The current and future global market dynamics of boiler systems

The global boiler market is influenced by different views on gas in the context of decarbonisation. While in Europe there is a clear trend to stir away from any fossil fuel boilers, including gas, in other part of the world, notably China, gas boilers are considered as a lower carbon solution than coal boilers that they are often replacing.

Therefore, even though the drive towards lower carbon heating progresses globally, the boiler market is still the most prominent in size, in the heating segment. Nevertheless, due to the global market structure, where Europe accounts for the largest share in sales of both domestic and commercial boilers, global boiler sales are today in decline.

Even though they are supported by a robust replacement market and, often, by lower installation and running cost in comparison to the most common alternative: heat pumps, boilers are expected to lose some 1.5 million units in sales over the next 5 years in Europe. Increasingly stringent legislation, financial support, efficiency which drives energy usage down, growing base of environmentally aware consumers and of well qualified installers are driving sales of alternative solutions, mainly heat pumps, in both, residential and commercial markets.

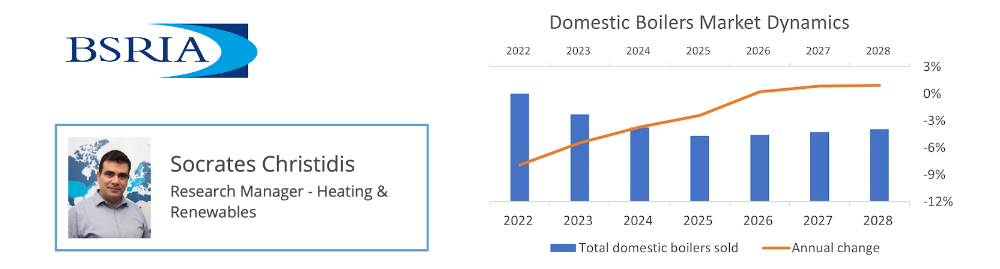

In 2023 the global market of domestic boilers declined by 8% by volume of sales to the previous year.

In Asia-Pacific we see consumers’ awareness of energy efficiency rise. As there is no clear plan yet to switch from gas boilers to heat pumps it is likely that current heating structures remain in the next five years with the main trend being the increased market share of condensing boilers.

In Europe, bans or indirect phase out of gas boilers in new dwellings through building regulations enforce the installation of heat pumps. This is pushing the new build housing market to be nearly all heat pumps equipped, but district heating is likely to increase its penetration in apartments, particularly in areas of high population density.

However, the expected push back to a direct ban of gas boilers in retrofit market will result in a slowdown of boilers’ displacement. If the price of gas remains lower to that of electricity by a factor of 3, hybrid solutions are likely to see an uptake. This is a trend observed in some countries (e.g. Germany, Netherlands) where boilers are installed accompanied by a sustainable technology - heat pump. The majority of boilers sold nowadays are ready to accommodate a heat pump as part of a hybrid heating system. As many dwellings are not prepared for 100% renewable heating (they are not fully insulated and/or have unsuitable radiators, etc.) to meet peak heating demand in very cold weather, such modern boilers, will still be part of a heating system. Therefore, after the initial steep decline of the boiler market caused by the displacement of boilers by heat pumps in the new build, BSRIA sees sales of boilers remain flat rather than significantly declining before 2028.

Hybrid heating systems, whether packaged, integrated, or retrofit are seen by the industry as a good way to get consumers more used to the acceptance of low carbon technologies. Having a hybrid system allows households to install a smaller capacity heat pump and draw upon a boiler when the extra capacity is needed. While hybrid boilers are viewed positively as a solution for the short to medium term, their future is uncertain in the long term, especially with plans to move away from gas in 2030s.

Biomass boilers face uncertainty due to the volatility of the fuel price and will mostly remain an option to replace traditional fossil fuel boilers and be an alternative to heat pumps where electricity is limited, and biomass fuel is locally sourced and abundant.

Electric boilers will mostly remain a marginal market due to being inferior, in terms of efficiency, to the growing heat pump market. However, we will see more electric boilers in commercial heating installed as back up to heat pumps in heat networks in all-electric solutions.

The global boiler market is navigating a complex landscape of economic, regulatory, and technological factors. Its future will depend on its ability to adapt to these evolving conditions and embrace new technologies while balancing cost-effectiveness and sustainability.

This article appears on the BSRIA news and blog site as 'Boilers face significant challenges but adapt to sustain for longe' dated July 2024 and was written by Socrates Christidis, Research Manager - Heating & Renewables.

--BSRIA

[edit] Related articles on Designing Buildings

- 2021 UK HVAC trends: winners and losers.

- BSRIA articles on Designing Buildings.

- Biomass boiler.

- Boiler.

- Boiler markets and the green recovery.

- Building heating systems.

- Condensing boiler.

- Domestic boiler market 2019.

- European decarbonisation and heating technologies beyond 2021.

- Global study of challenges and opportunities in the BACS market.

- Industrial gas boilers market 2020.

- Radiator.

- Thermal comfort.

- Types of domestic boiler.

Featured articles and news

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Heat pumps, vehicle chargers and heating appliances must be sold with smart functionality.

Experimental AI housing target help for councils

Experimental AI could help councils meet housing targets by digitising records.

New-style degrees set for reformed ARB accreditation

Following the ARB Tomorrow's Architects competency outcomes for Architects.

BSRIA Occupant Wellbeing survey BOW

Occupant satisfaction and wellbeing tool inc. physical environment, indoor facilities, functionality and accessibility.

Preserving, waterproofing and decorating buildings.

Many resources for visitors aswell as new features for members.

Using technology to empower communities

The Community data platform; capturing the DNA of a place and fostering participation, for better design.

Heat pump and wind turbine sound calculations for PDRs

MCS publish updated sound calculation standards for permitted development installations.

Homes England creates largest housing-led site in the North

Successful, 34 hectare land acquisition with the residential allocation now completed.

Scottish apprenticeship training proposals

General support although better accountability and transparency is sought.

The history of building regulations

A story of belated action in response to crisis.

Moisture, fire safety and emerging trends in living walls

How wet is your wall?

Current policy explained and newly published consultation by the UK and Welsh Governments.

British architecture 1919–39. Book review.

Conservation of listed prefabs in Moseley.

Energy industry calls for urgent reform.