About Buytoletplan

If you understand that buying a buy-to-let property is long-term investment, it is still viable option. Complete strategy to build BTL Plan

[edit] Contents |

[edit] How to Build a 10 Year Buy-to-Let Plan (BTL)

The entire process of buying a 'Buy to Let' property differs from buying a home to live in. The purchase is still part of a real estate process, but the fees and expectations are different.

If you understand that buying a buy-to-let property is a long-term investment, it is still a viable option. Many things must be taken into account, including your budget, the location you want to buy in, and the type of landlord property you want to buy.

However, at the point; where it creates an exciting investment opportunity, there are a lot of challenges that need a comprehensive guide on it. While you are at the buy to let explained stage, you must also consider digging into the 10-year plan for buy to let.

[edit] Things to consider for your buy-to-let plan for a decade

Landlords are notoriously difficult to sympathize with; the public image of them is that of a ruthless property tycoon flush with cash.

However, the government's most recent Private Landlords Survey paints a very different picture, revealing that 94 percent of landlords are individuals.

They earn an average of £15,000 per year from their properties, with only 4% of them relying on buy-to-let as a primary source of income.

Furthermore, nearly 60% are 55 or older, with a third being retired. In other words, rather than chasing profits, many landlords simply rent out properties to supplement their income later in life. Margin can be thin, and additional layers of regulation can exacerbate the problem.

Now, if you think, buy to let explained is not your piece of cake. Just remember that it is not a run-time solution but a lifetime plan, so you need a lot of patience.

So, despite the current challenges most landlords are facing, there is still an opportunity lying for the people who have had a plan for a decade.

So, what do you need to consider?

[edit] · Shortlist the places where tenant demand is stronger

Bristol has topped the list, according to recent research. This city in the South West moves up from the seventh place in last year's rankings, passing Manchester, which drops to fourth place.

[edit] · Places where prices could rise in coming years

Rent is only one source of income from a buy-to-let property. The other, longer-term profit comes from any increase in the property's resale value.

From now to the next five years till 2025, it is predicted that the average home would increase in value by 20% to 35%.

So, all you need is to choose the state where you know that value will rise. You can expect the massive rise in Housing transaction volumes in Scotland, the South West, and the East of England.

[edit] · Watch out for the buy to let pitfalls.

One of the biggest blows to higher-earning landlords in recent years has been the loss of buy-to-let tax relief on mortgage interest. But it won't affect you if you're a basic rate taxpayer. Other pressures that have recently manifested themselves include:

- Section 21 'No fault' evictions are no longer available.

- Relief for private residences is dwindling.

[edit] What are the long-term benefits of buy-to-let?

Any investment is almost always motivated by the desire to make money. With monthly rental returns and capital appreciation providing investors with more lucrative long-term returns, Buy-to-Let property has become a popular asset over the years.

- The rental income, which can be used in a variety of ways, is the most important aspect of a Buy-to-Let investment.

- It can also be used to increase the size of your investments, other than its primary function as a source of income.

- Whether you're covering mortgage payments, building a 'rainy-day' fund to cover unexpected costs, funding a new deposit, or 'compounding' - reinvesting your returns, returns can help you accelerate your growth.

- In addition to the possibility of gradually building a profit from rental income during your holding period, the property is likely to experience capital growth.

- The profit you make on renting property in the UK is known as capital growth, and with UK property prices rising month after month, there is more opportunity to reap these benefits.

[edit] Bottom line

You may want to end the decade as a real estate tycoon, but your first buy-to-let investment should be as safe as possible. Purchase within your budget and set rents just high enough to cover your costs plus a small profit margin. This gives you the freedom to make mistakes – which you will – and learn from them so you can apply what you've learned to your next property and start chasing bigger profits.

You are now beyond the question “how to become a landlord UK”. Now make a plan by focusing on the areas to invest in. However, keep an eye on the daily reports as the world is moving quite fast right now. Hopefully, this buy to let explained guide has helped you. For more information, the Star Sterling is always there to assist you.

Featured articles and news

CIOB student competitive construction challenge Ireland

Inspiring a new wave of Irish construction professionals.

Challenges of the net zero transition in Scotland

Skills shortage and ageing workforce hampering Scottish transition to net zero.

Private rental sector, living standards and fuel poverty

Report from the NRH in partnership with Impact on Urban Health.

.Cold chain condensing units market update

Tracking the evolution of commercial refrigeration unit markets.

Attending a conservation training course, personal account

The benefits of further learning for professsionals.

Restoring Alexander Pope's grotto

The only surviving part of his villa in Twickenham.

International Women's Day 8 March, 2025

Accelerating Action for For ALL Women and Girls: Rights. Equality. Empowerment.

Lack of construction careers advice threatens housing targets

CIOB warning on Government plans to accelerate housebuilding and development.

Shelter from the storm in Ukraine

Ukraine’s architects paving the path to recovery.

BSRIA market intelligence division key appointment

Lisa Wiltshire to lead rapidly growing Market Intelligence division.

A blueprint for construction’s sustainability efforts

Practical steps to achieve the United Nations Sustainable Development Goals.

Timber in Construction Roadmap

Ambitious plans from the Government to increase the use of timber in construction.

ECA digital series unveils road to net-zero.

Retrofit and Decarbonisation framework N9 launched

Aligned with LHCPG social value strategy and the Gold Standard.

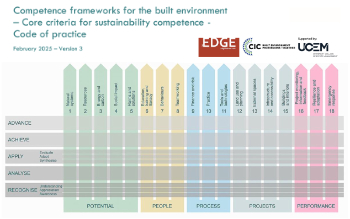

Competence framework for sustainability

In the built environment launched by CIC and the Edge.

Institute of Roofing members welcomed into CIOB

IoR members transition to CIOB membership based on individual expertise and qualifications.

Join the Building Safety Linkedin group to stay up-to-date and join the debate.

Government responds to the final Grenfell Inquiry report

A with a brief summary with reactions to their response.