Business structures commonly used by small businesses in Australia

The four main business structures commonly used by small businesses in Australia are:

- Sole trader: an individual operating as the sole person legally responsible for all aspects of the business. Like other structures, as a sole trader you can employ people to help you run your business.

- Company: a legal entity separate from its shareholders.

- Partnership: an association of people or entities running a business together, but not as a company.

- Trust: an entity that holds property or income for the benefit of others.

When deciding on a structure for your business, choose the one that best suits your business needs, keeping in mind that there are advantages and disadvantages for each structure. It's important to investigate each option carefully, as choosing your business structure is an important decision.

Your business structure can determine:

- the licenses you require how much tax you pay

- whether you're considered an employee, or the owner of the business

- your potential personal liability

- how much control you have over the business

- ongoing costs and volume of paper work for your business.

It is important to note that you can change your business structure throughout the life of your business. As your business grows and expands, you may decide to change your business structure, or to restructure your business.

Obtaining legal or other professional advice can help you understand your own particular circumstances. Speak to your accountant, or use our Advisor Finder tool to find a business adviser, when deciding on your business's structure and type. It is important to determine your business structure and business type before you register a business or company as the steps may differ.

| Main Advantages | Main Disadvantages | |

| Sole Proprietorship |

Easy to create and maintain Business and owner are legally the same entity No fees associated with the creation of the business entity Owner may deduct a net business loss from personal income taxes |

Owner is personally liable for any debts, judgments or other liabilities of the business Owner must pay personal income taxes for all net business profits |

| LTD Company |

Limited Liability, in case the company goes in to financial difficulty, the assets and personal finances of shareholders are protected beyond value of their shareholding. Tax efficiency, more opportunity and great flexibility is offered by limited companies in the case of taxation on profits and on personal income Professional Status: A professional and corporate image is created by a limited company, thus boosting the value of business. |

Must incorporate the company with Companies House. Generally there are more costs to set up. One cannot be a director of a company if he is disqualified director or un-discharged bankrupt. There are certain restrictions with regard to the company name. The information relating to the owner of the company and the company are displayed on public record. There are more complex, time consuming accounting and administration requirements. |

| General Partnership |

Easy to create and maintain No fees associated with creation of the business entity Owners may report their share of net business losses on personal income taxes |

All owners are jointly and personally liable for any debts, judgments or other liabilities of the business Owners must pay personal income taxes for all net business profits |

| Limited Partnership |

Easy to attract investors as they are only liable for their total amount of their investment into the business The limited partners enjoy limited liability for any debts, judgments or other liabilities of the business The general partners are more free to focus their attention on the business General partners are able to raise cash without diminishing their control of the business Limited partners can leave the business without dissolving the limited partnership |

General partners are jointly and personally liable for any debts, judgments or other liabilities of the business Can be more expensive to create than a general partnership Mainly suited to businesses such as real estate investment groups or in the film industry |

| Limited Liability Company (LLC) |

Owners of the business enjoy limited liability for the business' debts, judgments and other liabilities, even if the owners engage in significant control of the business The business profits and losses can be allocated to the owners along different lines than ownership interest (for example, a 10% owner may be allocated 30% of the business' profits) Owners can choose how the LLC will be taxed, either as a partnership or a corporation |

More expensive to establish than a sole proprietorship or partnership |

| Professional Limited Liability Company | Allows state licensed professionals to enjoy the same advantages as a LLC |

Same disadvantages as a LLC All members must belong to the same profession |

| Limited Liability Partnership |

Business entities associated with things like law, medicine and accounting normally use this Partners are not liable for the malpractice of other partners Partners take their share of loss or gain on their personal income taxes |

Partners remain personally liable for obligations to business creditors, landlords and lenders Not every state allows limited liability partnerships Often limited to only a select few professions |

[edit] Find out more

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

A five minute introduction.

50th Golden anniversary ECA Edmundson apprentice award

Showcasing the very best electrotechnical and engineering services for half a century.

Welsh government consults on HRBs and reg changes

Seeking feedback on a new regulatory regime and a broad range of issues.

CIOB Client Guide (2nd edition) March 2025

Free download covering statutory dutyholder roles under the Building Safety Act and much more.

AI and automation in 3D modelling and spatial design

Can almost half of design development tasks be automated?

Minister quizzed, as responsibility transfers to MHCLG and BSR publishes new building control guidance.

UK environmental regulations reform 2025

Amid wider new approaches to ensure regulators and regulation support growth.

The maintenance challenge of tenements.

BSRIA Statutory Compliance Inspection Checklist

BG80/2025 now significantly updated to include requirements related to important changes in legislation.

Shortlist for the 2025 Roofscape Design Awards

Talent and innovation showcase announcement from the trussed rafter industry.

OpenUSD possibilities: Look before you leap

Being ready for the OpenUSD solutions set to transform architecture and design.

Global Asbestos Awareness Week 2025

Highlighting the continuing threat to trades persons.

Retrofit of Buildings, a CIOB Technical Publication

Now available in Arabic and Chinese aswell as English.

The context, schemes, standards, roles and relevance of the Building Safety Act.

Retrofit 25 – What's Stopping Us?

Exhibition Opens at The Building Centre.

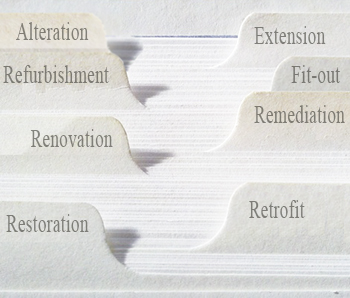

Types of work to existing buildings

A simple circular economy wiki breakdown with further links.

A threat to the creativity that makes London special.