Research and development tax relief

Research and development tax relief is a specialist piece of tax relief made available by governments to provide incentives to businesses. It is designed to provide support to companies who invest in research and development (R&D), to help bring new products to market, to develop new processes, or to improve existing products or processes.

R&D tax relief should be considered at the start of a project as it can have a significant impact on costs and the budget and may even make an unfeasible project, feasible. Tax relief mechanisms may vary widely in different countries and for different periods of time, so should be checked based on location and year of application.

This article is aimed primarily at companies operating in the UK, there are similar schemes in many EU countries. In the 2023 spring budget the UK Government made a number of significant changes to the mechanisms relating to Research and Development tax relief, in particular with respect to small and medium enterprises (SME's)

There are two schemes available to UK companies, an SME Scheme, aimed at Small to Medium Sized Companies, (SME R&D relief) and a large company scheme for companies that do not meet the criteria of the SME Scheme referred to as Research and Development Expenditure Credit (RDEC).

To qualify for the SME Scheme the following criteria need to be met:

- Less than 500 staff

- A turnover of under 100 million euros or a balance sheet total under 86 million euros

Partner and linked enterprises, may also need to be included when assessing if the company is an SME, but the SME R&D relief allows companies to:

- Deduct an extra 130% of their qualifying costs from their yearly profit, as well as the normal 100% deduction, to make a total 230% deduction

- Claim a tax credit if the company is loss making, worth up to 14.5% of the surrenderable loss

To get R&D relief a project needs to explain how it;

- looked for an advance in science and technology

- had to overcome uncertainty

- tried to overcome this uncertainty

- could not be easily worked out by a professional in the field

The project may research or develop a new process, product or service or improve on an existing one.

Any company that does meet the criteria of the SME Scheme is eligible to claim under the Large Company Scheme.

The Research and Development Expenditure Credit is a tax credit, it was 11% of qualifying R&D expenditure up to 31 December 2017 and was increased to:

- 12% from 1 January 2018 to 31 March 2020

- 13% from 1 April 2020

SMEs and large companies who have been subcontracted to do R&D work by a large company can also claim under the schemes.

In September 2020, HM Revenue & Customs reported that £175m was paid to UK construction firms in research and development tax credits in the previous year,a significant increase on the £90m paid the year before.

[edit] Related articles on Designing Buildings

Featured articles and news

ECA digital series unveils road to net-zero.

Retrofit and Decarbonisation framework N9 launched

Aligned with LHCPG social value strategy and the Gold Standard.

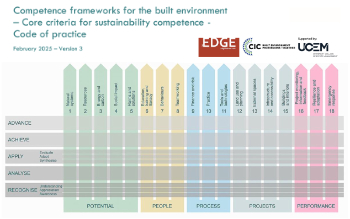

Competence framework for sustainability

In the built environment launched by CIC and the Edge.

Institute of Roofing members welcomed into CIOB

IoR members transition to CIOB membership based on individual expertise and qualifications.

Join the Building Safety Linkedin group to stay up-to-date and join the debate.

Government responds to the final Grenfell Inquiry report

A with a brief summary with reactions to their response.

A brief description and background to this new February law.

Everything you need to know about building conservation and the historic environment.

NFCC publishes Industry White Paper on Remediation

Calling for a coordinated approach and cross-departmental Construction Skills Strategy to manage workforce development.

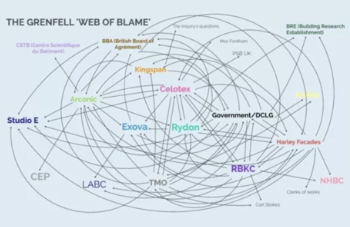

'who blames whom and for what, and there are three reasons for doing that: legal , cultural and moral"

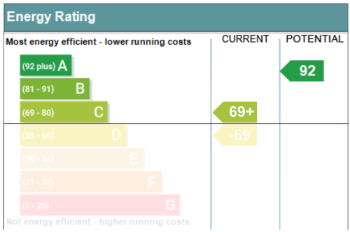

How the Home Energy Model will be different from SAP

Comparing different building energy models.

Mapping approaches for standardisation.

UK Construction contract spending up at the start of 2025

New construction orders increase by 69 percent on December.

Preparing for the future: how specifiers can lead the way

As the construction industry prepares for the updated home and building efficiency standards.

Embodied Carbon in the Built Environment

A practical guide for built environment professionals.

Updating the minimum energy efficiency standards

Background and key points to the current consultation.

Heritage building skills and live-site training.