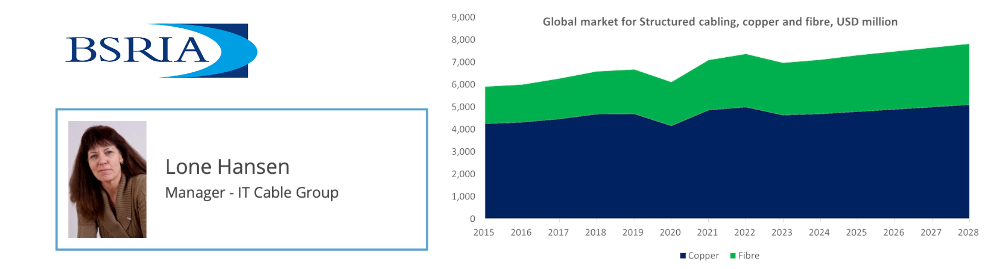

Overstocking and macro-economics cause global cabling market to decline

The structured cabling market decreased by almost 6% in 2023 to USD 6.98 bn, after a rise of 4% in 2022 and 16% in 2021. Sales of copper cable and connectivity suffered the most, decreasing by just over 7%, while fibre only declined slightly. The supply issues and shortage of materials experienced in most markets in 2021 and 2022 meant that the channel boosted levels of stock in most markets at the end of 2022. That affected sales in the first half of 2023, in addition to a reduction in demand due to a slowdown in the office vertical, high interest rates, lack of investment and the threat of recession in many countries.

Two thirds of the countries researched in 2023 and beginning of 2024 have recovered or are exceeding pre-pandemic LAN sales levels measured in USD. The biggest increases are in Saudi Arabia, France, Spain and Brazil. At the other end of the scale, India, Japan, Norway and Canada are struggling to recover. Looking at the recovery measured by copper cables sold, only a few countries have performed well, including Spain, Sweden and Finland. Nearly all countries are below or far below pre-pandemic levels. The recovery in LAN in value is mainly due to the significant price increase seen over the last three years but also due an increase in sales of higher value products such as Cat 6A.

The data centre market decreased marginally in 2023 with the sector facing the same issues as LAN, as well as a reduction in new permits for data centres in some cities/areas. Power restraints will be a key issue over the forecast period. Demand for DC power has grown exponentially and in the future the sector will face competition from electrical vehicles and some sectors of manufacturing. The European commission estimates an increase in power consumption of 60% by 2030. In addition, power generation needs huge investments in most countries to meet green (renewable) targets.

BSRIA covers 37 countries in their yearly update of cabling markets published in March/April 2024. 16 countries were researched in the latest round of research and they include: USA, Canada, Brazil, Mexico, China, Japan, India, Germany, UK, France, Netherlands, Spain, Norway, Poland, Saudi Arabia and UAE. Data from 2022 include: Colombia, South Korea, Italy, Switzerland, Ireland, Denmark and Finland. 2021 include 6 countries: Chile, Australia, Belgium, Sweden, Portugal and SEA. Data from 2020 include: HK & Macao, Russia and South Africa.

This article appears on the BSRIA news and blog site as 'The global cabling market declined in 2023 due to overstocking and macro-economic factors' dated July, 2024.

--BSRIA

[edit] BSRIA articles on Designing Buildings

Featured articles and news

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Many resources for visitors aswell as new features for members.

Using technology to empower communities

The Community data platform; capturing the DNA of a place and fostering participation, for better design.

Heat pump and wind turbine sound calculations for PDRs

MCS publish updated sound calculation standards for permitted development installations.

Homes England creates largest housing-led site in the North

Successful, 34 hectare land acquisition with the residential allocation now completed.

Scottish apprenticeship training proposals

General support although better accountability and transparency is sought.

The history of building regulations

A story of belated action in response to crisis.

Moisture, fire safety and emerging trends in living walls

How wet is your wall?

Current policy explained and newly published consultation by the UK and Welsh Governments.

British architecture 1919–39. Book review.

Conservation of listed prefabs in Moseley.

Energy industry calls for urgent reform.

Heritage staff wellbeing at work survey.

A five minute introduction.

50th Golden anniversary ECA Edmundson apprentice award

Showcasing the very best electrotechnical and engineering services for half a century.

Welsh government consults on HRBs and reg changes

Seeking feedback on a new regulatory regime and a broad range of issues.

CIOB Client Guide (2nd edition) March 2025

Free download covering statutory dutyholder roles under the Building Safety Act and much more.