Taxes associated with selling a business

Contents |

[edit] Introduction

As the economy creaks under the strain of a third lockdown, along comes the Office of Tax Simplification (OTS) report to add to the bad news. The report, the first to consider Capital Gains Tax (CGT) specifically, was undertaken in response to the Chancellor’s request ‘to identify opportunities relating to administrative and technical issues as well as areas where the present rules can distort behaviour or do not meet their policy intent.’

Simply put, the Government is looking for new sources of tax revenue to replace the billions spent on addressing the COVID-19 pandemic in 2020/2021. In the current climate, it looks like targeting wealth creators will be the likely route, so business owners should expect some impact.

[edit] Tax grab to pay the COVID bill?

The OTS report makes suggestions that will fundamentally change the capital gains tax rules in the UK if adopted and any outcry proves no deterrent. One suggestion is to align CGT rates with income tax rates, which will significantly increase the tax paid when a business is sold.

There have already been mutterings from within Government that the money to pay the COVID-19 bill will have to come from somewhere and it is unlikely to be another round of austerity, so we have to accept CGT rates will probably increase in the future.

The news is another blow to those business owners considering a sale, having only just recovered from the reduction of the entrepreneurs’ relief (now Business Asset Disposal Relief) limit from £10 million to £1 million, with any balance of CGT payable at a rate of 20%.

If as suggested in the OTS report the rates are aligned in the Budget, this 20% rate would be increased to 45% and owners will pay a huge increase in tax following the sale of their business.

[edit] Keep calm and sell wisely?

Whilst the economic impact of the pandemic is expected to extend beyond 2021, it may not be the easiest time to sell a business, but for those ready to sell, there remains a window for still extracting maximum personal reward from any deal.

If you are already in discussions with a potential buyer, it is crucial that at the earliest possible opportunity you require them to execute a Non-disclosure Agreement and only then proceed to full legal documents once the prospective transaction is well described in a ‘heads of terms’ agreement.

If you are trying to sell before any changes to the CGT rules, it is critical to get the advice of experienced corporate lawyers who will ensure that as the seller you do not make easy or unnecessary concessions early on in the ‘heads of terms’, before the deal becomes binding.

With the right advice at an early stage, there is more likelihood of being able to get the buyer to commit to key points crucial in maximising the value you can generate, which might include:

- Cash at completion: this maximises the up-front payment made to you and minimises any extended earn-out.

- Security for deferred payments: if any payments are to be deferred, it is important to establish what security the buyer can offer.

- Clarifying what the price really means: it is also crucial from the outset to properly describe the interdependence of price i.e., whether it assumes a cash-free, debt-free asset and whether a target level of working capital is required.

- Locked box vs completion accounts: proposing a locked box structure instead of completion accounts. This generally favours the seller by accelerating any asset-value disputes to a point, before signing the share purchase agreement, when you have more bargaining power, rather than after completion when the buyer arguably has greater leverage.

- Liability limitations: establishing the level of financial-based - and the duration of time-based - limits on the seller’s warranty liability.

- Buyer’s ability to fund: establishing whether the buyer requires third-party financing to complete the deal and whether that introduces greater uncertainty to the prospect of a deal.

- Timetable: setting timetable expectations and limits on any exclusivity period.

These are just a few considerations (and a conversation with an experienced corporate law team will undoubtedly throw up a lot more pertinent ones)cvx, but the key thing is to seek advice early in the process, long before you talk to anyone, even close associates, about selling your business.

If you hope to sell your business, any corporate lawyer will be happy to talk you through the process and explain what is possible in the time available to ensure you extract the maximum value from the sale, whilst making the process as painless as possible. But do not wait too long.

This article originally appeared in the Architectural Technology Journal (at) issue 137 published by CIAT in spring 2021. It was published under the headline, 'Just when business owners thought it could not get any worse', and written by Simon Hughes, Partner, Taylor Walton.

--CIAT

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

Farnborough College Unveils its Half-house for Sustainable Construction Training.

Spring Statement 2025 with reactions from industry

Confirming previously announced funding, and welfare changes amid adjusted growth forecast.

Scottish Government responds to Grenfell report

As fund for unsafe cladding assessments is launched.

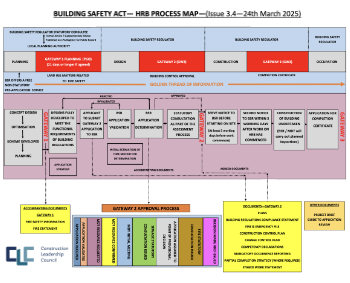

CLC and BSR process map for HRB approvals

One of the initial outputs of their weekly BSR meetings.

Architects Academy at an insulation manufacturing facility

Programme of technical engagement for aspiring designers.

Building Safety Levy technical consultation response

Details of the planned levy now due in 2026.

Great British Energy install solar on school and NHS sites

200 schools and 200 NHS sites to get solar systems, as first project of the newly formed government initiative.

600 million for 60,000 more skilled construction workers

Announced by Treasury ahead of the Spring Statement.

The restoration of the novelist’s birthplace in Eastwood.

Life Critical Fire Safety External Wall System LCFS EWS

Breaking down what is meant by this now often used term.

PAC report on the Remediation of Dangerous Cladding

Recommendations on workforce, transparency, support, insurance, funding, fraud and mismanagement.

New towns, expanded settlements and housing delivery

Modular inquiry asks if new towns and expanded settlements are an effective means of delivering housing.

Building Engineering Business Survey Q1 2025

Survey shows growth remains flat as skill shortages and volatile pricing persist.

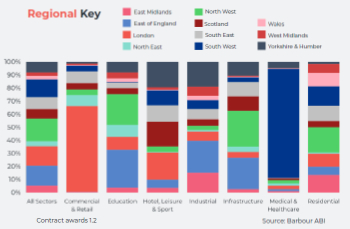

Construction contract awards remain buoyant

Infrastructure up but residential struggles.

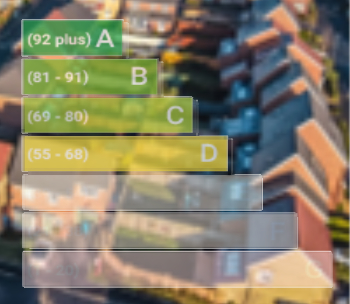

Warm Homes Plan and existing energy bill support policies

Breaking down what existing policies are and what they do.

A dynamic brand built for impact stitched into BSRIA’s building fabric.