UandI Preliminary results Feb 2017

On 26 April 2017, regeneration and development firm U+I reported preliminary results for the year ended 28 February 2017.

The headlines included:

- Four new large-scale PPP projects were won, adding £90m to the pipeline of gains from 2020 and £1.5bn of gross development value to the portfolio.

- Two specialist platforms were established – joint ventures with Proprium Capital Partners and Colony NorthStar to leverage equity and intellectual capital and generate fees.

- Investment portfolio values stabilised.

- £18.0m of non-core investment asset disposals in line with the strategy to reposition the investment portfolio and drive higher returns.

- £35m of development and trading gains were realised.

- £65m - £70m of development and trading gains set to be delivered in FY2018 and visibility on more than £150m of development and trading gains in the next three years from existing projects alone.

- Investment portfolio total return of 10% targeted for FY2018 through non-core asset disposals (FY2018 target: £50m), reinvestment (FY2018 target: £50m) and asset management (FY2018 target: £5m).

- Targeting a £2m reduction in net recurring overheads in FY2018 through cost savings and management fees from specialist platforms.

- The business is on track to deliver a 12% post tax total return per annum in the next three years.

Matthew Weiner, Chief Executive said:

"I am encouraged by our performance. We delivered £35 million of development and trading gains from our planning-led regeneration activities, notwithstanding the substantial hit to transaction activity following the EU referendum. This result, which was within our guidance range, has enabled us to declare a third consecutive supplemental dividend in addition to our ordinary dividend. In the year ahead, we are set to deliver our highest level of development and trading gains to date - £65-70 million - from a mix of large-scale public private partnership (PPP) projects and shorter-term trading opportunities, delivering our target 12% post-tax return to shareholders.

“We have made good progress on our strategy. During the year, we secured four significant PPP projects totalling £1.5 billion of gross development value and adding £90 million of development and trading gains in FY2020 and beyond. This reflects our stated focus on large-scale PPP regeneration opportunities and underlines our leading reputation in this market. We were pleased to establish two specialist platforms during the year with Proprium Capital Partners and Colony NorthStar. These platforms allow us to acquire and deliver projects off-balance sheet, in line with our equity efficient approach, leveraging our equity and intellectual capital whilst generating fees to the business to offset overhead.

“Improving the performance of our investment portfolio remains a key priority. We are focused on delivering a 10% total return from our investment activities in the year ahead as we transition our portfolio to better align to our core regeneration expertise. We are targeting £100 million of transactional activity this year with £18 million already in hand, and are set to deliver £5 million of value gain as a result of our proactive asset management.

“The potential in the UK for mixed-use regeneration is significant and the number of opportunities is growing. Based on our extensive expertise in planning and development, we are confident that we can deliver sustainable returns to shareholders as we create long lasting social and economic change for the communities in which we work."

For more information, see U+I's report.

--U and I

[edit] Find out more

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

Microcosm of biodiversity in balconies and containers

How minor design adaptations for considerable biodiversity benefit.

CIOB student competitive construction challenge Ireland

Inspiring a new wave of Irish construction professionals.

Challenges of the net zero transition in Scotland

Skills shortage and ageing workforce hampering Scottish transition to net zero.

Private rental sector, living standards and fuel poverty

Report from the NRH in partnership with Impact on Urban Health.

.Cold chain condensing units market update

Tracking the evolution of commercial refrigeration unit markets.

Attending a conservation training course, personal account

The benefits of further learning for professsionals.

Restoring Alexander Pope's grotto

The only surviving part of his villa in Twickenham.

International Women's Day 8 March, 2025

Accelerating Action for For ALL Women and Girls: Rights. Equality. Empowerment.

Lack of construction careers advice threatens housing targets

CIOB warning on Government plans to accelerate housebuilding and development.

Shelter from the storm in Ukraine

Ukraine’s architects paving the path to recovery.

BSRIA market intelligence division key appointment

Lisa Wiltshire to lead rapidly growing Market Intelligence division.

A blueprint for construction’s sustainability efforts

Practical steps to achieve the United Nations Sustainable Development Goals.

Timber in Construction Roadmap

Ambitious plans from the Government to increase the use of timber in construction.

ECA digital series unveils road to net-zero.

Retrofit and Decarbonisation framework N9 launched

Aligned with LHCPG social value strategy and the Gold Standard.

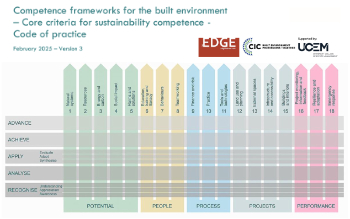

Competence framework for sustainability

In the built environment launched by CIC and the Edge.

Institute of Roofing members welcomed into CIOB

IoR members transition to CIOB membership based on individual expertise and qualifications.

Join the Building Safety Linkedin group to stay up-to-date and join the debate.

Government responds to the final Grenfell Inquiry report

A with a brief summary with reactions to their response.