Owner-controlled insurance

Contents |

[edit] Introduction

An owner-controlled insurance programme (OCIP) is a business practice that consolidates insurance liability for construction projects. Owner-controlled insurance programmes allow property owners to purchase insurance on behalf of all of the contractors working on a project rather than allowing each contractor to purchase individual coverage.These policies are also referred to as wrap-up coverage or wrap policies.

Owner-controlled insurance programmes are purchased by the owner alone, which differentiates them from contractors' all-risk insurance or contractor controlled insurance programmes issued under the joint names of the contractor and the property owner.

[edit] Scope of coverage

Owner-controlled insurance policies may include:

- Building related insurance.

- Construction.

- Hazards.

- Liability insurance.

- Materials.

- Terrorism insurance.

- Umbrella insurance.

- Workers' compensation (WC).

These policies are written for the term of the project plus any extended periods, assuring continuity of insurance policy terms, conditions and exclusions.

[edit] Benefits of OCIPs

Owner-controlled insurance programmes can reassure property owners of consistent coverage throughout the project. For instance, they ensure that no uninsured workers are on the job, since rules are uniformly enforced by a single insurer or broker.

They also help to clarify budgeting issues, since insurance costs are established at a consistent rate (rather than being controlled by each contractor) and handled by a single insurance provider.

An owner-controlled insurance policy may benefit property owners who are in charge of several simultaneous construction projects and can gain efficiencies by bundling several projects under this method of coverage.

[edit] Drawbacks of OCIPs

Bundled insurance provided by owner-controlled insurance policies may put an additional administrative burden on property owners charged with overseeing responsibilities that may not be within their area of expertise.

The pricing of these policies may offer budgetary convenience for property owners, but they may also mean contractors are less motivated to control losses when those losses are not coming directly from their budgets.

See also: Integrated Project Insurance.

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

A five minute introduction.

50th Golden anniversary ECA Edmundson apprentice award

Showcasing the very best electrotechnical and engineering services for half a century.

Welsh government consults on HRBs and reg changes

Seeking feedback on a new regulatory regime and a broad range of issues.

CIOB Client Guide (2nd edition) March 2025

Free download covering statutory dutyholder roles under the Building Safety Act and much more.

AI and automation in 3D modelling and spatial design

Can almost half of design development tasks be automated?

Minister quizzed, as responsibility transfers to MHCLG and BSR publishes new building control guidance.

UK environmental regulations reform 2025

Amid wider new approaches to ensure regulators and regulation support growth.

The maintenance challenge of tenements.

BSRIA Statutory Compliance Inspection Checklist

BG80/2025 now significantly updated to include requirements related to important changes in legislation.

Shortlist for the 2025 Roofscape Design Awards

Talent and innovation showcase announcement from the trussed rafter industry.

OpenUSD possibilities: Look before you leap

Being ready for the OpenUSD solutions set to transform architecture and design.

Global Asbestos Awareness Week 2025

Highlighting the continuing threat to trades persons.

Retrofit of Buildings, a CIOB Technical Publication

Now available in Arabic and Chinese aswell as English.

The context, schemes, standards, roles and relevance of the Building Safety Act.

Retrofit 25 – What's Stopping Us?

Exhibition Opens at The Building Centre.

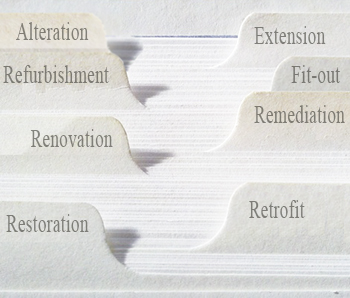

Types of work to existing buildings

A simple circular economy wiki breakdown with further links.

A threat to the creativity that makes London special.