

A story of belated action in response to crisis.

Moisture, fire safety and emerging trends in living walls

How wet is your wall?

Current policy explained and newly published consultation by the UK and Welsh Governments.

British architecture 1919–39. Book review.

Conservation of listed prefabs in Moseley.

Energy industry calls for urgent reform.

Heritage staff wellbeing at work survey.

A five minute introduction.

50th Golden anniversary ECA Edmundson apprentice award

Showcasing the very best electrotechnical and engineering services for half a century.

Welsh government consults on HRBs and reg changes

Seeking feedback on a new regulatory regime and a broad range of issues.

CIOB Client Guide (2nd edition) March 2025

Free download covering statutory dutyholder roles under the Building Safety Act and much more.