Key Management as a Service Market Latest Trends, Opportunities, Key Players & Forecast Outlook

Key Management as a Service Market is expected to reach USD 2625.16 Million by 2027 growing at a 27.24% CAGR.

In this day and age, data has become more important. Information technology solutions are at an all-time high and are diversifying rapidly to address other unmet needs of the society. The development of key management as a service thus comes at a convenient time when managing sensitive data and login credentials is extremely important. It has become vital that data is safeguarded and kept secure from malicious and unlawful attempts to exploit it. Many organizations are turning to cloud service suppliers to resolve challenges, and the novel risks and additional responsibilities that come with key management as a service.

Key Management as a Service Market Key Players include:

- IBM Corporation (US)

- Amazon Web Services (US)

- Thales eSecurity (France)

- Oracle Corporation (US)

- Equinix Inc. (US)

- Alibaba (China)

- Egnyte (US)

- Ciphercloud (US)

- Google (US)

- Keynexus (US)

- Sepior ApS (Denmark)

- Unbound Tech (Israel)

- Box (US).

By component, the key management as a service market has been segmented into solution and services. The key management solutions segment is dominating the market due to the increasing adoption of key management solutions by enterprises to enhance their IT security and efficiency. Government initiatives supporting digitalization and increasing adoption of cloud services are the factors contributing to the growth of key management solution. Whereas, the service segment comprising professional and managed services, is projected to see high growth in the coming years. Lack of technical expertise and awareness among enterprises regarding key management solutions has driven the market in favour of key management service providers.

By application, the key management as a service market has been segmented into disk encryption, file encryption, database encryption, communication encryption, and cloud encryption. Among these, currently, the disk encryption application is expected to dominate the market due to the increasing demand among enterprises to reduce the risk of unauthorized access to sensitive information. Whereas, the cloud encryption segment is expected to see the fastest CAGR during the forecast period. Rising adoption of cloud platforms has driven the market for cloud encryption.

By organisation size, the market has been segmented into small- and medium-sized enterprises and large enterprises. Among these, the large enterprises segment is currently dominating the market due to the increasing need to safeguard huge volumes of sensitive information present on-premise as well as on cloud platforms. Also, large enterprises have a sufficient budget for IT spends to enhance their security and efficiency. SMEs are projected to grow with the fastest CAGR due to rising adoption of cloud-based platforms accelerating the demand for KMaaS.

By vertical, the market has been segmented into BFSI, healthcare, IT and telecommunication, government, retail, manufacturing, and aerospace, and defense among others. Among these, BFSI is currently dominating the market due to the high demand for information security. Increasing adoption of digital and cloud technology across BFSI sectors are some of the prime factors driving the adoption of key management as a service among banking and financial institutions. The healthcare vertical is projected to grow at the fastest CAGR during the forecast period.

Featured articles and news

Twas the site before Christmas...

A rhyme for the industry and a thankyou to our supporters.

Plumbing and heating systems in schools

New apprentice pay rates coming into effect in the new year

Addressing the impact of recent national minimum wage changes.

EBSSA support for the new industry competence structure

The Engineering and Building Services Skills Authority, in working group 2.

Notes from BSRIA Sustainable Futures briefing

From carbon down to the all important customer: Redefining Retrofit for Net Zero Living.

Principal Designer: A New Opportunity for Architects

ACA launches a Principal Designer Register for architects.

A new government plan for housing and nature recovery

Exploring a new housing and infrastructure nature recovery framework.

Leveraging technology to enhance prospects for students

A case study on the significance of the Autodesk Revit certification.

Fundamental Review of Building Regulations Guidance

Announced during commons debate on the Grenfell Inquiry Phase 2 report.

CIAT responds to the updated National Planning Policy Framework

With key changes in the revised NPPF outlined.

Councils and communities highlighted for delivery of common-sense housing in planning overhaul

As government follows up with mandatory housing targets.

CIOB photographic competition final images revealed

Art of Building produces stunning images for another year.

HSE prosecutes company for putting workers at risk

Roofing company fined and its director sentenced.

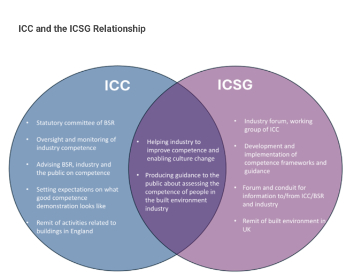

Strategic restructure to transform industry competence

EBSSA becomes part of a new industry competence structure.

Major overhaul of planning committees proposed by government

Planning decisions set to be fast-tracked to tackle the housing crisis.

Industry Competence Steering Group restructure

ICSG transitions to the Industry Competence Committee (ICC) under the Building Safety Regulator (BSR).

Principal Contractor Competency Certification Scheme

CIOB PCCCS competence framework for Principal Contractors.

The CIAT Principal Designer register

Issues explained via a series of FAQs.