Fintech in the construction industry

The term 'Fintech' is derived from the words ‘financial’ and ‘technology’ and is used to describe the emerging start-up technology companies that are influencing and disrupting the financial services industry. The services that are being disrupted most by Fintech include mobile payments, money transfers, loans, fundraising, and so on.

The proliferation of the smartphone has drastically changed consumer behaviour, creating a culture of ‘always online’ users. Online services and apps have widened the scope of what users expect to be able to access and action, and when. This has inevitably influenced banking and financial services, where Fintech can generate considerable savings through agility, an ability to innovate and adapt, and there relatively small size in contrast with the operations of traditional banks.

Two examples of Fintech’s influence include:

- Crowdsourcing through services such as Kickstarter, enabling people to acquire funding quickly and easily.

- The cross-border transfer of money, through services such as TransferWise, which allows SMEs and individuals to transfer money far more cheaply and quickly than was previously possible.

In the construction industry, Fintech has begun to influence processes such as payments and supply chain management. For example, an Australian Fintech platform Progressclaim, has enables building contractors to administer payment claims, avoid disputes and reduce processing costs.

Both contractors and subcontractors collaborate on a single neutral platform that provides a central communication mechanism for the contractor to value work and approve subcontractor payments quickly and accurately, improving the management process throughout the supply chain.

For more information, see Progressclaim.

On 6 December 2017, HM Treasury announced the launch of The Challenge, a competition offering budding entrepreneurs the chance to win £2 million. The prize will be awarded for the development of an application to use rental payment data to improve credit scores and mortgage applications for Britain's 11 million renters.

Winning bids will be selected by a panel of leading figures from the Fintech sector, and an initial round of grant funding will be provided to six proposals, helping to turn the ideas into workable products. These six will then be whittled down to a handful of teams who will receive further funding and support to bring their ideas to market.

The Challenge will open to applications early in 2018, and development will conclude in October 2018. For more information, see here.

[edit] Find out more

[edit] Related articles on Designing Buildings Wiki

- Accounting.

- Advanced construction technology.

- Building data exchange.

- Collaborative practices.

- Fair payment practices.

- Industry Disruption: 10 ways real estate is changing.

- Information and communications technology in construction.

- Life cycle costs.

- Proptech.

- Smart technology.

- Supply chain management.

Featured articles and news

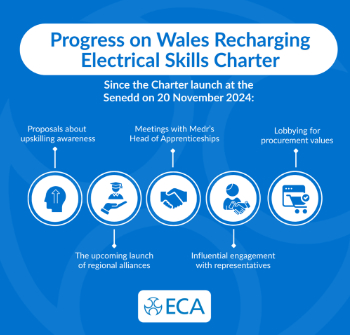

ECA progress on Welsh Recharging Electrical Skills Charter

Working hard to make progress on the ‘asks’ of the Recharging Electrical Skills Charter at the Senedd in Wales.

A brief history from 1890s to 2020s.

CIOB and CORBON combine forces

To elevate professional standards in Nigeria’s construction industry.

Amendment to the GB Energy Bill welcomed by ECA

Move prevents nationally-owned energy company from investing in solar panels produced by modern slavery.

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Heat pumps, vehicle chargers and heating appliances must be sold with smart functionality.

Experimental AI housing target help for councils

Experimental AI could help councils meet housing targets by digitising records.

New-style degrees set for reformed ARB accreditation

Following the ARB Tomorrow's Architects competency outcomes for Architects.

BSRIA Occupant Wellbeing survey BOW

Occupant satisfaction and wellbeing tool inc. physical environment, indoor facilities, functionality and accessibility.

Preserving, waterproofing and decorating buildings.

Many resources for visitors aswell as new features for members.

Using technology to empower communities

The Community data platform; capturing the DNA of a place and fostering participation, for better design.

Heat pump and wind turbine sound calculations for PDRs

MCS publish updated sound calculation standards for permitted development installations.

Homes England creates largest housing-led site in the North

Successful, 34 hectare land acquisition with the residential allocation now completed.

Scottish apprenticeship training proposals

General support although better accountability and transparency is sought.

The history of building regulations

A story of belated action in response to crisis.

Moisture, fire safety and emerging trends in living walls

How wet is your wall?

Current policy explained and newly published consultation by the UK and Welsh Governments.

British architecture 1919–39. Book review.

Conservation of listed prefabs in Moseley.

Energy industry calls for urgent reform.

Comments

Fintech, which stands for financial technology, offers several recommendations for trading software development services https://inoxoft.com/industries/fintech/trading-software-development-services/ in the construction industry. These recommendations include leveraging automated trading algorithms to increase efficiency and accuracy, integrating real-time data analytics to make informed investment decisions, and ensuring robust security measures to protect sensitive financial information. By implementing these fintech solutions, construction companies can streamline their trading processes and achieve better financial outcomes.