Real estate investment types and potential profitability

Contents |

[edit]

[edit] What type of real estate is the most profitable investment?

Investing in real estate is a trend that has been hot over the past few decades. Rightfully so, as it is one of the most efficient ways to build wealth and provide you with a steady income. Now more than ever, people are educating themselves about how to invest in real estate appropriately and what type of investments will give them the edge. When it comes to making such a decision, challenges arise.

It is not often easy to say which type of real estate investments are the most profitable because many factors impact the situation. The location, the rental demand, and the property type are just a few of these factors that might make or break an investment plan.

However, there is common knowledge of different kinds of real estate investments that might help you decide the best fit for you. We’ll list them from most profitable to least profitable based on the general statistics. However, remember that the order is not a one-size-fits-all type of thing; each individual should evaluate which type will work best for them.

[edit] Real estate investment type by indicative profitability

[edit] Commercial real estate

Commercial real estate properties are, without a doubt, the most lucrative way to ensure a steady income flow. They offer higher cash potential and lower vacancy rates when compared to the other types of real estate investments. Commercial real estate properties include office spaces, retail stores, industrial properties, multi-family buildings, and hospitality projects.

These rental properties require significant investment in advance and a good understanding of commercial tenant management and local zoning regulations. When investing in commercial real estate, you will be renting to a business instead of an individual, which means the process is expected to be much more straightforward and seamless. Companies make sure their reputation stays good, and thus, the chances for proper property management are increased. In addition, businesses that rent out commercial space pay their rent regularly because they want to keep their distance, which enables a steady income flow.

[edit] High-tenant properties

Next in line are the properties that accommodate a high number of tenants or high-tenant properties. Such properties are RV parks, self-storage facilities, apartment complexes, and office spaces. The fact that multiple tenants who occupy the premises need to pay guarantees significant returns on investment. The more tenants there are - the more influential the income becomes. Plus, the higher demand for the property is, the less concern you will have to find tenants with little notice.

However, you must be prepared to deal with different personalities since the more tenants, the more diverse characters you will have to do business with. One thing to make the whole process smooth is to have an apparent agreement signed by both parties, yours and the tenants.

[edit] Triple net lease properties

Triple net lease properties are properties are usually single-tenant spaces, with a higher likelihood of tenants signing long-term leases. Also, they are a good investment plan for investors with little to no experience. This is because tenants usually take responsibility for paying real estate taxes, maintaining maintenance, and taking care of insurance alone. This makes it easier for the investor to collect the money on payday.

[edit] Residential rental properties

Residential rental properties properties include single-family, multi-family, vacation, and duplexes. Tenants pay monthly rent so that you will generate a consistent money flow. This type is a real money-maker, but you must be ready to handle the possible challenges; first, residential rental properties require regular maintenance, and late rent payments or vacancies might complicate the steady flow of money.

In such cases, you need a plan to address momentary financial setbacks to overcome such struggles. In the worst case - if you cannot keep your head above the water in such financially struggling items, you can always sell the rental property and profit from the sale.

[edit] Real Estate Investment Trusts (REITs)

Real estate investment trusts (REITs) are companies that own different commercial real estate types, including shops, hotels, offices, restaurants, and malls. The investment in this type is through the stock exchange. A great thing about this investment plan is that while you invest in the property these businesses own, you aren’t exposed to the risk of owning the property.

There is a requirement, though, that you must return 90% of their taxable income to shareholders per year. The publicly traded REITs are the most lucrative ones because they provide flexible liquidity compared to other real estate investments. What does this mean? You sell your company shares on the stock exchange if you need emergency funds. Or you can simply buy to leave.

[edit] A few final words

Real estate investment gives you profitable opportunities to make more money. However, choosing the right type can be challenging. To help you choose the most lucrative type, we listed the real estate investment properties from most profitable to least. So, commercial properties provide the highest income potential, while properties with multiple tenants offer steady returns; triple-net lease properties give you stability, especially for inexperienced investors, while residential rentals provide consistent income with added management responsibilities. Real estate investment trusts offer dividends. The best thing to do when choosing the right type for you is to consider your goals and risk tolerance when selecting the best option.

[edit] Related articles on Designing Buildings

- Business plan.

- Buyer-funded development.

- Cash flow.

- Corporate finance.

- Developer.

- Development appraisal.

- Internal rate of return.

- Investment.

- Investment decision maker.

- Investment property.

- Investment Property Databank (IPD).

- Land value.

- Mixed use property investment.

- Off-plan property.

- Premises.

- Profitability.

- Real estate investment trust REIT.

- Speculative construction.

- Stakeholders.

- Types of development.

- Yield.

[edit] External links

https://financesonline.com/real-estate-statistics/

https://investproinc.com/reducing-vacancy-rates-strategies-for-miami-property-owners/

https://theearnesthomes.com/blog/how-to-invest-in-high-end-properties-as-an-out-of-state-investor/

Featured articles and news

ECA Blueprint for Electrification

The 'mosaic of interconnected challenges' and how to deliver the UK’s Transition to Clean Power.

Grenfell Tower Principal Contractor Award notice

Tower repair and maintenance contractor announced as demolition contractor.

Passivhaus social homes benefit from heat pump service

Sixteen new homes designed and built to achieve Passivhaus constructed in Dumfries & Galloway.

CABE Publishes Results of 2025 Building Control Survey

Concern over lack of understanding of how roles have changed since the introduction of the BSA 2022.

British Architectural Sculpture 1851-1951

A rich heritage of decorative and figurative sculpture. Book review.

A programme to tackle the lack of diversity.

Independent Building Control review panel

Five members of the newly established, Grenfell Tower Inquiry recommended, panel appointed.

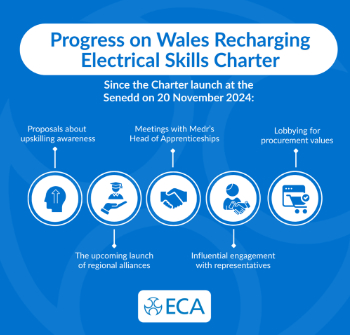

Welsh Recharging Electrical Skills Charter progresses

ECA progressing on the ‘asks’ of the Recharging Electrical Skills Charter at the Senedd in Wales.

A brief history from 1890s to 2020s.

CIOB and CORBON combine forces

To elevate professional standards in Nigeria’s construction industry.

Amendment to the GB Energy Bill welcomed by ECA

Move prevents nationally-owned energy company from investing in solar panels produced by modern slavery.

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Heat pumps, vehicle chargers and heating appliances must be sold with smart functionality.

Experimental AI housing target help for councils

Experimental AI could help councils meet housing targets by digitising records.

New-style degrees set for reformed ARB accreditation

Following the ARB Tomorrow's Architects competency outcomes for Architects.

BSRIA Occupant Wellbeing survey BOW

Occupant satisfaction and wellbeing tool inc. physical environment, indoor facilities, functionality and accessibility.