Financial hedging in the construction industry

Contents |

[edit] Introduction

In common parlance, ‘hedging one's bets’ usually involves putting something in place to protect the individual from a possible loss or negative future event. It is taking a parallel action to offset something that might happen which is thought might result in a loss or unfortunate state of affairs. Buying home insurance is a hedge against burglary, fire and other calamities.

[edit] Financial hedging

Similarly, in the finance sector, a hedge is a risk management strategy used to protect against a possible financial loss. It is a counterbalancing tool that protects individuals or companies from a loss that may be incurred in some parallel financial investment. It is important to remember that hedging does not usually make investors money, but protects them from financial loss.

A hedge may comprise one or many different types of financial investments such as stocks, insurance, forward contracts, exchange-traded funds and options. In creating this hedge, an individual or company may take an opposing position in one investment or market to balance a risk that may be incurred in a contrary investment or market. The risk, should it occur, will usually be to do with adverse price movements

[edit] Long and short hedges.

Long and short hedges are both classed as ‘futures’ and can be favourable as they iron-out price volatility in a market.

A long hedge contract allows a company (Company A) to buy - say copper - at a specific price at a set date in the future. If the price of copper rises before the contract expires, company A has saved money by paying a lower price (otherwise it would have bought copper at a higher price); however, if the price of copper falls, company A loses out as it must still pay the higher price agreed to in the contract. In that case, the hedge has been costly and it would have been better not to have hedged at all.

A short hedge protects against the price of an asset falling at some point in the future. For example, an aluminium producer (company B) might enter into a contract (short hedge) to lock into a preferred sale price allowing it to sell aluminium at a specified future price. Should the price of aluminium fall below that price during the contract period, company B can sell at the (higher) price it agreed to in the contract and will have reduced its losses and earned a profit.

[edit] Reasons to hedge

- Can minimise exposure to risk.

- Determines the sale or purchase price of a commodity or security.

- Produces consistent and stable cash-flows.

- Minimises transaction costs.

[edit] Related articles on Designing Buildings Wiki

- Budget

- Business case.

- Business plan

- Cashflow.

- Cash flow forecast.

- Construction loan.

- Construction Supply Chain Payment Charter.

- Fair payment practices for construction.

- Housing Grants, Construction and Regeneration Act.

- Remedies for late payment.

- Scheme for Construction Contracts.

- The Late Payment of Commercial Debts Regulations 2013.

.

Featured articles and news

Global Asbestos Awareness Week 2025

Highlighting the continuing threat to trades persons.

The context, schemes, standards, roles and relevance of the Building Safety Act.

Retrofit 25 – What's Stopping Us?

Exhibition Opens at The Building Centre.

Types of work to existing buildings

A simple circular economy wiki breakdown with further links.

A threat to the creativity that makes London special.

How can digital twins boost profitability within construction?

The smart construction dashboard, as-built data and site changes forming an accurate digital twin.

Unlocking surplus public defence land and more to speed up the delivery of housing.

The Planning and Infrastructure Bill

An outline of the bill with a mix of reactions on potential impacts from IHBC, CIEEM, CIC, ACE and EIC.

Farnborough College Unveils its Half-house for Sustainable Construction Training.

Spring Statement 2025 with reactions from industry

Confirming previously announced funding, and welfare changes amid adjusted growth forecast.

Scottish Government responds to Grenfell report

As fund for unsafe cladding assessments is launched.

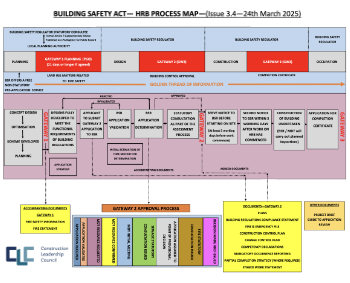

CLC and BSR process map for HRB approvals

One of the initial outputs of their weekly BSR meetings.

Architects Academy at an insulation manufacturing facility

Programme of technical engagement for aspiring designers.

Building Safety Levy technical consultation response

Details of the planned levy now due in 2026.

Great British Energy install solar on school and NHS sites

200 schools and 200 NHS sites to get solar systems, as first project of the newly formed government initiative.

600 million for 60,000 more skilled construction workers

Announced by Treasury ahead of the Spring Statement.

The restoration of the novelist’s birthplace in Eastwood.

Life Critical Fire Safety External Wall System LCFS EWS

Breaking down what is meant by this now often used term.

PAC report on the Remediation of Dangerous Cladding

Recommendations on workforce, transparency, support, insurance, funding, fraud and mismanagement.

New towns, expanded settlements and housing delivery

Modular inquiry asks if new towns and expanded settlements are an effective means of delivering housing.