Business Asset Disposal Relief BADR

Contents |

[edit] Introduction

Prior to 6 April 2020, Business Asset Disposal Relief (BADR) was known as Entrepreneurs’ Relief. The name was changed under the Finance Act 2020.

BADR is a source of capital gains tax (CGT) tax relief that supports entrepreneurs in their efforts to improve and invest in their businesses. It does this by reducing the amount of CGT on qualifying capital gains to 10% on the disposal of qualifying business assets on or after 6 April 2008.

BADR may be beneficial when the proceeds of the disposal of the asset would otherwise push the business owner into a higher tax band. Qualifying capital gains for each individual are subject to a lifetime limit as follows, for disposals on or after:

- 6 April 2008 to 5 April 2010, £1 million.

- 6 April 2010 to 22 June 2010, £2 million.

- 23 June 2010 to 5 April 2011, £5 million.

- 6 April 2011 to 10 March 2020, £10 million.

- 11 March 2020, £1 million.

[edit] Eligibility

BADR applies to qualifying disposals of business assets under:

- A sole trade and its assets.

- Partnership interests and assets.

- Shares in a self-owned company.

- Joint venture interests.

- Business assets held by a trust

In order to be eligible for BADR, the business owner must meet certain conditions throughout a two year qualifying period (either up to the date of disposal or the date the business ceased). The business owner must dispose of business assets within three years to qualify for relief.

BADR is available to CGT disposals made by individuals and some trustees of settlements, but it is not available to companies or in relation to a trust where the entire trust is a discretionary settlement. Personal representatives of deceased persons can only claim if the disposal took place whilst the deceased person was alive.

[edit] Making claims

Spouses or civil partners are separate individuals and may each make a claim. They are each entitled to BADR up to the maximum amount available for an individual, provided that they each satisfy the relevant conditions for relief.

BADR must be claimed, either by the individual or, in the case of trustees of settlements, jointly by the trustees and the qualifying beneficiary. The claim must be made to HMRC in writing by the first anniversary of the 31 of January following the end of the tax year in which the qualifying disposal takes place. A claim to BADR may be amended or revoked within the time limit for making a claim.

[edit] Related articles on Designing Buildings Wiki

- Capital gains tax.

- Finance Act.

- Rate relief schemes.

- Taxes associated with selling a business.

- Tax relief.

[edit] External resources

- Gov.uk, Capital Gains Manual.

Featured articles and news

Farnborough College Unveils its Half-house for Sustainable Construction Training.

Spring Statement 2025 with reactions from industry

Confirming previously announced funding, and welfare changes amid adjusted growth forecast.

Scottish Government responds to Grenfell report

As fund for unsafe cladding assessments is launched.

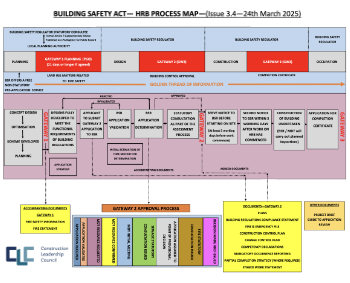

CLC and BSR process map for HRB approvals

One of the initial outputs of their weekly BSR meetings.

Architects Academy at an insulation manufacturing facility

Programme of technical engagement for aspiring designers.

Building Safety Levy technical consultation response

Details of the planned levy now due in 2026.

Great British Energy install solar on school and NHS sites

200 schools and 200 NHS sites to get solar systems, as first project of the newly formed government initiative.

600 million for 60,000 more skilled construction workers

Announced by Treasury ahead of the Spring Statement.

The restoration of the novelist’s birthplace in Eastwood.

Life Critical Fire Safety External Wall System LCFS EWS

Breaking down what is meant by this now often used term.

PAC report on the Remediation of Dangerous Cladding

Recommendations on workforce, transparency, support, insurance, funding, fraud and mismanagement.

New towns, expanded settlements and housing delivery

Modular inquiry asks if new towns and expanded settlements are an effective means of delivering housing.

Building Engineering Business Survey Q1 2025

Survey shows growth remains flat as skill shortages and volatile pricing persist.

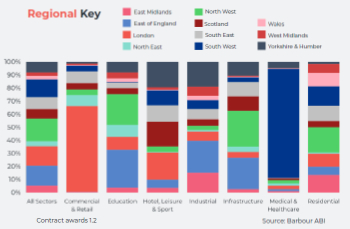

Construction contract awards remain buoyant

Infrastructure up but residential struggles.

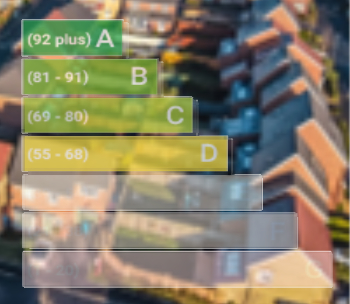

Warm Homes Plan and existing energy bill support policies

Breaking down what existing policies are and what they do.

A dynamic brand built for impact stitched into BSRIA’s building fabric.