Global water heating market shifts gear

|

| Article written by George Laganas |

[edit] Renewables Surge, Traditional Systems Sputter

The current energy crisis has added pressure on governments to accelerate their green initiatives in space and water heating technologies. It will therefore come as no surprise that our analysis of the global water heating markets found that heat pumps, electric storage, and instantaneous water heaters recorded the biggest growth in 2023 and the forecasted period.

2023 saw traditional water heating systems grow by 1.5% globally, whereas water heaters powered by renewable sources (i.e. heat pump water heaters) reported an impressive growth of 21.3% (vs 2022). Our analysis showed that end-users are increasingly replacing gas systems with electricity storage or instantaneous units, given the ever-growing spark gap in most economies. Oil-fuelled water heaters are declining, as they are banned from most markets, with some exceptions for remote areas off the gas grid. Nonetheless, there are certain countries that still permit oil water heaters, but they do so under the condition that a renewable source of heating works alongside them; hence ensuring partial sustainable output.

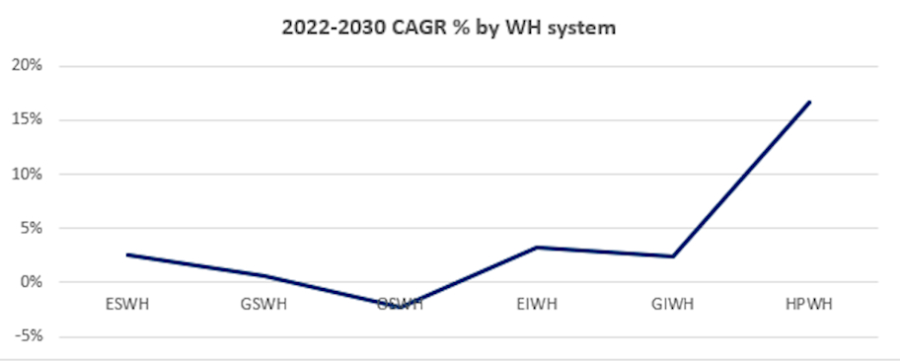

The above graph depicts the CAGR % for each water heating system from 2022 to 2030. Besides oil-fuelled systems that are in decline, gas storage water heaters note the lowest growth (below 1%). Middle East and Africa still rely on these types of systems, so slight growth is seen in this region. Electric storage water heaters also note a CAGR of 4.5%. However, in Europe gas storage systems are forecasted to decline by almost 5% by 2030 and electric storage water heaters note a marginal growth of 1.3%, for the same period.

Instantaneous water heating systems show a different global picture. In all researched regions, we found that electric instantaneous water heating systems are growing at a faster rate than gas instantaneous systems. The Americas show a 3.3% CAGR (2022-2030) for EIWH and 2.1% for GIWH. Europe’s CAGR for EIWH is marked at 2.7% yet GIWH are in decline with CAGR -2.9% for the same period.

Heat pump water heaters note the biggest potential globally, with almost 17% CAGR for the period 2022-2030. The Americas and Asia & Oceania hold the biggest participation in this market, with over 20% CAGR, whilst Europe notes a 12% CAGR, albeit representing the most advanced market worldwide when it comes to renewables and sustainable sources of energy. Middle East & Africa are not regions we find heat pumps established, as they still rely on traditional systems to heat space and water.

Solar-Thermal water heating saw a slight growth in 2023 versus 2022; however, the future outlook seems much more promising with an overall CAGR 2022-2030 at 3%. Middle East & Africa are the regions that invest the most in ST systems, benefitting from the local climate.

This article appears on the BSRIA news and blog site as 'Global Water Heating Market Shifts Gear: Renewables Surge, Traditional Systems Sputter' dated January 2024 and was written by George Laganas.

--BSRIA

[edit] Related articles on Designing Buildings

- Aaron Gillich, Professor of Building Decarbonisation and Director of the BSRIA LSBU Net Zero Building Centre.

- Building services.

- BSRIA seminar on knowledge to achieve a net zero future. March 2023

- BSRIA topic guide to thermal comfort TG22 / 2023. February 2023

- Combustion plant.

- Heat pump.

- Heat pumps and heat waves: How overheating complicates ending gas in the UK.

- Heating controls.

- Heating large spaces.

- Heating.

- Hot water.

- Hot water safety.

- HVAC.

- Low carbon heating and cooling.

- Net zero building centre with BSRIA and LSBU.

- Pipework.

- Radiant heating.

- Radiator.

- Rules of Thumb - Guidelines for building services.

- Thermostat.

- Types of heating system.

- US water heating market update 2021.

- Water heating.

Featured articles and news

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Many resources for visitors aswell as new features for members.

Using technology to empower communities

The Community data platform; capturing the DNA of a place and fostering participation, for better design.

Heat pump and wind turbine sound calculations for PDRs

MCS publish updated sound calculation standards for permitted development installations.

Homes England creates largest housing-led site in the North

Successful, 34 hectare land acquisition with the residential allocation now completed.

Scottish apprenticeship training proposals

General support although better accountability and transparency is sought.

The history of building regulations

A story of belated action in response to crisis.

Moisture, fire safety and emerging trends in living walls

How wet is your wall?

Current policy explained and newly published consultation by the UK and Welsh Governments.

British architecture 1919–39. Book review.

Conservation of listed prefabs in Moseley.

Energy industry calls for urgent reform.

Heritage staff wellbeing at work survey.

A five minute introduction.

50th Golden anniversary ECA Edmundson apprentice award

Showcasing the very best electrotechnical and engineering services for half a century.

Welsh government consults on HRBs and reg changes

Seeking feedback on a new regulatory regime and a broad range of issues.

CIOB Client Guide (2nd edition) March 2025

Free download covering statutory dutyholder roles under the Building Safety Act and much more.