Forms of practice

To help develop this article, click 'Edit this article' above

Contents |

[edit] Introduction

There are three main types of practice:

- Sole trader

- Partnerships: traditional, limited partnership, limited liability partnership

- Limited company

[edit] Sole trader

- Trade in own name

- Easy setup

- No legal structure

- Responsible for yourself so face the risks alone

- High personal risk - personally liable

- Can cease to exist easily.

[edit] Partnerships

[edit] Traditional Partnership

- Relation between 2+ people in business for profit.

- Governed by 'Partnership act 1890'

- Easy to setup

- Not registered with companies house - no public disclosure of accounts

- Joint & several liability - personally responsible for each others errors

- Should have 'Partnership agreement'

- Deed of adherence - signed by incoming partners to agree with partnership agreement.

- Partners not a cost of business unless salaried.

- Profit taxed then distributed to partners.

- Pay NI.

- Audited.

[edit] Limited partnership

- 1+ general partner- operates partnership - liable for debts and obligations.

- 1+ limited partners with capital but no liability as not running firm.

- Registered at Companies house.

- No public disclosure of accounts.

- Often used for SPV ( special purpose vehicle).

- Should have 'Partnership agreement'

- Deed of adherence - signed by incoming partners to agree with partnership agreement.

- Partners not a cost of business unless salaried.

- profit taxed then distributed to partners.

- Pay NI.

- Audited.

[edit] Limited Liability Partnership (LLP)

- Trade in company name.

- All partners can participate in management.

- Partners liability limited to assets in firm - not affected personally.

- Registered at Companies House.

- Accounts publicly disclosed.

- Partners not a cost of business unless salaried.

- Profit taxed then distributed to partners.

- Pay NI.

- Audited

[edit] Limited liability company

- Directors.

- Owners are shareholders. minimum 1 shareholder

- Liability limited to value of shares.

- Banks/ landlords may seek personal guarantees as liability may be too low.

- Registered at Companies House.

- Public disclosure of accounts

- Articles of association + memorandum: forms companies constitution.

- Shareholders have control over board of directors.

- Profits taxed.

- Dividends taxed.

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

Insights of how to attract more young people to construction

Results from CIOB survey of 16-24 year olds and parents.

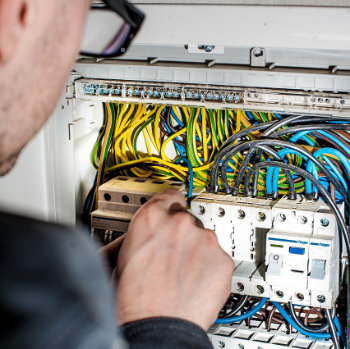

Focussing on the practical implementation of electrification.

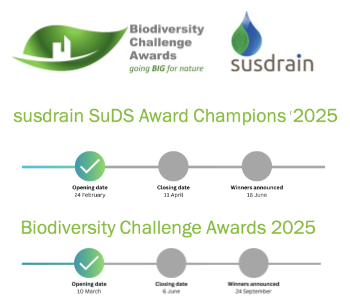

Sustainable Urban Drainage and Biodiversity

Awards for champions of these interconnected fields now open.

Microcosm of biodiversity in balconies and containers

Minor design adaptations for considerable biodiversity benefit.

CIOB student competitive construction challenge Ireland

Inspiring a new wave of Irish construction professionals.

Challenges of the net zero transition in Scotland

Skills shortage and ageing workforce hampering Scottish transition to net zero.

Private rental sector, living standards and fuel poverty

Report from the NRH in partnership with Impact on Urban Health.

.Cold chain condensing units market update

Tracking the evolution of commercial refrigeration unit markets.

Attending a conservation training course, personal account

The benefits of further learning for professsionals.

Restoring Alexander Pope's grotto

The only surviving part of his villa in Twickenham.

International Women's Day 8 March, 2025

Accelerating Action for For ALL Women and Girls: Rights. Equality. Empowerment.

Lack of construction careers advice threatens housing targets

CIOB warning on Government plans to accelerate housebuilding and development.

Shelter from the storm in Ukraine

Ukraine’s architects paving the path to recovery.

BSRIA market intelligence division key appointment

Lisa Wiltshire to lead rapidly growing Market Intelligence division.

A blueprint for construction’s sustainability efforts

Practical steps to achieve the United Nations Sustainable Development Goals.

Timber in Construction Roadmap

Ambitious plans from the Government to increase the use of timber in construction.

ECA digital series unveils road to net-zero.

Retrofit and Decarbonisation framework N9 launched

Aligned with LHCPG social value strategy and the Gold Standard.

Comments