Pay as you earn in construction PAYE

The Pay as you Earn scheme, or more familiarly, PAYE, is the means by which HM Revenue and Customs (HMRC) deduct tax and National Insurance contributions from employees.

Any person, whether an individual or company, who employs someone under a contract of employment is obliged to operate a PAYE scheme and then deduct tax and national insurance before passing those deductions to HMRC.

It is important for potential employers to have a full understanding of these rules and to ensure that they are applied correctly. In particular it is necessary to understand the meaning of “employee” so that PAYE is applied only to those individuals who can be so categorised.

For construction industry employers the application of PAYE has added complexity as the requirements of IR 35 and the Construction Industry Scheme have a direct bearing on the applicability of PAYE in particular cases.

Administering PAYE can be a time-consuming process for employers with a variety of reporting requirements and deadlines to be met. For this reason many small employers prefer to outsource the administration of the scheme to external service providers who undertake full payroll and reporting obligations via the use of proprietary software.

For more details visit HMRC: PAYE

[edit] Related articles on Designing Buildings

- Capital gains tax.

- Construction industry scheme.

- Construction Industry Scheme or IR35?

- Construction recruitment agency.

- Court of appeal ruling on holiday pay and employment status.

- Employee.

- Hourly rate.

- Human resource management in construction.

- IR35.

- IR35: essential steps for compliance.

- Limited appointment.

- National insurance.

- Payroll companies.

- Status determination statement SDS.

- Tax relief.

- Umbrella companies.

- Tax.

- VAT.

[edit] External references

Featured articles and news

British Architectural Sculpture 1851-1951

A rich heritage of decorative and figurative sculpture. Book review.

A programme to tackle the lack of diversity.

Independent Building Control review panel

Five members of the newly established, Grenfell Tower Inquiry recommended, panel appointed.

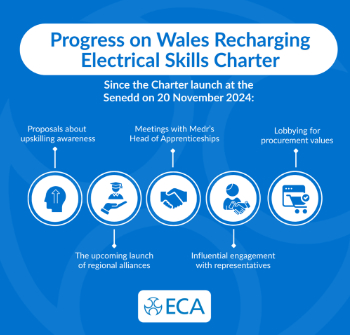

Welsh Recharging Electrical Skills Charter progresses

ECA progressing on the ‘asks’ of the Recharging Electrical Skills Charter at the Senedd in Wales.

A brief history from 1890s to 2020s.

CIOB and CORBON combine forces

To elevate professional standards in Nigeria’s construction industry.

Amendment to the GB Energy Bill welcomed by ECA

Move prevents nationally-owned energy company from investing in solar panels produced by modern slavery.

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Heat pumps, vehicle chargers and heating appliances must be sold with smart functionality.

Experimental AI housing target help for councils

Experimental AI could help councils meet housing targets by digitising records.

New-style degrees set for reformed ARB accreditation

Following the ARB Tomorrow's Architects competency outcomes for Architects.

BSRIA Occupant Wellbeing survey BOW

Occupant satisfaction and wellbeing tool inc. physical environment, indoor facilities, functionality and accessibility.

Preserving, waterproofing and decorating buildings.