Precast Construction Market

The precast construction market is projected to witness substantial growth in the next few years with the increase in demand for new construction across the world, due to rapid urbanisation and industrialisation with large-scale investments in the industrial and infrastructure sectors. A rise in construction activities in emerging economies and an increase sustainable construction methods are driving a reliance on modern construction techniques, creating growth opportunities for the precast construction market.

The 'eco-friendly' appeal of precast construction components and techniques, and its acceptance have helped it to enter the global market. Many innovations in designs and technological advancements have been witnessed by the industry in the last decade.

The non-residential buildings segment dominated the market in 2015 and is projected to be the fastest-growing end-user sector in the next five years. As a result of the rise in urbanisation and industrialisation, this market is mostly driven by a surge in demand for new construction across the world. An increase in public and private investment in the infrastructure sector in the emerging economies of Asia-Pacific, the Middle East, and Latin America are driving this growth.

The Asia-Pacific has a major market share in the global precast construction market. An increase in industrialisation as well as population growth in countries such as China, Indonesia, and India, which are experiencing high demand for residential and non-residential construction, is driving the market in these countries. Rapid urbanisation in these countries demands faster and more cost-efficient construction of buildings and facilities without compromising on quality. Additionally, increased government investment in infrastructure provides potential for growth in these countries.

The key players in the market include; Acs actividades de construcción y servicios, S.A (Spain), Komatsu Ltd. (Japan), Bouygues Construction (France), Larsen & Toubro Limited (India), Taisei Corporation (Japan), Balfour Beatty plc (U.K.), Kiewit Corporation (U.S.), Laing O’Rourke (U.K.), Julius Berger Nigeria Plc (Nigeria), and Red Sea Housing Services (Saudi Arabia).

Featured articles and news

Twas the site before Christmas...

A rhyme for the industry and a thankyou to our supporters.

Plumbing and heating systems in schools

New apprentice pay rates coming into effect in the new year

Addressing the impact of recent national minimum wage changes.

EBSSA support for the new industry competence structure

The Engineering and Building Services Skills Authority, in working group 2.

Notes from BSRIA Sustainable Futures briefing

From carbon down to the all important customer: Redefining Retrofit for Net Zero Living.

Principal Designer: A New Opportunity for Architects

ACA launches a Principal Designer Register for architects.

A new government plan for housing and nature recovery

Exploring a new housing and infrastructure nature recovery framework.

Leveraging technology to enhance prospects for students

A case study on the significance of the Autodesk Revit certification.

Fundamental Review of Building Regulations Guidance

Announced during commons debate on the Grenfell Inquiry Phase 2 report.

CIAT responds to the updated National Planning Policy Framework

With key changes in the revised NPPF outlined.

Councils and communities highlighted for delivery of common-sense housing in planning overhaul

As government follows up with mandatory housing targets.

CIOB photographic competition final images revealed

Art of Building produces stunning images for another year.

HSE prosecutes company for putting workers at risk

Roofing company fined and its director sentenced.

Strategic restructure to transform industry competence

EBSSA becomes part of a new industry competence structure.

Major overhaul of planning committees proposed by government

Planning decisions set to be fast-tracked to tackle the housing crisis.

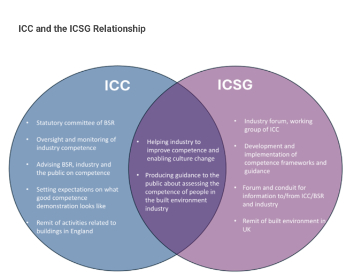

Industry Competence Steering Group restructure

ICSG transitions to the Industry Competence Committee (ICC) under the Building Safety Regulator (BSR).

Principal Contractor Competency Certification Scheme

CIOB PCCCS competence framework for Principal Contractors.

The CIAT Principal Designer register

Issues explained via a series of FAQs.