Landlord and Tenant Acts commercial implications

Contents |

[edit] Introduction

The Landlord and Tenant Act of 1954 was divided into two parts. It was aimed to provide security of tenure for residents (part 1) and businesses (part 2) of properties over a specified number of years. However the Housing Acts of 1924 and 1930 were in many ways more relevant residential tenants, particularly social housing tennants, the latter of which obliged local councils to clear slum housing, and provide re-housing.

Ammendments to the same Landlord and Tenant Act started to require the giving of information by landlords to tenants such as the rent books in 1962, gradually oriented more to commercial tenants, as residential aspects of the Act became superseded by other legislation. The Act of 1985 increased the information requirements on landlords, including obligations to repair and, then in 1987, granted tenants a right of first refusal of a disposal (offer) under certain circumstances.

The 1987 Landlord and Tenant Act 1987 according to the government website is up to date with all changes known to be in force on or before April 2023, though it is important to note that many provisons for both landords and tenants became increasingly also covered by a number of other legeslative vehicles. For example key Provisions of the Housing Act 1988 was the introduction of assured shorthold tenancies, which gave tenants the right to stay in a property for a fixed period of time and gave landlords the right to regain possession of the property after the tenancy had ended. This relates to assignment or the transfer of rights, to balance where consent could previously be withheld by landlords for no good reason, the aim being to ensure refusal only for good reason.

The Landlord and Tenant Act of 1995, reviewed the notions of covenants in leases but also consolidated certain provisions in law of landlord and tenantsformerly found in the Housing Acts, together with those in the original Landlord and Tenant Act of 1962.

[edit] Commercial application

Certain aspects of the origial Landlord and Tenant Act continue to be relevant for some commercial apliactions, for part II of the Act to be applicable, the following conditions must apply:

There must be a tenancy (as opposed to a licence).

The tenant must be in occupation of the property for business purposes.

The tenancy must not be excluded from the Act. The main exceptions to the Act are set out in section 43 and include mining leases and agriculturalpremises. In addition, the Act does not protect leases that are less than 6 months which hold no scope to renew. In addition, if a tenancy is granted due to being employed, this is not covered, assuming there is a clear agreement in writing which documents the purpose of the tenancy.

[edit] Protection afforded to a tenant

In broad terms, the Act gives a business security of tenure which means they have the right to renew the tenancy when it ends. In a situation where both the landlord and tenant agree on a new tenancy, but cannot agree on the terms, it is possible for either party to apply to the court for the new tenancy.

It is also possible for the tenant to apply if they would like a new tenancy but the landlord refuses to grant one. In such situations, the court will settle the rent and terms of the new tenancy.

[edit] Termination by a tenant

It is possible for a business tenant to terminate their lease by leaving the business premises on or before the termination date under the lease, or by the serviceof a statutory notice (to terminate no earlier than the termination date specified in the lease), giving the landlord 3 months notice and by vacating on or before the termination date specified in that notice.

[edit] Termination by a landlord

It is possible for a landlord to terminate a tenancy by the service of a statutory notice which provides a termination date not less than 6 months or more than 12 months after the notice has been served. The landlord must also prove a statutory ground for possession. It may be necessary for a landlord to satisfy the Courtsif matters cannot be agreed with the tenants.

The landlord may have to pay compensation to a business tenant on obtaining possession of the premises based on a statutory ground, which is calculated as a multiplier of the rateable value.

If a landlord does not oppose the grant of a new business tenancy to the tenant, then this affords the landlord an opportunity to be paid the current market rentfor the premises under the terms and conditions of the new lease.

[edit] Related articles on Designing Buildings

- Agricultural tenancy.

- Break clauses in leases.

- Comparable rent accusations.

- Ground rent.

- Homes (Fitness for Human Habitation) Act 2018.

- How to evict a tenant.

- Landlord.

- Lease Negotiations - Tenants Checklist.

- Leasehold.

- Leasehold covenants.

- Property guardianship.

- Rent.

- Rent-free period.

- Rent in administration.

- Rent review.

- Sample retail lease.

- Section 13 notice.

- Section 21 notice.

- Security of tenure.

- Service charge.

- Short term lets.

- Statutory declaration excluding security of tenure.

- Tenancy deposit protection.

- Tenant.

- Vacant possession.

- External references

- Landlord and Tenant Act 1954.

Featured articles and news

Grenfell Tower Principal Contractor Award notice

Tower repair and maintenance contractor announced as demolition contractor.

Passivhaus social homes benefit from heat pump service

Sixteen new homes designed and built to achieve Passivhaus constructed in Dumfries & Galloway.

CABE Publishes Results of 2025 Building Control Survey

Concern over lack of understanding of how roles have changed since the introduction of the BSA 2022.

British Architectural Sculpture 1851-1951

A rich heritage of decorative and figurative sculpture. Book review.

A programme to tackle the lack of diversity.

Independent Building Control review panel

Five members of the newly established, Grenfell Tower Inquiry recommended, panel appointed.

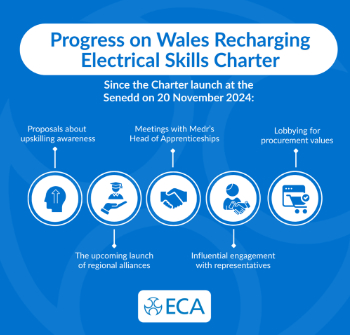

Welsh Recharging Electrical Skills Charter progresses

ECA progressing on the ‘asks’ of the Recharging Electrical Skills Charter at the Senedd in Wales.

A brief history from 1890s to 2020s.

CIOB and CORBON combine forces

To elevate professional standards in Nigeria’s construction industry.

Amendment to the GB Energy Bill welcomed by ECA

Move prevents nationally-owned energy company from investing in solar panels produced by modern slavery.

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Heat pumps, vehicle chargers and heating appliances must be sold with smart functionality.

Experimental AI housing target help for councils

Experimental AI could help councils meet housing targets by digitising records.

New-style degrees set for reformed ARB accreditation

Following the ARB Tomorrow's Architects competency outcomes for Architects.

BSRIA Occupant Wellbeing survey BOW

Occupant satisfaction and wellbeing tool inc. physical environment, indoor facilities, functionality and accessibility.

Preserving, waterproofing and decorating buildings.