2015 Emergency Budget

Rebekah Paczek from Snapdragon Consulting gives her own unique take on the ‘Emergency’ Budget.

Contents |

[edit] Introduction

So, no sooner had the Conservatives won an unexpected majority, than George Osborne announced that he would be presenting an ‘Emergency’ Budget just two months after their victory. Usually an Emergency Budget is reserved for a completely new government so that they can luxuriate in taunting the recently deposed team on the opposite benches by revealing how rubbish they really were at managing the country's finances and how much better everything will be from now on.

George Osborne has declared a new fiscal rule to run a Budget surplus in ‘normal times’. Helpfully there is no definition of what normal times may mean or what measurement of a Budget Surplus will be used. Although it is clear that, given the commitment not to raise Income Tax, National Insurance or VAT (collectively accounting for two thirds of tax revenues) Osborne has little wriggle room. As a result, this Budget is about spending cuts not revenue raising. For spending cuts read, don’t be working young, poor, sick or unemployed and definitely don’t be two of these at once.

In some ways it is reassuring to see the Conservatives return to type, all of this compassionate conservatism was somewhat confusing for the electorate and also the media, who have never known what to make of them. Of course, it is never fashionable for governments to admit that around 46% of the welfare bill is comprised of pensions with income support, job seekers allowance and housing benefit comprising just 22% combined.

The good news for everyone is that last week David Cameron abolished child poverty. So we can all be pleased to know that due to a change in the way it is measured – mainly getting rid of the ‘relative poverty’ measurement method, thousands of children have been lifted out of poverty. I’m sure those households struggling to pay the bills and relying on foodbanks will be relieved. At the same time, the inheritance tax threshold for couples has been raised to £1m on homes, as this will make a huge difference to struggling families financial planning when working out how to survive on reduced tax credits and benefits.

Cameron and Osborne are of the view that those Dickensian ‘hard-working poor families’ would be better off being paid more and taxed less. This is the basis for an overhaul of the tax credits system with a starting point being limiting tax credits to two children for new claimants. Now the Tories have to ensure working families are actually paid more. This means more than just the moderate increase in the minimum wage which has been announced. Still, at least they can also live off the riches of their inheritance instead…

Not wanting to be accused of having been elected to serve one part of the population, at the same time George Osborne has announced that those earning over £40,000 in London and over £30,000 outside of London and still living in Council housing will be made to pay market or near market rent. Not many people would argue with this – except those benefitting from massively subsidised rent whilst depriving those genuinely in need of a Council house. The flaw in his cunning plan is where the proceeds go. Logically the cash would be used to build much needed social housing. After all, with the increase in Right to Buy and the difficulties of replacing like for like this cash will be sorely needed to help support a sustainable social housing stock. This clearly doesn’t appeal George Osborne’s sense of social purpose so instead the cash will be diverted to the Treasury to offset the deficit – because £250m makes a real dent in an £87bn deficit…

In a classic case of stealing their opponents policies, there will also be a non-dom crackdown – is it just me or have successive governments been cracking down on non-doms for at least ten years now, with the only perceivable result being that non-doms just pay their accountants and advisers marginally more?

[edit] Business

A key factor for the Conservative victory was that they were simply much more effective and convincing on business than Labour, who appeared to think that attacking wealth creation was a sensible strategy whilst forgetting that without wealth creation there are no taxes to pay for all those lovely social programmes.

To help encourage more business, Osborne announced the further reduction in Corporation Tax to 19% in 2017 and 18% in 2020. This should mean that Britain remains amongst the most competitive business environments in the EU.

The Annual Investment Allowance has been fixed at £200,000 rather than reduced back to £25,000 to encourage continuing investment in the UK. Alongside this the Employment Allowance is increased from £1,000 to £3,000 to encourage job creation.

[edit] Planning

A new Planning Bill will be introduced on Friday so watch this space. I would like to think that it is tweaks and amends to the existing planning legislation and not wholesale reform but who knows. Rumours are that PRS won’t get a mention but expect more on garden cities/eco towns/sustainable urban extensions – or whatever you want to call them. Also on the agenda are local authorities with out of date plans - expect harsher penalties and more central Government intervention.

[edit] Devolution and The Northern Powerhouse

Regional devolution is set to continue apace with a shift of power to localities rather than simply from London. This also neatly allows Osborne and future governments to abdicate responsibility for any regional financial difficulties or infrastructure problems whilst no doubt claiming credit for the reverse.

