Drawdown

Contents |

[edit] Introduction

In relation to property development finance, the term 'drawdown' can have numerous meanings, including a portion of the funding - or drawdown - received incrementally over the duration of the project. Under this definition, a drawdown on financing (such as a loan) may be taken in stages to finance a project. The incremental distribution of funds is sometimes referred to as a progressive drawdown.

In some instances, drawdown may refer to the initiation of a transaction - or drawdown - under a loan agreement. Under this definition, funds can become available (or are officially borrowed) on a drawdown date. It can also be an amount of money - or drawdown - borrowed for a specific purpose. This usage is considered informal and is not traditionally used in the context of property development financing.

When not associated with financial matters, drawdown may refer to the controlled reduction of fluids or pressure wells, reservoirs and so on.

[edit] Drawdown and cash flow

The incremental distribution of funds is sometimes referred to as a progressive drawdown. While a progressive drawdown provides resources as needed, the success of this approach may require careful planning to ensure cash is distributed at the appropriate stages based on the progress of the project.

If drawdown is dictated by a schedule provided by the funder, this may present issues during times when increased spending is necessary, but money is not available. There may also be periods when less money is required, and an unsuitable drawdown schedule will result in the unnecessary release of funding.

With a progressive drawdown, it is possible to lower interest payments when compared to situations where the entire amount is borrowed at the start of the project. However, if too much of a progressive drawdown is taken too quickly, this can result in the accrual of additional interest.

The agreed interest rate and drawdown facilities should be provided in the funding or loan contract. Interest rates might be fixed, variable and/or capped. Drawdown facilities (often on a quarterly basis) need to be more than sufficient and timed to meet monthly valuations. Often developers will base residual value calculations on drawing down all construction and professional payments by the two thirds stage of the project to avoid any risk of defaulting on payments.

Careful planning cannot always anticipate emergency situations that may have an impact on the progress of a project and the allocation of resources. In these instances, drawdown contingency management measures should be considered. One consideration may be the creation of a contingency drawdown curve which can be updated regularly for revised forecasting.

[edit] Drawdown requirements

There is some general information that is typically part of financing arrangements that have drawdown agreements. This may include a specific time period for transactions (depending on agreed upon conditions) referred to as a conditions precedent.

A conditions precedent is used to safeguard funds. It requires that certain events take place in order for the contract to be valid. It may also require the submission of certain documentation, including:

- Official documents (such as project agreements) for borrowers and those providing security.

- Proof of authorisations (documents power and capacity) for borrowers and those providing security.

- Licences and consents evidence.

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

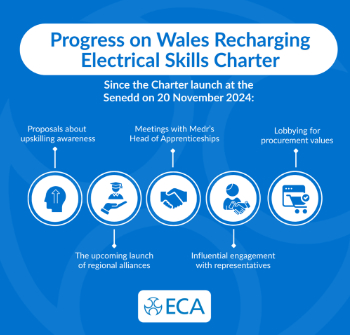

ECA progress on Welsh Recharging Electrical Skills Charter

Working hard to make progress on the ‘asks’ of the Recharging Electrical Skills Charter at the Senedd in Wales.

A brief history from 1890s to 2020s.

CIOB and CORBON combine forces

To elevate professional standards in Nigeria’s construction industry.

Amendment to the GB Energy Bill welcomed by ECA

Move prevents nationally-owned energy company from investing in solar panels produced by modern slavery.

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Heat pumps, vehicle chargers and heating appliances must be sold with smart functionality.

Experimental AI housing target help for councils

Experimental AI could help councils meet housing targets by digitising records.

New-style degrees set for reformed ARB accreditation

Following the ARB Tomorrow's Architects competency outcomes for Architects.

BSRIA Occupant Wellbeing survey BOW

Occupant satisfaction and wellbeing tool inc. physical environment, indoor facilities, functionality and accessibility.

Preserving, waterproofing and decorating buildings.

Many resources for visitors aswell as new features for members.

Using technology to empower communities

The Community data platform; capturing the DNA of a place and fostering participation, for better design.

Heat pump and wind turbine sound calculations for PDRs

MCS publish updated sound calculation standards for permitted development installations.

Homes England creates largest housing-led site in the North

Successful, 34 hectare land acquisition with the residential allocation now completed.

Scottish apprenticeship training proposals

General support although better accountability and transparency is sought.

The history of building regulations

A story of belated action in response to crisis.

Moisture, fire safety and emerging trends in living walls

How wet is your wall?

Current policy explained and newly published consultation by the UK and Welsh Governments.

British architecture 1919–39. Book review.

Conservation of listed prefabs in Moseley.

Energy industry calls for urgent reform.