Barnett consequentials and the Barnett guarantee

Contents |

[edit] Background

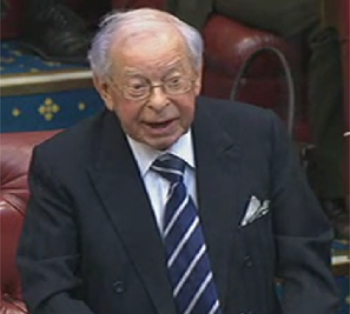

The Barnett formula was first used in 1978, for Scotland, introduced by and named after the then Labour chief secretary to the Treasury, Joel Barnett. It was extended to Northern Ireland in 1979 and to Wales in 1980.

It was meant as a temporary measure to avoid annual negotiations on funding allocations between the UK’s nations. The formula was used to determine the level of UK government spending on public services in Scotland, Wales and Northern Ireland until 1999, when devolution in the UK was brought in under the then Labour government.

Since devolution, the UK Government allocates funding in two ways, either to the UK as a whole, or specifically just for England when the funding is spent on a policy area where the devolved administrations are responsible (including health, education, local government and now Building Safety), block grants of the devolved administrations are set by the Barnett formula.

[edit] The Barnett formula

The Barnett formula refers to the way funding is calculated, effectively the yearly change to the block grant (the largest of the grants provided to the devolved administrations by the UK government) is carried out by a formula which aims to give each nation the same pounds-per-person change in funding each year.

[edit] Barnett consequentials

When additional public expenditure is planned in England, the corresponding additions which are made to the devolved administrations' funding allocations are referred to as Barnett consequentials, aiming to make fair provision to devolved nations of Scotland, Wales and Northern Ireland.

[edit] The Barnett guarantee

The Barnett guarantee, is effectively the same process as the consequentials and formula but as a guarantee it gives devolved administrations increased funding certainty, enabling them to decide how and when to provide support, rather than loans or the traditional Barnett consequentials. The guarantee thus allows devolved administrations to spend additional funding allocated by the Barnett guarantee without having to wait for it to be first spent in England.

The Barnett guarantee was established in July of 2020 as a result of the coronavirus pandemic and requests from the devolved administrations for more borrowing powers that followed. The Barnett guarantee set out how much additional funding the UK Government would provide to each of the devolved administrations to address the pressures of the pandemic in 2020-21. The Barnett guarantee has also been raised in connection to building safety since the Grenfell tragedy and in particular with reference to remediation programmes developed by each of the devolved nations, such as the Scottish Building Safety Levy.

[edit] The Barnett guarantee and Building Safety remediation

The Residential Property Developer Tax (RPDT) was a Corporation Tax supplement levied by the UK Government on the UK’s largest residential property developers,introduced on 1 April 2022. The aim for the tax was to obtain a contribution towards the cost of dealing with defective cladding in the UK’s high-rise housing stock, limited to the largest residential property developers by each group having an annual allowance of £25 million, with only profits from residential property development activities above this amount being subject to the tax.

Only residential development companies liable for UK Corporation Tax fall within scope of RPDT, which is charged at 4% on residential property development profits that exceed their annual allowance. The intention being to raise at least £2 billion from RPDT over a ten-year period, with £200 million generated in the first year. As a UK-wide tax where revenues are used to fund spending on cladding remediation in England, the Scottish Government receive Barnett consequentials, approximately £194 million over the expected ten-year period. The Scottish Government has committed to spending all Barnett consequentials generated from RPDT on cladding remediation in Scotland.

[edit] Related articles on Designing Buildings

Featured articles and news

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Many resources for visitors aswell as new features for members.

Using technology to empower communities

The Community data platform; capturing the DNA of a place and fostering participation, for better design.

Heat pump and wind turbine sound calculations for PDRs

MCS publish updated sound calculation standards for permitted development installations.

Homes England creates largest housing-led site in the North

Successful, 34 hectare land acquisition with the residential allocation now completed.

Scottish apprenticeship training proposals

General support although better accountability and transparency is sought.

The history of building regulations

A story of belated action in response to crisis.

Moisture, fire safety and emerging trends in living walls

How wet is your wall?

Current policy explained and newly published consultation by the UK and Welsh Governments.

British architecture 1919–39. Book review.

Conservation of listed prefabs in Moseley.

Energy industry calls for urgent reform.

Heritage staff wellbeing at work survey.

A five minute introduction.

50th Golden anniversary ECA Edmundson apprentice award

Showcasing the very best electrotechnical and engineering services for half a century.

Welsh government consults on HRBs and reg changes

Seeking feedback on a new regulatory regime and a broad range of issues.

CIOB Client Guide (2nd edition) March 2025

Free download covering statutory dutyholder roles under the Building Safety Act and much more.