Status determination statement SDS

Contents |

[edit] Introduction

From 6 April 2021, larger businesses face new duties under HMRC’s ‘off-payroll rules’ when they use individuals who work through their own limited company. In practice, this means that for those companies that have workers in their business who are there regularly, but not on the PAYE system because they are paid via other routes, it is vital to find out more and act accordingly. This is where the Status Determination Statement (SDS) comes into play.

[edit] What is SDS?

As a component of the Finance Bill 2020 (which amended IR35), the SDS became a requirement for the end user. When compiled correctly, an SDS documents the end user’s processes - and reasons - for deciding the employment status of contractors, whether that status is inside or outside IR35.

For the Status Determination Statement (SDS) to be valid, the end user must:

- State whether or not the worker would be an employee for tax and NIC purposes if they were directly engaged by the client.

- Provide their reasons for coming to that conclusion.

- Have taken reasonable care in coming to their conclusion.

[edit] Key details

Due to the significance of this term 'reasonable care', the Government has created an Employment Status Manual that can help end users understand the nuances of the phrase. HMRC’s Check Employment Status for Tax (CEST) tool can also be used to aid those making employment status decisions. A CEST test can be done anonymously, but if it shows that a worker is self-employed, it can be useful to log it with that person’s name and print a copy as evidence that the test was completed.

Status determinations that were made before 6 April 2021 can be valid SDS for projects that continue after 6 April 2021 as long as they meet the legislative requirements. An SDS must include the reason for reaching the conclusion and have been passed to the worker and any third party the client contracts with.

The SDS information should be reviewed every six months, since supply chain and subcontractors change frequently.

[edit] Related articles on Designing Buildings

- Construction Industry Scheme or IR35?

- Court of appeal ruling on holiday pay and employment status.

- Employee.

- IR35.

- IR35: essential steps for compliance.

- PAYE.

- Personal service company.

- Sub-contractor.

[edit] External resources

- Gov.uk, Check Employment Status for Tax.

- Gov.uk, Employment Status Manual.

Featured articles and news

BSRIA Statutory Compliance Inspection Checklist

BG80/2025 now significantly updated to include requirements related to important changes in legislation.

Shortlist for the 2025 Roofscape Design Awards

Talent and innovation showcase announcement from the trussed rafter industry.

OpenUSD possibilities: Look before you leap

Being ready for the OpenUSD solutions set to transform architecture and design.

Global Asbestos Awareness Week 2025

Highlighting the continuing threat to trades persons.

Retrofit of Buildings, a CIOB Technical Publication

Now available in Arabic and Chinese aswell as English.

The context, schemes, standards, roles and relevance of the Building Safety Act.

Retrofit 25 – What's Stopping Us?

Exhibition Opens at The Building Centre.

Types of work to existing buildings

A simple circular economy wiki breakdown with further links.

A threat to the creativity that makes London special.

How can digital twins boost profitability within construction?

The smart construction dashboard, as-built data and site changes forming an accurate digital twin.

Unlocking surplus public defence land and more to speed up the delivery of housing.

The Planning and Infrastructure Bill

An outline of the bill with a mix of reactions on potential impacts from IHBC, CIEEM, CIC, ACE and EIC.

Farnborough College Unveils its Half-house for Sustainable Construction Training.

Spring Statement 2025 with reactions from industry

Confirming previously announced funding, and welfare changes amid adjusted growth forecast.

Scottish Government responds to Grenfell report

As fund for unsafe cladding assessments is launched.

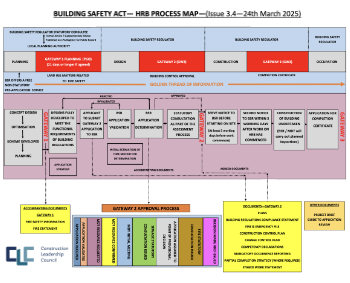

CLC and BSR process map for HRB approvals

One of the initial outputs of their weekly BSR meetings.

Building Safety Levy technical consultation response

Details of the planned levy now due in 2026.

Great British Energy install solar on school and NHS sites

200 schools and 200 NHS sites to get solar systems, as first project of the newly formed government initiative.

600 million for 60,000 more skilled construction workers

Announced by Treasury ahead of the Spring Statement.