New report finds decline in Infrastructure pipeline and shift towards private funding

[edit] Summary

- Analysis of latest NICP finds a significant drop off in new projects and a real-term decline in value.

- Barbour ABI notes a significant shift is underway from public-funded transport to privately funded energy projects.

- 92% of future energy projects in the NICP are privately funded.

[edit] 46% decrease in planned projects

The National Infrastructure and Construction Pipeline (NICP) published in February represents a 46% decrease in planned projects when overlapping projects from 2021 are taken into account – according to analysis from Barbour ABI

The findings came in a report, titled “Beyond the infrastructure pipeline” which features analysis from Build UK, Mace and Arcadis, which examined the £700-£775bn of projects listed in the new NCIP. Barbour found that the monetary value of projects listed in the pipeline represented a slight decline in 2021’s contract values when adjusted for inflation.

Report author Damon Schünmann said “The industry might have hoped for a 20% addition of new projects that could have indicated something close to business as usual. But since the projects allocated for the ten years from 2021 (£169bn) and those allocated from 2023 (£143bn), contain £34bn of overlapping projects, the picture looks more like a 46% decrease in fresh projects.”

Kate Perrin, Group Marketing Director at Barbour ABI said:

“February’s delayed publication of the NICP by the Infrastructure and Projects Authority saw the long-awaited update on government commitment to the nation’s infrastructure. Both society and much of the construction industry is dependent on the 700-775bn worth of projected investment set out within it, so it is vital to look closely at the pipeline to see in real terms what has changed.

“Barbour ABI combined its own project data analyses with expert industry opinion to provide some illumination for infrastructure businesses looking to chart a course through the next decade. Together, these elements provide a snapshot of shifting priorities, opportunities, and the choke points that must be navigated if we are to close the gap between national ambition and actual delivery.”

[edit] End of an era of transport mega projects

The report also notes the shift in spending away from publicly funded transport mega projects such as HS2 and Cross Rail to privately funded energy projects. Road projects have already been significantly impacted, with average value and total value of contracts plummeting between 2020 and 2023 as the government has shifted focus to smaller projects.

Barbour ABI found that in 2019, public spending made up 67% of infrastructure projects. However, in 2023 this figure was just 36%. Of the value set out in the NICP, 92% of energy projects are currently listed as privately funded.

Schünmann continued: “It appears the era of transport mega-projects is over, and a new era led by regulated, privately funded energy infrastructure projects is emerging to support the transition to net-zero.

“Large nuclear projects, windfarms and energy transmission upgrades represent some of the largest opportunities in the next decade. But it should be noted that they will be funded by end user charges rather than Government money.”

Beyond the Infrastructure Pipeline is available to download at barbour-abi.com.

Featured articles and news

Twas the site before Christmas...

A rhyme for the industry and a thankyou to our supporters.

Plumbing and heating systems in schools

New apprentice pay rates coming into effect in the new year

Addressing the impact of recent national minimum wage changes.

EBSSA support for the new industry competence structure

The Engineering and Building Services Skills Authority, in working group 2.

Notes from BSRIA Sustainable Futures briefing

From carbon down to the all important customer: Redefining Retrofit for Net Zero Living.

Principal Designer: A New Opportunity for Architects

ACA launches a Principal Designer Register for architects.

A new government plan for housing and nature recovery

Exploring a new housing and infrastructure nature recovery framework.

Leveraging technology to enhance prospects for students

A case study on the significance of the Autodesk Revit certification.

Fundamental Review of Building Regulations Guidance

Announced during commons debate on the Grenfell Inquiry Phase 2 report.

CIAT responds to the updated National Planning Policy Framework

With key changes in the revised NPPF outlined.

Councils and communities highlighted for delivery of common-sense housing in planning overhaul

As government follows up with mandatory housing targets.

CIOB photographic competition final images revealed

Art of Building produces stunning images for another year.

HSE prosecutes company for putting workers at risk

Roofing company fined and its director sentenced.

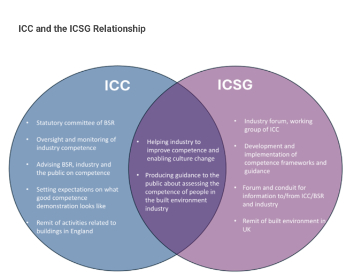

Strategic restructure to transform industry competence

EBSSA becomes part of a new industry competence structure.

Major overhaul of planning committees proposed by government

Planning decisions set to be fast-tracked to tackle the housing crisis.

Industry Competence Steering Group restructure

ICSG transitions to the Industry Competence Committee (ICC) under the Building Safety Regulator (BSR).

Principal Contractor Competency Certification Scheme

CIOB PCCCS competence framework for Principal Contractors.

The CIAT Principal Designer register

Issues explained via a series of FAQs.