Transport for the North gets a £30m grant for three years – a pretty small fraction of the £10.8 billion annual budget... But then Osborne certainly isn't courting votes in the north east anyway.

Also on infrastructure, the Government will appoint a dedicated body to look at opportunities for development of Network Rail owned land – perhaps they have realised that having Network Rail involved in a regeneration project tends to signal major delays for development, much like the trains really.

[edit] Housing and Development

Housing benefit for the under-25s will be cut, because obviously those under-25 don’t need somewhere decent to live. Although you never know, this could fuel a massive demand in housing as parents desperate to turn their child’s room into a cinema/sauna/gym/walk-in-wardrobe withdraw their entire pension in one lump sum to buy a property so they can rent it to their offspring. Obviously if you don’t have parents who have the money for this and you happen to be under-25 you are rather stuffed – one can only assume the Conservatives have given up on courting the non-independently wealthy youth vote for at least the next five years.

[edit] The Housing Bill

The Housing Bill has been much trailed with many commitments stated pre-election. The announcements at the weekend and in the Budget are basically just the re-announcing of existing policy. Also, don't forget that planning permission will be in place for 90% of 'suitable' brownfield sites by 2020. No really, it will, George Osborne and David Cameron said it would be so it must be true.

Aside from this, mortgage rate relief for buy-to-let landlords will be gradually cut to the basic rate of taxation – I guess they are working on the basis that landlords make enough from the increase in capital value. Whilst the government are keen to improve the private rented sector, potentially taking a whole load of properties out of the sector seems an odd way to go about it.

Obviously, all of these calculations are based on a Eurozone which brings itself back from the brink and doesn’t fall apart on a Grexit.

[edit] Related articles on Designing Buildings Wiki

- BSRIA reaction to 2015 emergency budget.

- Apprenticeships levy.

Featured articles and news

CLC and BSR process map for HRB approvals

One of the initial outputs of their weekly BSR meetings.

Building Safety Levy technical consultation response

Details of the planned levy now due in 2026.

Great British Energy install solar on school and NHS sites

200 schools and 200 NHS sites to get solar systems, as first project of the newly formed government initiative.

600 million for 60,000 more skilled construction workers

Announced by Treasury ahead of the Spring Statement.

The restoration of the novelist’s birthplace in Eastwood.

Life Critical Fire Safety External Wall System LCFS EWS

Breaking down what is meant by this now often used term.

PAC report on the Remediation of Dangerous Cladding

Recommendations on workforce, transparency, support, insurance, funding, fraud and mismanagement.

New towns, expanded settlements and housing delivery

Modular inquiry asks if new towns and expanded settlements are an effective means of delivering housing.

Building Engineering Business Survey Q1 2025

Survey shows growth remains flat as skill shortages and volatile pricing persist.

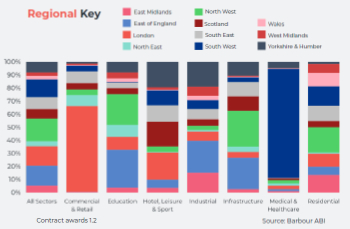

Construction contract awards remain buoyant

Infrastructure up but residential struggles.

Home builders call for suspension of Building Safety Levy

HBF with over 100 home builders write to the Chancellor.

CIOB Apprentice of the Year 2024/2025

CIOB names James Monk a quantity surveyor from Cambridge as the winner.

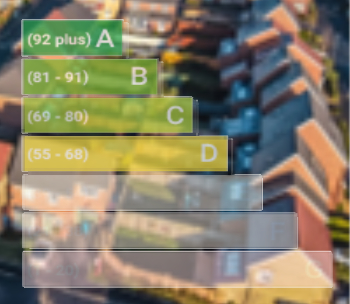

Warm Homes Plan and existing energy bill support policies

Breaking down what existing policies are and what they do.

Treasury responds to sector submission on Warm Homes

Trade associations call on Government to make good on manifesto pledge for the upgrading of 5 million homes.

A tour through Robotic Installation Systems for Elevators, Innovation Labs, MetaCore and PORT tech.

A dynamic brand built for impact stitched into BSRIA’s building fabric.

BS 9991:2024 and the recently published CLC advisory note

Fire safety in the design, management and use of residential buildings. Code of practice.