Scottish Aggregates Tax Bill

Aggregates is the term used to describe materials, such as sand, rock or gravel, compacted together to be used in construction and other industries. The Aggregates Tax and Devolved Taxes Administration (Scotland) Bill will replace the UK Aggregates Levy and tax the sale or use of aggregates consisting of freshly extracted rock, gravel or sand.

The Bill sets out the aggregates tax to be created for Scotland and makes some changes to how existing Scottish taxes work. The new Bill was introduced on 14 November 2023 with stage 3 of it progress ending on 1 October 2024.

Public Finance Minister Ivan McKee said:

“By encouraging the use of recycled materials in aggregates across a range of construction-related activities, the Aggregates Tax Bill supports the Scottish Government’s ambitions for a fair, green and growing economy.

“It has been informed by extensive engagement with the aggregates industry and others, and I look forward to continuing this positive relationship as we prepare to introduce the Scottish Aggregates Tax.”

[edit] Related articles on Designing Buildings

Featured articles and news

Grenfell Tower Principal Contractor Award notice

Tower repair and maintenance contractor announced as demolition contractor.

Passivhaus social homes benefit from heat pump service

Sixteen new homes designed and built to achieve Passivhaus constructed in Dumfries & Galloway.

CABE Publishes Results of 2025 Building Control Survey

Concern over lack of understanding of how roles have changed since the introduction of the BSA 2022.

British Architectural Sculpture 1851-1951

A rich heritage of decorative and figurative sculpture. Book review.

A programme to tackle the lack of diversity.

Independent Building Control review panel

Five members of the newly established, Grenfell Tower Inquiry recommended, panel appointed.

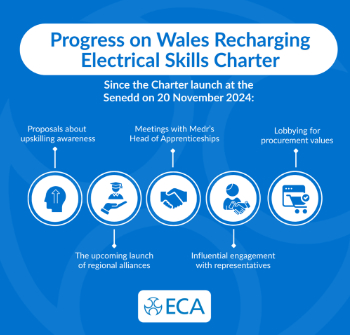

Welsh Recharging Electrical Skills Charter progresses

ECA progressing on the ‘asks’ of the Recharging Electrical Skills Charter at the Senedd in Wales.

A brief history from 1890s to 2020s.

CIOB and CORBON combine forces

To elevate professional standards in Nigeria’s construction industry.

Amendment to the GB Energy Bill welcomed by ECA

Move prevents nationally-owned energy company from investing in solar panels produced by modern slavery.

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Heat pumps, vehicle chargers and heating appliances must be sold with smart functionality.

Experimental AI housing target help for councils

Experimental AI could help councils meet housing targets by digitising records.

New-style degrees set for reformed ARB accreditation

Following the ARB Tomorrow's Architects competency outcomes for Architects.

BSRIA Occupant Wellbeing survey BOW

Occupant satisfaction and wellbeing tool inc. physical environment, indoor facilities, functionality and accessibility.

Preserving, waterproofing and decorating buildings.