CIS contractors and CIS sub-contractors

Contents |

[edit] Introduction

The Construction Industry Scheme (CIS) sets out a series of rules for how contractors should make payments to sub-contractors. The scheme was introduced to try and prevent the loss of revenue to the exchequer arising from payments between contractors not being properly accounted for for tax purposes

For the purposes of the CIS the terms contractors and sub-contractors have very specific meanings. These are terms that are widely used within the building industry but for the purposes of the CIS it is important that the specific meanings are clearly understood as they have direct relevance to the manner in which payments between parties may be made, and the associated tax treatment of those payments.

In this article they are referred to CIS contractors and CIS sub-contractors.

[edit] CIS contractors

Under the CIS there are two groups of contractors:

- Mainstream contractors

- Deemed contractors

[edit] Mainstream contractors

These include:

- Any businesses that undertake construction operations and pay others for work carried out.

- Any property developers or speculative builders erecting and altering buildings in order to make a profit.

- Gang-leaders organising construction labour (although gang-leaders may also be a CIS sub-ontractors)

- Foreign businesses carrying out construction work in the UK.

[edit] Deemed contractors

The CIS also identifies entities that are deemed to be contractors. These may be public bodies or other concerns who carry out or commission construction activities. Such entities are deemed to be contractors in the following circumstances:

- Their average annual expenditure on construction operations in the period of three years ending on the last accounting date exceeds £1 million.

- If they have not been trading for the whole of the last three years they will be deemed to be contractors if their total expenditure on construction activities for that part of the three year period during which they have traded exceeds £3 million.

Any concern that is deemed to be a contractor because one of the above conditions is met will continue to be treated as such until construction expenditure reduces to less than £1 million for three successive years.

[edit] CIS sub-contractors

This term describes a person or body that has agreed to carry out construction operations for a contractor. This may involve the CIS sub-ontractor:

- Carrying out the operations themselves, or;

- Having the work done by other CIS sub-contractors.

Such CIS sub-contractors may be companies, self-employed persons, public bodies, foreign businesses or gang-leaders. Persons may be employed by agencies to undertake construction work in which case the agency, howsoever constituted, shall be treated as a CIS sub-contractor.

NB: In June 2014, the government launched a consultation into ways to improve the CIS by reducing the administrative burden it imposes. Some people within the industry have called for the scheme to be scrapped. Ref. Construction Enquirer Calls grow to scrap CIS tax scheme 11 July 2014.

This page was created by:--Martinc 17:59, 19 June 2013 (BST)

[edit] Related articles on Designing Buildings Wiki:

- Construction Industry Scheme.

- Construction Industry Scheme or IR35?

- Contractor.

- Sole trader.

- Sub-contractor.

- Trade contractor.

- Types of contractor.

- Works contractor.

[edit] External references:

- HMRC: Construction Industry Scheme.

- Cantor Atkin: CIS Scheme assistance.

Featured articles and news

The context, schemes, standards, roles and relevance of the Building Safety Act.

Retrofit 25 – What's Stopping Us?

Exhibition Opens at The Building Centre.

Types of work to existing buildings

A simple circular economy wiki breakdown with further links.

A threat to the creativity that makes London special.

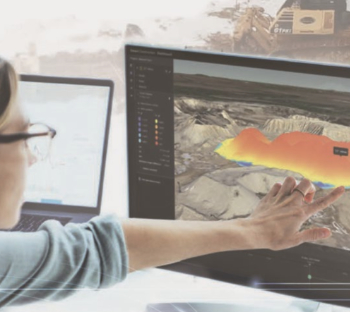

How can digital twins boost profitability within construction?

The smart construction dashboard, as-built data and site changes forming an accurate digital twin.

Unlocking surplus public defence land and more to speed up the delivery of housing.

The Planning and Infrastructure Bill

An outline of the bill with a mix of reactions on potential impacts from IHBC, CIEEM, CIC, ACE and EIC.

Farnborough College Unveils its Half-house for Sustainable Construction Training.

Spring Statement 2025 with reactions from industry

Confirming previously announced funding, and welfare changes amid adjusted growth forecast.

Scottish Government responds to Grenfell report

As fund for unsafe cladding assessments is launched.

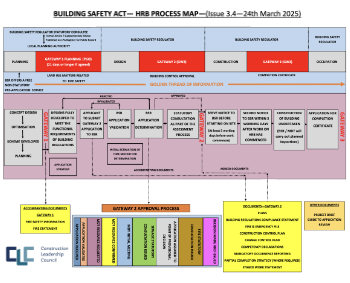

CLC and BSR process map for HRB approvals

One of the initial outputs of their weekly BSR meetings.

Architects Academy at an insulation manufacturing facility

Programme of technical engagement for aspiring designers.

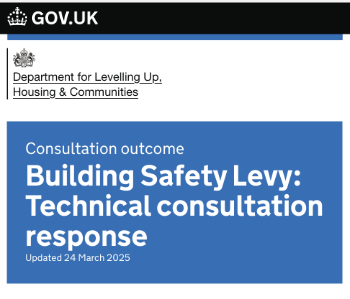

Building Safety Levy technical consultation response

Details of the planned levy now due in 2026.

Great British Energy install solar on school and NHS sites

200 schools and 200 NHS sites to get solar systems, as first project of the newly formed government initiative.

600 million for 60,000 more skilled construction workers

Announced by Treasury ahead of the Spring Statement.

The restoration of the novelist’s birthplace in Eastwood.

Life Critical Fire Safety External Wall System LCFS EWS

Breaking down what is meant by this now often used term.

PAC report on the Remediation of Dangerous Cladding

Recommendations on workforce, transparency, support, insurance, funding, fraud and mismanagement.

New towns, expanded settlements and housing delivery

Modular inquiry asks if new towns and expanded settlements are an effective means of delivering housing.