Thermal spray coating

The aerospace and power generation industries are actively focusing on the development of advanced surface coating processes. The presence of hexavalent chromium and environmental issues related to it has caused a number of end-use industries to look for alternatives. As a result, thermal spray coatings have gained traction as a replacement for hard chromium plating in the aerospace industry.

Thermal spray coatings are also used in medical implants. Increasing use of titanium and hydroxyapatite coatings in biomedical implants using thermal spray technology, is expected to drive the growth of the market. However, thermal spray coating is a line-of-sight coating process, i.e. it covers only the part which is in a line of the coating system. Moreover, robotic functions and frequent adjustments in case of complex geometries lead to high costs, which is expected to inhibit the growth of the market.

Global sales of thermal spray coatings are expected to beUS$ 7.6 Bn by the end of 2016, witnessing a year-on-year growth of 5.6% compared to 2015. North America and Europe are expected to account for more than 50% of the global thermal spray coatings market by the end of 2016 and are anticipated to remain dominant.

By material type, ceramics are expected to continue to dominate the market in terms of value. This segment is also expected to witness high growth. Metals, alloys, and carbides are expected to account for more than 50% of the market by the end of 2016.

On the basis of process type, hte cold spray segment is expected to expand at double-digit CAGR in terms of value. This is mainly because it is suitable for depositing a wide range materials on various types of substrate, especially those that are temperature sensitive.

On the basis of application, aerospace is expected to account for a market value share of 37.4%, valued at US$ 4.7 Bn by the end of 2024. Industrial gas turbines are expected to expand at the highest CAGR in terms of value as a result of increasing energy requirements across the globe. This, in turn, is projected to fuel demand for thermal spray coatings, as this process provides excellent coatings and exhibits superior resistance to wearing and corrosion.

Sales of thermal spray coatings in North America are estimated to account for highest share by the end of 2016. Sales in the Asia Pacific are expected to increase at the highest CAGR.

Key players in the global thermal spray coatings market include Sulzer Ltd., Oerlikon Group, Praxiar Ltd., Bodycote plc., Abakan Inc., Curtis-Wright Corporation, Metallisation Ltd., Thermal Spray Technologies Inc., and ASB Industries, Inc. The thermal spray coatings market has witnessed various merger and acquisition activities, leading to industry consolidation over the last few years. Most of these activities were undertaken by market leaders in North America and Europe markets.

The long-term outlook for the global thermal spray coatings market remains positive,with the Cold spray and High-Velocity Oxy-fuel (HVOF) segments expected to expand at highest CAGRs.

Featured articles and news

Twas the site before Christmas...

A rhyme for the industry and a thankyou to our supporters.

Plumbing and heating systems in schools

New apprentice pay rates coming into effect in the new year

Addressing the impact of recent national minimum wage changes.

EBSSA support for the new industry competence structure

The Engineering and Building Services Skills Authority, in working group 2.

Notes from BSRIA Sustainable Futures briefing

From carbon down to the all important customer: Redefining Retrofit for Net Zero Living.

Principal Designer: A New Opportunity for Architects

ACA launches a Principal Designer Register for architects.

A new government plan for housing and nature recovery

Exploring a new housing and infrastructure nature recovery framework.

Leveraging technology to enhance prospects for students

A case study on the significance of the Autodesk Revit certification.

Fundamental Review of Building Regulations Guidance

Announced during commons debate on the Grenfell Inquiry Phase 2 report.

CIAT responds to the updated National Planning Policy Framework

With key changes in the revised NPPF outlined.

Councils and communities highlighted for delivery of common-sense housing in planning overhaul

As government follows up with mandatory housing targets.

CIOB photographic competition final images revealed

Art of Building produces stunning images for another year.

HSE prosecutes company for putting workers at risk

Roofing company fined and its director sentenced.

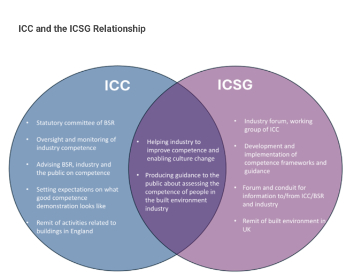

Strategic restructure to transform industry competence

EBSSA becomes part of a new industry competence structure.

Major overhaul of planning committees proposed by government

Planning decisions set to be fast-tracked to tackle the housing crisis.

Industry Competence Steering Group restructure

ICSG transitions to the Industry Competence Committee (ICC) under the Building Safety Regulator (BSR).

Principal Contractor Competency Certification Scheme

CIOB PCCCS competence framework for Principal Contractors.

The CIAT Principal Designer register

Issues explained via a series of FAQs.