Overheads

In accounting, the term ‘overheads’ refers to expenses that are paid by an organisation on an ongoing basis. Overheads can be fixed (i.e. the same each month) such as rent on office buildings, or variable (i.e. fluctuating depending on business activities) such as delivery costs. Overheads can also be semi-variable, where part of the expense is incurred at a fixed level and another part fluctuates, such as utility charges.

In construction contracts, overheads are often priced proportionately against a project and are the calculated costs of running the company contracted to carry out a project. Often these costs are described as head office administrative costs (in some cases there may also be factory or manufacturing overheads).

Head office costs might include; property costs, finance charges on loans, insurances, staff, taxes, external advisors, marketing and tendering activities and so on. Most contracting organisations will calculate a percentage against project costs to be set against each project somewhere between 2.5% and 5% to cover head office services.

Site overheads such as site accommodation, insurance, and so on, are generally accounted for separately and in contractual terms are included in the preliminaries element of the contract.

On prime cost contracts the contractor is paid for carrying out the works based on the prime cost (the actual cost of labour, plant and materials) and a fee for overheads and profit. This fee can be agreed by negotiation or by competition, and may be a lump sum (which it may be possible to adjust if the actual cost is different from the estimate), or a percentage of the prime cost (which it may be possible to revise if the client changes the nature of the works).

[edit] Related articles on Designing Buildings

- Business.

- Business plan.

- Cash flow statement.

- Cost information.

- Cost overruns.

- Cost planning.

- Direct cost.

- Estimate.

- Head office overheads.

- How to calculate head office overheads and profit.

- Loss and expense.

- Margin.

- Organisation.

- Preliminaries.

- Profit.

- Profit and overheads.

- Project overheads.

- Revenue.

Featured articles and news

A five minute introduction.

50th Golden anniversary ECA Edmundson apprentice award

Showcasing the very best electrotechnical and engineering services for half a century.

Welsh government consults on HRBs and reg changes

Seeking feedback on a new regulatory regime and a broad range of issues.

CIOB Client Guide (2nd edition) March 2025

Free download covering statutory dutyholder roles under the Building Safety Act and much more.

AI and automation in 3D modelling and spatial design

Can almost half of design development tasks be automated?

Minister quizzed, as responsibility transfers to MHCLG and BSR publishes new building control guidance.

UK environmental regulations reform 2025

Amid wider new approaches to ensure regulators and regulation support growth.

The maintenance challenge of tenements.

BSRIA Statutory Compliance Inspection Checklist

BG80/2025 now significantly updated to include requirements related to important changes in legislation.

Shortlist for the 2025 Roofscape Design Awards

Talent and innovation showcase announcement from the trussed rafter industry.

OpenUSD possibilities: Look before you leap

Being ready for the OpenUSD solutions set to transform architecture and design.

Global Asbestos Awareness Week 2025

Highlighting the continuing threat to trades persons.

Retrofit of Buildings, a CIOB Technical Publication

Now available in Arabic and Chinese aswell as English.

The context, schemes, standards, roles and relevance of the Building Safety Act.

Retrofit 25 – What's Stopping Us?

Exhibition Opens at The Building Centre.

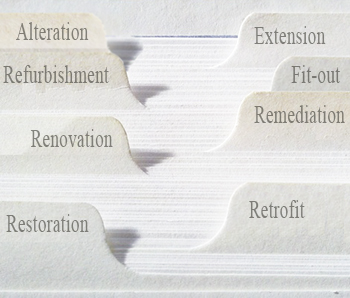

Types of work to existing buildings

A simple circular economy wiki breakdown with further links.

A threat to the creativity that makes London special.