Global bathroom market 2015

In August 2015, BSRIA launched Global Bathroom Market (2015), a report that formed part of its World Multi-Client Study.

The key finding of the report were:

- The global baths market accounted for 24m units sold in 2014 and is predicted to grow at a CAGR (compound annual growth rate) of just below five per cent until 2019.

- The 2014 shower trays market was just under 20m units, estimated to grow by a CAGR of over nine per cent in the next five years. Customers are switching from baths to shower trays and ‘walk-in’ showers due to space pressures.

- Almost 400m units of ceramic sanitary ware were sold in 2014, and the market is expected to grow at a CAGR of seven to eight per cent in the next five years.

- Sales of concealed and exposed plastic cisterns reached around 20m units globally, with concealed models set to take some of the share of exposed models.

- Around 430m taps and mixers / faucets were sold in 2014, estimated to grow by six to seven per cent annually until 2019.

Global analysis revealed that:

- EMEA (Europe, Middle East and Africa) accounts for more than 62 per cent of the World baths market in volume, followed by Asia-Pacific (around 22 per cent) and Americas (around 16 per cent).

- In the shower trays segment, sales to EMEA accounted for around half of all commercialised units; the Americas have over 41 per cent of the global share in the CSW (ceramic sanitary ware) market and the Asia-Pacific market accounted for almost 34 per cent of CSWs.

- In the taps and mixers (T&M) segment, Asia Pacific is the largest market (mainly one-hand mixers), accounting for around 43 per cent of global sales. This is followed by EMEA (over 34 per cent) and the Americas (23 per cent).

The contents of the report includes:

- Market opportunities for bathroom / sanitary products.

- Market size (2014) and trends (2011-2019) for baths (cast iron, steel and plastic / acrylic).

- Market size (2014) and trends (2011-2019) for shower trays (ceramic, steel and plastic / acrylic).

- Market size (2014) and trends (2011-2019) for ceramic sanitary ware.

- Market size (2014) and trends (2011-2019) for plastic cisterns (exposed and concealed).

- Market size (2014) and trends (2011-2019) for taps and mixers / faucets.

Zoltan Karpathy, Senior Manager Intelligent Buildings and Homes, BSRIA Worldwide Market Intelligence (WMI), said: “There is a growing desire by home / building owners to renovate and improve bathrooms, so in the context of sluggish new construction activity across several markets, refurbishment / retrofit is the main end-use segment. Innovations such as silent flushing systems and clog free WCs are catching people’s attention, but low water consumption, easy installation and improved quality are important decision making factors.”

--BSRIA

Featured articles and news

Government responds to the final Grenfell Inquiry report

A with a brief summary with reactions to their response.

A brief description and background to this new February law.

Everything you need to know about building conservation and the historic environment.

NFCC publishes Industry White Paper on Remediation

Calling for a coordinated approach and cross-departmental Construction Skills Strategy to manage workforce development.

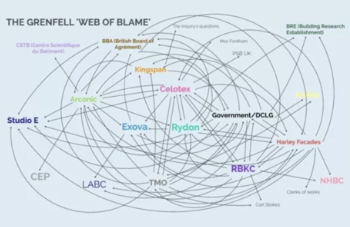

'who blames whom and for what, and there are three reasons for doing that: legal , cultural and moral"

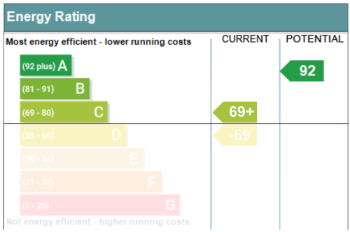

How the Home Energy Model will be different from SAP

Comparing different building energy models.

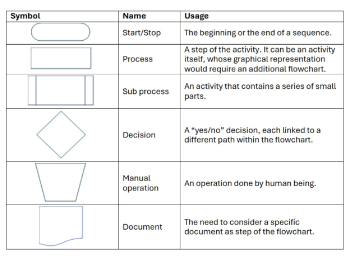

Mapping approaches for standardisation.

UK Construction contract spending up at the start of 2025

New construction orders increase by 69 percent on December.

Preparing for the future: how specifiers can lead the way

As the construction industry prepares for the updated home and building efficiency standards.

Embodied Carbon in the Built Environment

A practical guide for built environment professionals.

Updating the minimum energy efficiency standards

Background and key points to the current consultation.

Heritage building skills and live-site training.

Shortage of high-quality data threatening the AI boom

And other fundamental issues highlighted by the Open Data Institute.

Data centres top the list of growth opportunities

In robust, yet heterogenous world BACS market.

Increased funding for BSR announced

Within plans for next generation of new towns.