Financial hedging in the construction industry

Contents |

[edit] Introduction

In common parlance, ‘hedging one's bets’ usually involves putting something in place to protect the individual from a possible loss or negative future event. It is taking a parallel action to offset something that might happen which is thought might result in a loss or unfortunate state of affairs. Buying home insurance is a hedge against burglary, fire and other calamities.

[edit] Financial hedging

Similarly, in the finance sector, a hedge is a risk management strategy used to protect against a possible financial loss. It is a counterbalancing tool that protects individuals or companies from a loss that may be incurred in some parallel financial investment. It is important to remember that hedging does not usually make investors money, but protects them from financial loss.

A hedge may comprise one or many different types of financial investments such as stocks, insurance, forward contracts, exchange-traded funds and options. In creating this hedge, an individual or company may take an opposing position in one investment or market to balance a risk that may be incurred in a contrary investment or market. The risk, should it occur, will usually be to do with adverse price movements

[edit] Long and short hedges.

Long and short hedges are both classed as ‘futures’ and can be favourable as they iron-out price volatility in a market.

A long hedge contract allows a company (Company A) to buy - say copper - at a specific price at a set date in the future. If the price of copper rises before the contract expires, company A has saved money by paying a lower price (otherwise it would have bought copper at a higher price); however, if the price of copper falls, company A loses out as it must still pay the higher price agreed to in the contract. In that case, the hedge has been costly and it would have been better not to have hedged at all.

A short hedge protects against the price of an asset falling at some point in the future. For example, an aluminium producer (company B) might enter into a contract (short hedge) to lock into a preferred sale price allowing it to sell aluminium at a specified future price. Should the price of aluminium fall below that price during the contract period, company B can sell at the (higher) price it agreed to in the contract and will have reduced its losses and earned a profit.

[edit] Reasons to hedge

- Can minimise exposure to risk.

- Determines the sale or purchase price of a commodity or security.

- Produces consistent and stable cash-flows.

- Minimises transaction costs.

[edit] Related articles on Designing Buildings Wiki

- Budget

- Business case.

- Business plan

- Cashflow.

- Cash flow forecast.

- Construction loan.

- Construction Supply Chain Payment Charter.

- Fair payment practices for construction.

- Housing Grants, Construction and Regeneration Act.

- Remedies for late payment.

- Scheme for Construction Contracts.

- The Late Payment of Commercial Debts Regulations 2013.

.

Featured articles and news

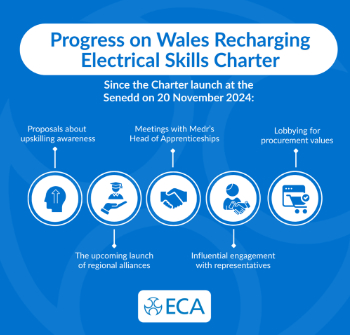

ECA progress on Welsh Recharging Electrical Skills Charter

Working hard to make progress on the ‘asks’ of the Recharging Electrical Skills Charter at the Senedd in Wales.

A brief history from 1890s to 2020s.

CIOB and CORBON combine forces

To elevate professional standards in Nigeria’s construction industry.

Amendment to the GB Energy Bill welcomed by ECA

Move prevents nationally-owned energy company from investing in solar panels produced by modern slavery.

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Heat pumps, vehicle chargers and heating appliances must be sold with smart functionality.

Experimental AI housing target help for councils

Experimental AI could help councils meet housing targets by digitising records.

New-style degrees set for reformed ARB accreditation

Following the ARB Tomorrow's Architects competency outcomes for Architects.

BSRIA Occupant Wellbeing survey BOW

Occupant satisfaction and wellbeing tool inc. physical environment, indoor facilities, functionality and accessibility.

Preserving, waterproofing and decorating buildings.

Many resources for visitors aswell as new features for members.

Using technology to empower communities

The Community data platform; capturing the DNA of a place and fostering participation, for better design.

Heat pump and wind turbine sound calculations for PDRs

MCS publish updated sound calculation standards for permitted development installations.

Homes England creates largest housing-led site in the North

Successful, 34 hectare land acquisition with the residential allocation now completed.

Scottish apprenticeship training proposals

General support although better accountability and transparency is sought.

The history of building regulations

A story of belated action in response to crisis.

Moisture, fire safety and emerging trends in living walls

How wet is your wall?

Current policy explained and newly published consultation by the UK and Welsh Governments.

British architecture 1919–39. Book review.

Conservation of listed prefabs in Moseley.

Energy industry calls for urgent reform.