About Dave251092

The global market is somewhat of a tower of cards; it consists of multiple elements that together create a monumental structure. However in reality it is a delicate structure that once one element becomes unstable can have a domino effect on the whole structure in question, in this case leading to the recessions.

There are many elements that need to be addressed individually to co-ordinate a recovery for the collapse of the market, and more importantly ensure investors come with open cheque books to keep it sustained.

Initially the 3 aspects that I believe have great significance to the successful scheme to keep investors interested involve quantative easing, the investment in transportation and the Eurozone collapse. These essentially are the base of the tower of cards.

Quantative Easing is a slow process that seems to be the fabrication of money to further enhance the debt most nations are in; however this easing allows money to be invested in a way that can then have a knock on effect allowing the money to be carried forward directly to the consumer. This carrying forward of the money enables people to lend again and will eventually create a flow of money, lower interest rates and most importantly create a portfolio of mortgages and investments that can be further marketed by aggregators. This process should effectively create a self-sustaining system of investment which will eventually see the money fabricated by the bank paid back and normality returned, however this is only a starting point of what needs to be done.

The next aspect of the success is the definitive decision to our future within the Eurozone. There are two perspectives to look at this situation, the first being the continuation within the Eurozone which will lead to more debts to be created between countries and more bail outs to be agreed dwindling our chance of flourishing again. The other perspective would be leaving the Eurozone creating an initial recession due to debts being unpaid and currencies being reinstated, however this could work in our favour with our currency being the strongest in value within the Eurozone and our nation being one of the most reliable in the sense of market. This will in turn create a further desire for foreign investors to come to the nation confident that their investments are safer.

The final part to the base of the market is the investment in transportation on a national scale. Although the HS2 has been subjected to controversy throughout the years it is the step forward in ensuring investment. This transportation system has made commuting from the heart of England an ease opposed to the previous systems in place, this will essentially allow people to flow between various areas of the country and should in turn see people invest in property in different cities/towns knowing commuting can be achieved easily.

With the transportation options expanding throughout the nation it will widen the scope of future investment opportunities and allow people to avoid the ‘London Bubble’. However there is one issue with the HS2 development, although it spreads across the nation it only has a very select amount of stations that are not going to be developed enough to present a range of commuting options. If these stations were similar to the recent Bond Street, Tottenham or White chapel developments they could present a range of further options further enhancing the choice for investors to seize.

In conclusion by combining the investment of extra money into the economy, further expanding ease of accessing to lower house priced areas and opting out of a debt ridden Eurozone we could ensure a system where the money is flowing again and the investments are distributed throughout the nation to allow an even spread of this money.

Featured articles and news

Microcosm of biodiversity in balconies and containers

How minor design adaptations for considerable biodiversity benefit.

CIOB student competitive construction challenge Ireland

Inspiring a new wave of Irish construction professionals.

Challenges of the net zero transition in Scotland

Skills shortage and ageing workforce hampering Scottish transition to net zero.

Private rental sector, living standards and fuel poverty

Report from the NRH in partnership with Impact on Urban Health.

.Cold chain condensing units market update

Tracking the evolution of commercial refrigeration unit markets.

Attending a conservation training course, personal account

The benefits of further learning for professsionals.

Restoring Alexander Pope's grotto

The only surviving part of his villa in Twickenham.

International Women's Day 8 March, 2025

Accelerating Action for For ALL Women and Girls: Rights. Equality. Empowerment.

Lack of construction careers advice threatens housing targets

CIOB warning on Government plans to accelerate housebuilding and development.

Shelter from the storm in Ukraine

Ukraine’s architects paving the path to recovery.

BSRIA market intelligence division key appointment

Lisa Wiltshire to lead rapidly growing Market Intelligence division.

A blueprint for construction’s sustainability efforts

Practical steps to achieve the United Nations Sustainable Development Goals.

Timber in Construction Roadmap

Ambitious plans from the Government to increase the use of timber in construction.

ECA digital series unveils road to net-zero.

Retrofit and Decarbonisation framework N9 launched

Aligned with LHCPG social value strategy and the Gold Standard.

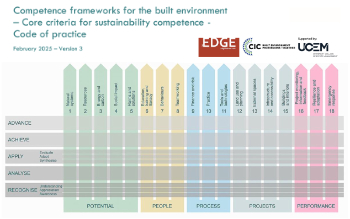

Competence framework for sustainability

In the built environment launched by CIC and the Edge.

Institute of Roofing members welcomed into CIOB

IoR members transition to CIOB membership based on individual expertise and qualifications.

Join the Building Safety Linkedin group to stay up-to-date and join the debate.

Government responds to the final Grenfell Inquiry report

A with a brief summary with reactions to their response.