Bridging loan for property

Contents |

[edit] Introduction

A bridging loan is a short-term funding solution which can be used to ‘bridge’ a gap between money being owed and credit becoming available. Typically, bridging loans are used in property transactions and can be essential in ensuring a property purchase can be achieved.

They often only take between seven and ten working days to organise, but can incur a large administration fee and high interest charges.

[edit] Details

Bridging loans are short-term finance options that enable a house buyer to complete a purchase before they sell their existing home through a high-rate interest loan. This type of finance option can also help home-movers if there is a gap between the sale and completion dates in a chain, for example somebody looking for a quick-sale after renovating a property or to help assist with purchasing at an auction.

There are two types of loans: closed and open. A closed bridge loan has a fixed repayment date. An open bridge loan does not have a fixed date, but is usually required to be paid off within a year. With closed bridge loans, the borrower will usually already have exchanged to sell a property and fixed the completion date.

[edit] Predominant target market

The typical recipients of bridging finance are landlords, small-scale property developers, and individual’s purchasing at an auction where finance is required quickly. Other recipients can include wealthy borrowers who require simple lending on residential properties.

It is possible to secure bridging loans against a variety of residential, semi-commercial, commercial or land and options can include:

- Properties to purchase: A new property, buy-to-let purchases, auction purchases.

- Properties to build and renovate: Housing developments, self-builds, barn conversions, refurbishment projects to sell for profit.

- Properties where funds are to be raised: Un-mortgageable properties, purchasing before selling, short-term cash flow solutions.

[edit] Sources of bridging finance

There are a wide variety of bridging lenders which range from small, one-man bands to larger professional organisations that are regulated by the Financial Conduct Authority.

NB Businesses can also use bridging loans secured against land and property to raise capital, to pay off tax liabilities, or to meet business obligations.

[edit] Related articles on Designing Buildings Wiki.

- Budget.

- Construction loan.

- Conveyancing.

- Cost plans.

- Credit check.

- Estate agent fees.

- Equity and loan capital.

- Funding options for building developments.

- Funding prospectus for new developments.

- How much does it cost to sell my home.

- Mezzanine finance.

- PF2.

- Private Finance Initiative.

- Project-based funding.

- Property development finance.

- Trade credit insurance.

Featured articles and news

British Architectural Sculpture 1851-1951

A rich heritage of decorative and figurative sculpture. Book review.

A programme to tackle the lack of diversity.

Independent Building Control review panel

Five members of the newly established, Grenfell Tower Inquiry recommended, panel appointed.

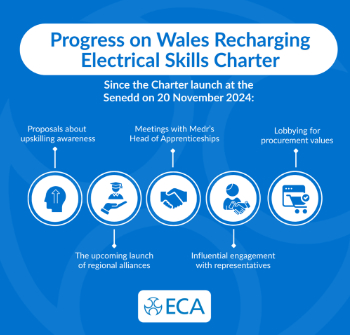

Welsh Recharging Electrical Skills Charter progresses

ECA progressing on the ‘asks’ of the Recharging Electrical Skills Charter at the Senedd in Wales.

A brief history from 1890s to 2020s.

CIOB and CORBON combine forces

To elevate professional standards in Nigeria’s construction industry.

Amendment to the GB Energy Bill welcomed by ECA

Move prevents nationally-owned energy company from investing in solar panels produced by modern slavery.

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Heat pumps, vehicle chargers and heating appliances must be sold with smart functionality.

Experimental AI housing target help for councils

Experimental AI could help councils meet housing targets by digitising records.

New-style degrees set for reformed ARB accreditation

Following the ARB Tomorrow's Architects competency outcomes for Architects.

BSRIA Occupant Wellbeing survey BOW

Occupant satisfaction and wellbeing tool inc. physical environment, indoor facilities, functionality and accessibility.

Preserving, waterproofing and decorating buildings.