Building automation systems market 2022-2031

The Building Automation Systems (BAS) market was valued at US $ 53.66 billion in 2016 and will grow between 2022 and 2031 at a CAGR of 10.73%, it is expected to reach US $ 99.11 billion by 2022. Factors such as increasing demand for energy-efficient systems, increasing needs for automation of security systems in buildings, and advances in IoT in BAS are expected to drive the growth of the BAS market as a whole. However, the high cost of implementation, technical difficulties, and lack of skilled professionals are factors that limit market growth.

The BAS market for security and access control systems is expected to grow at the fastest rate during the forecast period. The need to increase the level of security, activity monitoring, and access control has led to increased demand for security and access control systems. Demand for home security solutions is also growing rapidly due to a variety of factors, including technological advances, rising crime rates, the need for medical assistance to the elderly at home, and monitoring of children at home.

The Asia Pacific region is expected to be the fastest growing market for BAS. Markets in this region are subdivided into India, China, Japan and other Asia Pacific regions. Expected growth is due to the high economic growth witnessed by the major countries in the region. Rapid modernisation and increased construction activity in the APAC region has accelerated the growth of automatic centralised control of HVAC systems installed in the region, ultimately leading to the growth of APAC's BAS market. North America had the largest share of the BAS market in 2016. Commercial and residential applications have the largest share of the North American BAS market, and increasing demand for BAS and industrial applications for these applications is likely to stimulate the North American BAS market.

Extensive primary interviews with key industry players were conducted in the process of determining and validating the market size of several segments and sub-segments collected through the following surveys. The breakdown of the profile of the main participants is as follows:

- By company type: Tier 1 = 30%, Tier 2 = 40%, Tier 3 = 30%

- By designation: Executives = 30%, Manager = 35% , Other = 30%

- By Region: North America = 40%, Europe = 20%, APAC = 30%, Row = 10%

The major market players featured in the report are:

- Honeywell International, Inc. (USA)

- Siemens AG (Germany)

- Johnson Controls International PLC (Ireland)

- Schneider Electric SE (France)

- United Technologies Corporation (USA)

[edit] Related articles on Designing Buildings

- Artificial intelligence.

- Automated blinds.

- BACS building automation controls - the information revolution.

- Building energy efficiency - is building automation the answer?

- Building energy management systems BEMS.

- Building management systems.

- Commercial building automation market.

- Continental Automated Buildings Association CABA.

- Cyber threats to building automation and control systems.

- Energy management and building controls.

- Global building energy management systems market.

- Parking reservation systems.

- Smart building market projections through 2030.

- Smart buildings.

- US Smart Connected HVAC in Commercial Buildings Study 2017.

- Wireless vs wired building energy management system.

Featured articles and news

Institute of Roofing members welcomed into CIOB

IoR members transition to CIOB membership based on individual expertise and qualifications.

Join the Building Safety Linkedin group to stay up-to-date and join the debate.

Government responds to the final Grenfell Inquiry report

A with a brief summary with reactions to their response.

A brief description and background to this new February law.

Everything you need to know about building conservation and the historic environment.

NFCC publishes Industry White Paper on Remediation

Calling for a coordinated approach and cross-departmental Construction Skills Strategy to manage workforce development.

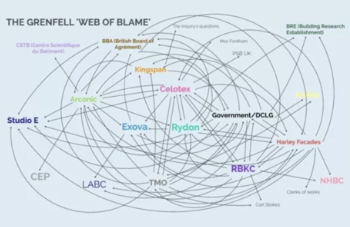

'who blames whom and for what, and there are three reasons for doing that: legal , cultural and moral"

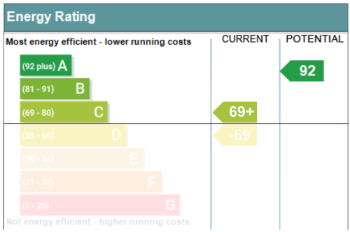

How the Home Energy Model will be different from SAP

Comparing different building energy models.

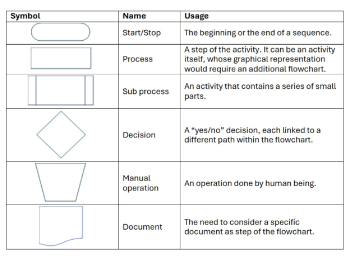

Mapping approaches for standardisation.

UK Construction contract spending up at the start of 2025

New construction orders increase by 69 percent on December.

Preparing for the future: how specifiers can lead the way

As the construction industry prepares for the updated home and building efficiency standards.

Embodied Carbon in the Built Environment

A practical guide for built environment professionals.

Updating the minimum energy efficiency standards

Background and key points to the current consultation.

Heritage building skills and live-site training.

Shortage of high-quality data threatening the AI boom

And other fundamental issues highlighted by the Open Data Institute.

Data centres top the list of growth opportunities

In robust, yet heterogenous world BACS market.

Increased funding for BSR announced

Within plans for next generation of new towns.