Real estate investment trust REIT

A Real Estate Investment Trust (REIT) is a company that owns and manages property on behalf of investors where revenue is principally (not less than 75%) derived from rent or interest on mortgages. As such, REITs receive special tax considerations. Owner-occupied properties are excluded from such trusts.

Many of the largest property development companies have, since their introduction in 2007, restructured themselves as publicly-quoted REITs.

This structure offers certain tax advantages to investors as well as providing property investment opportunities to those investors who do not wish to invest directly into the property market, either commercial or retail, and who wish to be able to trade in and out of the asset class.

REITs are exempt from paying corporation tax or capital gains tax on profits, but must instead pay out at least 90% of property income to investors in the form of dividends which are then subject to tax depending upon the circumstances of each investor. A withholding tax is applied at the time that dividends are paid.

For these reasons, a REIT is an investment structure that appeals to the widest possible cross-section of potential investors, all of whom will have very differing income and tax considerations.

Typically, the REITs market offers the investor high yields and liquidity not usually associated with the ownership of property. Investors can purchase individual REIT shares through the stock exchange or can invest in a fund that specialises in property holdings thereby spreading risk across the property sector. Generally, REIT investments apply to commercial buildings, shopping centres, warehousing and residential apartment blocks.

To become a REIT a company must be listed on a recognised stock exchange.

Subject to the rules, companies and groups can become REITs paying an entry charge on 2% of the value of their investment properties which can be spread with interest over four years. This is taxed at the main rate of corporation tax.

No investor may have more than a 10% stake in a REIT.

On the condition that a REIT distributes at least 90% of its property income and capital gains by way of dividends, distribution is made without deduction of tax. While the investor will be taxed on the basis of property income it is not subject to capital gains tax. Effectively, it is a way of an investor benefiting by capital gain on property without having to pay capital gains tax.

[edit] Related articles on Designing Buildings Wiki

- Affordable housing.

- Capital allowances.

- Developer.

- Investment property.

- Investment Property Databank (IPD).

- Leaseback.

- Property ownership.

- Real estate.

- Speculative construction.

- Tax relief.

- Tenant management organisation.

- Types of development.

[edit] External references

Featured articles and news

The context, schemes, standards, roles and relevance of the Building Safety Act.

Retrofit 25 – What's Stopping Us?

Exhibition Opens at The Building Centre.

Types of work to existing buildings

A simple circular economy wiki breakdown with further links.

A threat to the creativity that makes London special.

How can digital twins boost profitability within construction?

The smart construction dashboard, as-built data and site changes forming an accurate digital twin.

Unlocking surplus public defence land and more to speed up the delivery of housing.

The Planning and Infrastructure Bill

An outline of the bill with a mix of reactions on potential impacts from IHBC, CIEEM, CIC, ACE and EIC.

Farnborough College Unveils its Half-house for Sustainable Construction Training.

Spring Statement 2025 with reactions from industry

Confirming previously announced funding, and welfare changes amid adjusted growth forecast.

Scottish Government responds to Grenfell report

As fund for unsafe cladding assessments is launched.

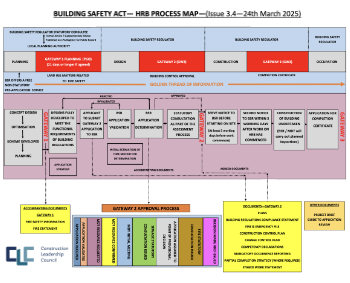

CLC and BSR process map for HRB approvals

One of the initial outputs of their weekly BSR meetings.

Architects Academy at an insulation manufacturing facility

Programme of technical engagement for aspiring designers.

Building Safety Levy technical consultation response

Details of the planned levy now due in 2026.

Great British Energy install solar on school and NHS sites

200 schools and 200 NHS sites to get solar systems, as first project of the newly formed government initiative.

600 million for 60,000 more skilled construction workers

Announced by Treasury ahead of the Spring Statement.

The restoration of the novelist’s birthplace in Eastwood.

Life Critical Fire Safety External Wall System LCFS EWS

Breaking down what is meant by this now often used term.

PAC report on the Remediation of Dangerous Cladding

Recommendations on workforce, transparency, support, insurance, funding, fraud and mismanagement.

New towns, expanded settlements and housing delivery

Modular inquiry asks if new towns and expanded settlements are an effective means of delivering housing.