Construction plastics market

The global building and construction plastics market is expecter to reach around USD 486.2 billion by 2026, growing with 7.4% CAGR.

Increasing population and developing urbanisation across the globe have been driving the building and construction plastics market along with government initiatives to advance building structures. Rising need for cable ties, plastic rivets, and grommets due to their light weight and corrosion resistance is anticipated to drive further growth.

The market is extremely fragmented with many small and medium producers. The market players are anticipated to compete based on geographical development, quality, price, design and product.

North America and Europe saw high product penetration due to high spending on interiors and wooden structures in these regions. The rapid development of private, business, and modern structures in the Asia Pacific and Central and South America is expected to drive development in these regions over the forecast period.

Volatility in raw material costs and the strong foothold of established companies in the market are expected to be the key parameters restricting the entry of new companies. Though, a high scope for product growth in terms of strength and design is anticipated to open new opportunities, raising the threat of new competitors.

The global building & construction plastics market is segmented into product, application and region.

- On the basis of product, the market is segmented into Polyvinyl Chloride (PVC), Polystyrene, Polyethylene, Polyurethanes, and Others.

- On the basis of application, the market is segmented into roofing (polyvinyl chloride, polyurethanes, others), insulation (polystyrene, polyurethanes, others), pipes and ducts (polyvinyl chloride, polystyrene, polyethylene, others), wall coverings (polyvinyl chloride and others), windows (polyvinyl chloride, polyurethanes, and others), and other (polyvinyl chloride, polystyrene, polyethylene, polyurethanes, and others).

- On the basis of region the market is segmented into Latin America, Europe, Asia Pacific, North America, and Middle East & Africa.

Asia Pacific was the main market in 2017. It is likely to see an increase in infrastructure spending over the long term by virtue of quick urbanisation and developing population. The administration undertaking and infrastructure market in the region will increase by roughly 7% to 8% consistently throughout the following decade and reach over USD 5,300.0 billion towards the finish of the forecast period.

North America is one of the key markets for building and development plastics. Rising need for redesign of old structures is expected to drive development in the coming years. Industry bodies such as the Plastics Industry Association and National Association of Plastic Industries (ANIPAC) are promoting activities to help the development and improvement of plastics and its end applications.

The key players in the global building and construction plastics market are Borealis AG, BASF SE, DuPont, Trinseo, Solvay SA.BASF SE, and The Dow Chemical Company. These players are associated with the generation of plastics for various applications in the infrastructure sector. Organizations associated with the assembling of product for the infrastructure sector are highly combined across the value chain.

Costs of raw materials, for example, ethylene, propylene, and styrene are exceptionally sensitive to crude oil costs, which are unpredictable in nature. Plastic assembly utilises 4.0% crude oil, and so unpredictable costs are expected to frustrate the development of the market over the forecast period.

[edit] Related articles on Designing Buildings Wiki

- Adhesives.

- Cladding.

- Construction materials.

- ETFE.

- Fabric structures.

- Glass reinforced plastic GRP.

- India looks at using plastic instead of sand.

- Nylon.

- Paint.

- Plastic.

- Polyethylene.

- Polymers.

- Recyclable construction materials.

- Sandwich panel.

- Thermoplastic materials in buildings.

- Transparent insulation materials.

- Weatherboarding.

Featured articles and news

About the 5 Percent Club and its members

The 5% Club; a dynamic movement of employers committed to building and developing the workforce.

New Homes in New Ways at the Building Centre

Accelerating the supply of new homes with MMC.

Quality Planning for Micro and Small to Medium Sized Enterprises

A CIOB Academy Technical Information sheet.

A briefing on fall protection systems for designers

A legal requirement and an ethical must.

CIOB Ireland launches manifesto for 2024 General Election

A vision for a sustainable, high-quality built environment that benefits all members of society.

Local leaders gain new powers to support local high streets

High Street Rental Auctions to be introduced from December.

Infrastructure sector posts second gain for October

With a boost for housebuilder and commercial developer contract awards.

Sustainable construction design teams survey

Shaping the Future of Sustainable Design: Your Voice Matters.

COP29; impacts of construction and updates

Amid criticism, open letters and calls for reform.

The properties of conservation rooflights

Things to consider when choosing the right product.

Adapting to meet changing needs.

London Build: A festival of construction

Co-located with the London Build Fire & Security Expo.

Tasked with locating groups of 10,000 homes with opportunity.

Delivering radical reform in the UK energy market

What are the benefits, barriers and underlying principles.

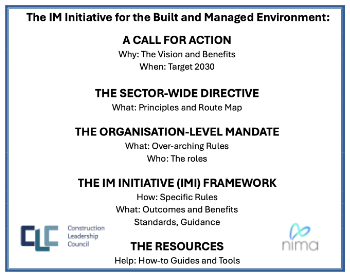

Information Management Initiative IMI

Building sector-transforming capabilities in emerging technologies.

Recent study of UK households reveals chilling home truths

Poor insulation, EPC knowledge and lack of understanding as to what retrofit might offer.