Floating charge

A floating charge is a type of security interest granted by a company over its assets. Unlike a fixed charge, which is tied to specific assets, a floating charge covers a class of assets that may change over time.

A floating charge applies to a general class of assets, such as stock, receivables, or inventory, which can change in the ordinary course of business. This flexibility allows the company to use and dispose of the assets without needing the lender's consent. Lenders, such as banks or financial institutions, use floating charges to secure loans. This provides them with a security interest over assets that are crucial to the company's operations but are not easily covered by fixed charges.

The floating charge applies to the specified class of assets until certain events occur, such as default on a loan, insolvency, or winding up of the company. It then becomes a fixed charge attached to the specific assets within the class that the company holds.

In the case of insolvence, floating charge holders rank after fixed charge holders and preferential creditors (such as employees and certain tax obligations) but before unsecured creditors.

In the construction industry, floating charges can be used to secure financing for various purposes, such as providing working capital while still holding assets that fluctuate in value and quantity, such as construction materials, equipment, and work-in-progress. A floating charge allows them to manage these assets dynamically while still providing security to lenders. For example, a construction company might secure a loan from a bank to finance a large project. The bank takes a floating charge over the company's inventory, accounts receivable, and other current assets. The company continues to use these assets in its operations. However, if the company defaults on the loan or becomes insolvent, the floating charge crystallises, converting into a fixed charge over the assets held at that time, giving the bank a priority claim over them.

Floating charges provide flexibility for the company to manage its assets without restricting the company's operational flexibility. However they give lower priority in insolvency compared to fixed charges, and settlement can become complex in terms of legal and financial management, especially at the point of crystallisation.

[edit] Related articles on Designing Buildings

- Bridging loan.

- Business process outsourcing (BPO).

- Buyer-funded development.

- Collateral.

- Construction loan.

- Construction project funding.

- Cost plans.

- Drawdown.

- Equity and loan capital.

- Funder.

- Funding options for building developments.

- Funding prospectus.

- Leaseback.

- Mezzanine finance.

- Private Finance Initiative.

- Project-based funding.

- Property development finance.

- Property valuation.

- Remortgage.

Featured articles and news

UKCW London to tackle sector’s most pressing issues

AI and skills development, ecology and the environment, policy and planning and more.

Managing building safety risks

Across an existing residential portfolio; a client's perspective.

ECA support for Gate Safe’s Safe School Gates Campaign.

Core construction skills explained

Preparing for a career in construction.

Retrofitting for resilience with the Leicester Resilience Hub

Community-serving facilities, enhanced as support and essential services for climate-related disruptions.

Some of the articles relating to water, here to browse. Any missing?

Recognisable Gothic characters, designed to dramatically spout water away from buildings.

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

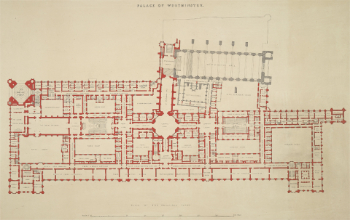

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

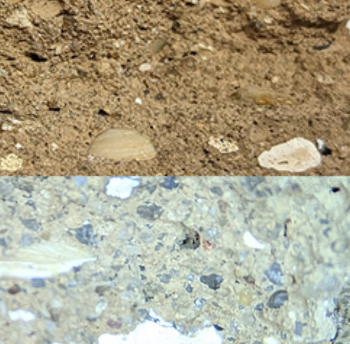

A detailed description from the experts at Cornish Lime.